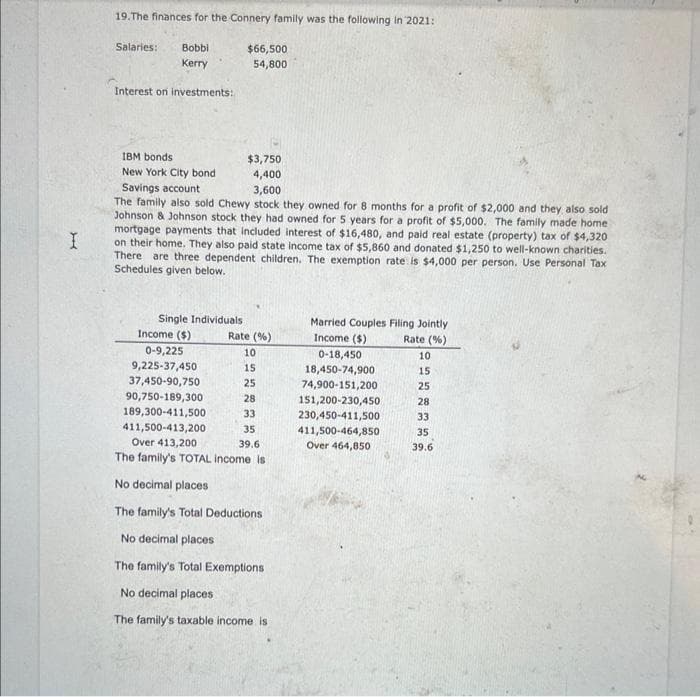

amily was the following in 2021:

Q: Less: Cost of Purchase consumed (30000+120000-40000) Gross Profir

A: The question belongs to the follow-up question. Cost of purchase consumed is the item which is…

Q: The Keppners file a joint income tax return. Assume the taxable year is 2022. Required: a. Compute…

A: Tax is imposed on the gross income of individuals and entities/corporations/firms by federal, state…

Q: Calculate the moving average cost per unit at January 1, 5, 8, 10, 15, 16, 20, & 25. (Round moving…

A: Methods of Valuation of Inventory 1. First In First Out (FIFO): Under FIFO method, inventory is…

Q: The following transactions and events pertain to Bean County’s General Fund for the calendar year…

A: Lets understand the basics. Journal entry is a first step of recording event or transaction in books…

Q: is a 26-year who is filr parately

A: Caroline's Gross Total Income is $ 15,000 from her part time job in 2020. She…

Q: Carlberg Company has two manufacturing departments, Assembly and Painting. The Assembly department…

A: Lets understand the basics. There are two methods for calculating cost per unit under process…

Q: How can you discuss the need for liquidity to conduct business for a parts store to someone that…

A: Liquidity is a measurement of ability to pay it's short term obligations which are due within one…

Q: The following information relates to the only product made by Mario Traders for the year ended 31…

A: Income statement as per absorption costing is the one that considers total or full cost relating to…

Q: Compare general, limited, and limited liability partnerships. Formulate reasons as to why a group of…

A: General Partnership An unincorporated partnership having two or more owners who divide the company's…

Q: Measures of liquidity, solvency, and profitability The comparative financial statements of Marshall…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: company weighted average method and it reports the following unit data for the Forming department.…

A: The total cost of producing a product, including raw materials and operating costs, is detailed in a…

Q: The Asian Regional Division of a large manufacturing corporation has sales of P1,200,000, cost of…

A: According to the given question, we are required to compute the required values. Contribution…

Q: 2.10.1. Melissa takes a loan of R950 000 to buy a house. The interest is 14,25% p.a. compounded…

A: Answer - Monthly Repayment – Repayments means the monthly installments of principal and interest…

Q: The auditor's report is where the auditor certifies that the financial statements present fairly the…

A: Introduction: An auditor's report is a written letter from the auditor in which the auditor…

Q: Identify and define the two major types of controls in an accounting information system.

A: Accounting Controls Accounting controls are the policies and procedures that a company adopts to…

Q: Prepare journal entries to record the following transactions as they relate to th mpany's common…

A: Introduction: A journal entry is used to document a business transaction in a company's accounting…

Q: why preset value is different? PV of Cash flow = (CFAT × PVIFA @10%, 3 Years) = ($22,000 × 2.4869)…

A: Net Present Value=(Present Value of Cash Inflows-Present Value of Cash Outflows)

Q: The following information is available for the first month of operations of Bahadir Company, a…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: The cost data for Evencoat Paint for the year 2019 is as follows: Evencoat Paint data Month…

A: The question is based on the concept of Cost Accounting.

Q: How can you predict the length of the cash conversion cycle within that cycle for a parts store?

