ames owns a framing business, Frames-4-U, that frames artworks, prints and photos for clients. He purchased equipment for R100 000 with the intention of using it to assist him to frame the art of his clients. The expected useful life of the equipment is five years. The supplier of the equipment is in Johannesburg, and James had to pay for transport rom the supplier to his workshop in Cape Town. This cost R5 000. The workers had to offload the equipment and carry it to the correct location in the workshop and James pai hem R500 for this task. You are required to a. Explain to James what type of asset the equipment will be classified in the accounting records of Frames-4-U. In your answer you should also give the definition of the classification of the asset. (...) b. Calculate the total cost of the equipment he should use to debit the equipment account. Give a reason to explain to James why you calculated the cost is this manner.

ames owns a framing business, Frames-4-U, that frames artworks, prints and photos for clients. He purchased equipment for R100 000 with the intention of using it to assist him to frame the art of his clients. The expected useful life of the equipment is five years. The supplier of the equipment is in Johannesburg, and James had to pay for transport rom the supplier to his workshop in Cape Town. This cost R5 000. The workers had to offload the equipment and carry it to the correct location in the workshop and James pai hem R500 for this task. You are required to a. Explain to James what type of asset the equipment will be classified in the accounting records of Frames-4-U. In your answer you should also give the definition of the classification of the asset. (...) b. Calculate the total cost of the equipment he should use to debit the equipment account. Give a reason to explain to James why you calculated the cost is this manner.

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 75IP

Related questions

Question

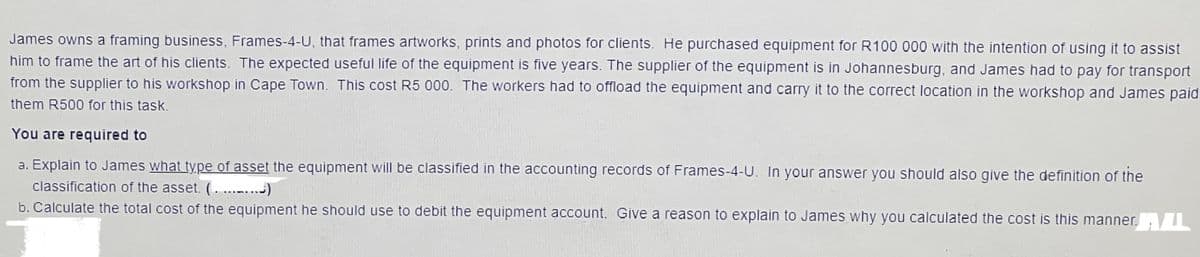

Transcribed Image Text:James owns a framing business, Frames-4-U, that frames artworks, prints and photos for clients. He purchased equipment for R100 000 with the intention of using it to assist

him to frame the art of his clients. The expected useful life of the equipment is five years. The supplier of the equipment is in Johannesburg, and James had to pay for transport

from the supplier to his workshop in Cape Town. This cost R5 000. The workers had to offload the equipment and carry it to the correct location in the workshop and James paid

them R500 for this task.

You are required to

a. Explain to James what type of asset the equipment will be classified in the accounting records of Frames-4-U. In your answer you should also give the definition of the

classification of the asset. (...)

b. Calculate the total cost of the equipment he should use to debit the equipment account. Give a reason to explain to James why you calculated the cost is this manner.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT