American Labs provides lab testing services for a variety of clients, mostly doctors’ offices and other small medical businesses throughout the Midwest. Clients send test vials containing blood samples or other test requests to American Labs’ testing center, where the requested tests are performed, after which the results are sent back to the client via fax. Jim Larsen, the head technician in the testing facility at American Labs, has approached you for help with the company’s outdated inventory tracking system. Business has picked up recently, and the turnaround for clients’ requested tests has been lengthening. To make matters worse, the lab technicians are seldom able to give customers an answer regarding where their requests fall in the testing queue or how long they can expect the turnaround to be. Much of this stems from an old, mostly paper-based inventory tracking system, which includes handwritten labels put on each of the incoming test vials and a logbook with entries made for each vial at each stage of the testing process. Jim would like to streamline the inventory tracking process with an updated information system that uses barcodes and a modern database to keep track of customer test requests and the accompanying vials. He would like to enable technicians to provide accurate status updates and turnaround estimates, and generally shorten the turnaround time for test requests. After an initial analysis, you make the following estimations. You will use these data as part of your initial feasibility assessment.a. Identify several benefits and costs associated with implementing this new system. b. Using Figure 4-10 as a guide, prepare an economic feasibility analysis worksheet for American Labs. Using a discount rate of 10 percent, what are the overall NPV and ROI? When will break-even occur? c. Modify the spreadsheet developed for part b to reflect discount rates of 11 and 14 percent. What impact will these new rates have on the economic analysis?

American Labs

American Labs provides lab testing services

for a variety of clients, mostly doctors’ offices

and other small medical businesses throughout the Midwest. Clients send test vials containing blood samples or other test requests

to American Labs’ testing center, where the

requested tests are performed, after which

the results are sent back to the client via fax.

Jim Larsen, the head technician in the testing

facility at American Labs, has approached you

for help with the company’s outdated inventory

tracking system. Business has picked up recently, and the turnaround for clients’ requested

tests has been lengthening. To make matters

worse, the lab technicians are seldom able to

give customers an answer regarding where their

requests fall in the testing queue or how long

they can expect the turnaround to be. Much of

this stems from an old, mostly paper-based inventory tracking system, which includes handwritten labels put on each of the incoming test

vials and a logbook with entries made for each

vial at each stage of the testing process.

Jim would like to streamline the inventory

tracking process with an updated information system that uses barcodes and a modern

database to keep track of customer test requests and the accompanying vials. He would

like to enable technicians to provide accurate

status updates and turnaround estimates,

and generally shorten the turnaround time

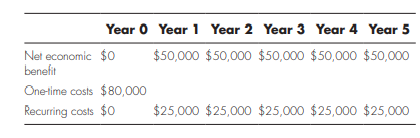

for test requests. After an initial analysis, you make the following estimations. You will use these data

as part of your initial feasibility assessment.a. Identify several benefits and costs associated with implementing this new system.

b. Using Figure 4-10 as a guide, prepare an

economic feasibility analysis worksheet

for American Labs. Using a discount rate

of 10 percent, what are the overall NPV

and

c. Modify the spreadsheet developed for

part b to reflect discount rates of 11 and

14 percent. What impact will these new

rates have on the economic analysis?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images