A: Business wants to measure the cycle of the cash so that it can be helpful in the decision and…

Q: Using the table below create SinCo's Income Statement and Balance Sheet for the Prior Year and…

A: Income Statement Particulars Current Year Sales 4558 Less : Cost of Goods Sold (1,914) Gross…

Q: Cost of Goods Sold, Income Statement, and Statement of Comprehensive Income Gaskin Company derives…

A: COGS - Cost of goods sold is the direct cost incurred for the production of any goods Opening…

Q: Due to erratic sales of its sole product-a high-capacity battery for laptop computers-PEM,…

A: Solution Net profit is calculated by deducting all operating , interest and tax expenses from the…

Q: Using general GL codes (expense, receivable, revenue, etc.), write out the JE necessary to post each…

A: A business's accounting records can contain information about a transaction by creating a journal…

Q: Western Trucking operates a fleet of delivery trucks. The fixed expenses to operate the fleet are…

A: Total variable cost = 92,097 miles x $0.49 per mile = $45,127.53

Q: Decker Company has five products in its inventory. Information about ending inventory follows. Unit…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: An investor has $80,000 to invest in a CD and a mutual fund. The CD yields 6% and the mutual fund…

A: Mutual Fund :— A mutual fund is a professionally managed investment fund that pools money from many…

Q: Marigold, Inc., manufactures clamps used in the overhead bin latches of several leading airplan of…

A: The period costs are the costs which are not related to the production process. Examples, selling…

Q: 3. Determine the revenues, expenses, and net income of Reliable Repairs & Service after the…

A: 2) Revenue Fees Earned $ 2,99,210 Expenses Wages Expense $…

Q: fixed charges, taxes, and incidentals looks as follows. Store: A typical annual income statement for…

A:

Q: Sparrow Company uses the retail inventory method to estimate ending inventory and cost of goods…

A: As per the honor code, We’ll answer the first question since the exact one wasn’t specified. Please…

Q: Income tax expense Total expenses and losses Net Income 51,500 Gross profit Required: Prepare a…

A: Income statement is one of the useful financial statement which shows all incomes and all expenses…

Q: Mr Stephen Ncube is a resident of Zambia. The following detail relate to his employment in the tax…

A: Using the submitted data, Stephen Ncube has a tax due for the year ending 31 December 2020 which…

Q: The AAA Division has permanent current assets of P50,000 and operating non-current assets of…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. If you want…

Q: Prepare a statement of stockholders’ equity for the year ended August 31, 20Y6. If an amount box…

A: Statement of stockholder's equity is a section of balance sheet which shows the performance of the…

Q: Milano Gallery purchases the copyright on a painting for $480,000 on January 1. The copyright is…

A: Introduction: A journal entry is a record of the business transaction in an organization's…

Q: Consider the “control environment.” Asses why it is important for auditors to understand a client’s…

A: A control environment, also called "Internal control environment", is a term of financial audit,…

Q: 4. 5. 6. Jul Aug Sep Oct Nov Dec Extra information includes: 1. 2. ON 4 co is going to start trading…

A: Cash Budget :— A cash budget is a company's estimation of cash inflows and outflows over a specific…

Q: Broncos Company leased equipment from Wilson-Tech Leasing on January 1, 2022. Other information:…

A: Introduction: Lease is an agreement between two parties wherein the one party known as lessor allows…

Q: Firms in Japan often employ both high operating and financial leverage because of the use of modern…

A: In order to determine the contribution margin, the variable cost are required to be subtracted from…

Q: have purchased a machine worth ₱1,893,877.00. And it needs maintenance every 6 months starting from…

A: To know the requirements of money today we need to calculate present value of all payment in future.…

Q: The question states: "Write a memo to the CEO, to offer your response to the request to skip the…

A: A memo is used by the company so that the information regarding the accounts can be sought by the…

Q: QS 16-14A (Algo) FIFO: Equivalent units of production LO C2 For the Assembly department: (a) Compute…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Q: 5 ! Required information [The following information applies to the questions displayed below.]…

A: Variable Cost :— It is the cost that changes with change in units. It depends on the units. It is…

Q: Use this information about Department S to answer the question that follows. Department S had no…

A: Conversion costs are the production costs required to turn raw resources into final products. Cost…

Q: Which statement is TRUE? If next years' tax rate will go down, companies with more existing deferred…

A: Solution Tax are mandatory contribution that is levied by the government entity on individuals and…

Q: Company Z has $ 529415 in annual fixed costs. The primary product generates $ 82.29 in revenue per…

A: Answer - Profit of the Company – The profit or gain in a business is calculated to determine the…

Q: BuyCo, Inc., holds 26 percent of the outstanding shares of Marqueen Company and appropriately…

A: The accounting approach to handling investments in related corporations is known as the equity…

Q: Which of the following is a type of real property that can also be classified as personal-use…

A: We are authorized to answer one question at a time, since you have not mentioned which question you…

Q: Department S had 500 units 70% completed in process at the beginning of the period, 8,600 units…

A: Introduction: Equivalent production units are represented by the work-in-process inventory at the…

Step by step

Solved in 2 steps

- Soong, single and age 32, had the following items for the tax year 2019: Salary of 30,000. Interest income from U.S. government bonds of 2,000. Dividends from a foreign corporation of 500. Sale of small business 1244 stock on October 20, 2019, for 20,000. The stock had been acquired two years earlier for 65,000. Business bad debt of 4,000. Nonbusiness bad debt of 5,000. Sale of small business 1244 stock on November 12, 2019, for 4,000. The stock had been acquired on June 5, 2019, for 800. Sale of preferred stock on December 4, 2019, for 40,000. The stock was acquired four years ago for 18,000. Total itemized deductions of 25,000 (no casualty or theft). a. Determine Soong's NOL for 2019- b. Assuming that Soong had taxable income for each of the last five years, deter mine to which years the 2019 NOL should be applied.Robin Corp. had the following in 2020: Taxable Income: $330,000 Federal income tax: $69,300 Interest on state gov’t (muni) bond: $5,000 Interest on corporate bond: $10,000 Meals expense (total): $3,000 Key person life insurance premiums: $3,500 Key person life insurance proceeds: $130,000 Ordinary & necessary business expenses: $250,000 Dividends (from a less-than-20%-owned US corp.; hint: make sure to include the 50% DRD in your E&P calculations): $35,000 What is Robin Corp.’s current E&P? Assume that there is no cash surrender value on the life insurance policy. Ans: 425,700 Q1. Same facts as previous question (use the current E&P from the previous question). Robin Corp. had the following in 2020: In addition to the current year E&P, Robin Corp. had accumulated E&P of $50,000. At the end of 2020, Robin Corp. distributed $450,000 cash to its sole shareholder, Robyn. Robyn’s stock basis prior to the distribution was…Y8 In January of 2022, Molly contracted a student loan of $10,000 to be repaid over 5 years at a rate of 7%, compounded monthly. Payments are monthly. In addition, she incurred eligible moving expenses of $500, paid tuition of $5,000 and earned gross employment income of $21,300 in 2022. What total tax credit will he receive for education-related expenses? Round to the nearest dollar. Select one: a. $1,024 b. $274 c. $900 d. $847

- During 2021, Linx had the following transactions: Salary $50,000 Bank loan (proceeds used to buy personal auto) 10,000 Alimony paid (divorce was finalized in 2010). 12,000 Child support paid 6,000 Gift from aunt 20,000 Linx s AGI is: a.$32,000. b.$56,000. c.$38,000. d.$44,000.Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses 760 800 Pretax accounting income (income statement) $ 128 $ 180 Taxable income (tax return) $ 116 $ 200 Tax rate: 25% Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. Expenses include $2 million insurance premiums each year for life insurance on key executives. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint: View this as two temporary differences—one reversing in 2021; one originating in 2021. 2021…Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses 760 800 Pretax accounting income (income statement) $ 128 $ 180 Taxable income (tax return) $ 116 $ 200 Tax rate: 25% Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. Expenses include $2 million insurance premiums each year for life insurance on key executives. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint: View this as two temporary differences—one reversing in 2021; one originating in 2021. 2021…

- Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses 760 800 Pretax accounting income (income statement) $ 128 $ 180 Taxable income (tax return) $ 116 $ 200 Tax rate: 25% Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. Expenses include $2 million insurance premiums each year for life insurance on key executives. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint: View this as two temporary differences—one reversing in 2021; one originating in 2021. 2021…Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses 760 800 Pretax accounting income (income statement) $ 128 $ 180 Taxable income (tax return) $ 116 $ 200 Tax rate: 25% Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. Expenses include $2 million insurance premiums each year for life insurance on key executives. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint: View this as two temporary differences—one reversing in 2021; one originating in 2021. 2021…In 20x0, Chain, Inc. purchased a P1,000,000 life insurance policy on its president, of which Chain is the beneficiary. Information regarding the policy for the year ended December 31, 20x5 follows: Cash surrender value, 1/1/x5 - 87,000 Cash surrender value, 12/31/x5 - 108,000 Annual Avance Premium Paid 1/1/x5 - 40,000 During 20x5, dividends of P6,000 were applied to increase the cash surrender value of the policy. What amount should Chain report as life insurance expense for 20x5? Answer:

- George bought 1,500 shares of stock LCC on March 7 at Php12. On June 3 of the same year, he sold these shares at Php14.50. If the broker's commission, transaction fees and taxes total 0.255% when buying, how much was George's total cash out in buying the 1,500 LCC shares?Hunt Taxidermy, Inc., is concerned about the taxes paid by the company in 2021. In addition to $14.1 million of taxable income, the firm received $1,555,000 of interest on state-issued bonds and $1,110,000 of dividends on common stock it owns in Oakdale Fashions, Inc. (Use corporate tax rate of 21 percent for your calculations.) Calculate Hunt Taxidermy’s tax liability. (Enter your answer in dollars not in millions. Round your answer to the nearest dollar amount.) Calculate Hunt Taxidermy’s average tax rate. (Round your answer to 2 decimal places.) Calculate Hunt Taxidermy’s marginal tax rate.