An agent is typically either an employee of the principal or an independent contractor. Very important legal consequences hinge on this distinction. The primary distinction between an employee and an independent contractor is B) The official title of the agent. A) The degree of control retained or exercised by the principal over the agent. D) Whether the principal and the agent have a fiduciary relationship. OC) The nature of the contract between the principal and the agent.

An agent is typically either an employee of the principal or an independent contractor. Very important legal consequences hinge on this distinction. The primary distinction between an employee and an independent contractor is B) The official title of the agent. A) The degree of control retained or exercised by the principal over the agent. D) Whether the principal and the agent have a fiduciary relationship. OC) The nature of the contract between the principal and the agent.

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

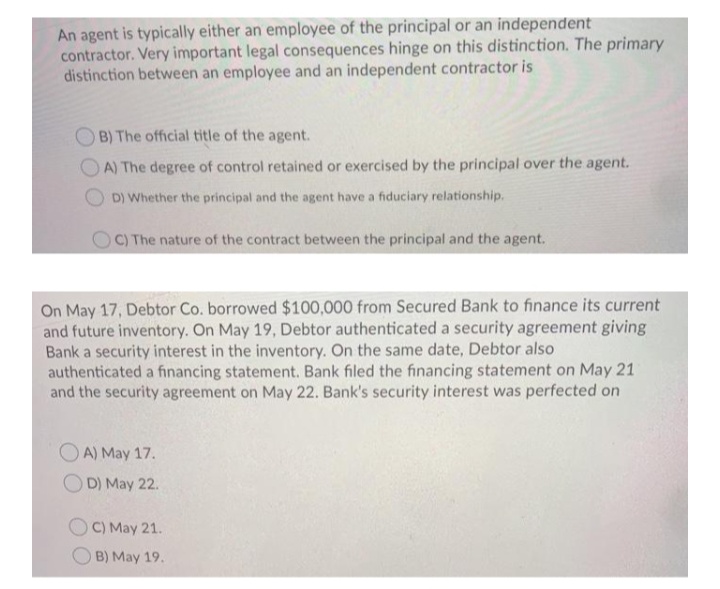

Transcribed Image Text:An agent is typically either an employee of the principal or an independent

contractor. Very important legal consequences hinge on this distinction. The primary

distinction between an employee and an independent contractor is

B) The official title of the agent.

A) The degree of control retained or exercised by the principal over the agent.

D) Whether the principal and the agent have a fiduciary relationship.

OC) The nature of the contract between the principal and the agent.

On May 17, Debtor Co. borrowed $100,000 from Secured Bank to finance its current

and future inventory. On May 19, Debtor authenticated a security agreement giving

Bank a security interest in the inventory. On the same date, Debtor also

authenticated a financing statement. Bank filed the financing statement on May 21

and the security agreement on May 22. Bank's security interest was perfected on

O A) May 17.

O D) May 22.

C) May 21.

B) May 19.

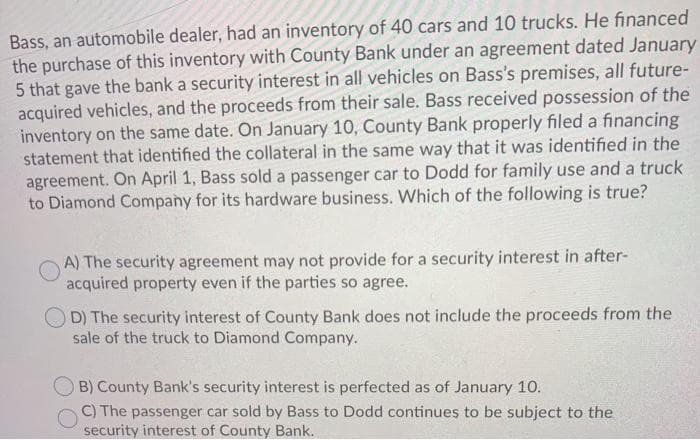

Transcribed Image Text:Bass, an automobile dealer, had an inventory of 40 cars and 10 trucks. He financed

the purchase of this inventory with County Bank under an agreement dated January

5 that gave the bank a security interest in all vehicles on Bass's premises, all future-

acquired vehicles, and the proceeds from their sale. Bass received possession of the

inventory on the same date. On January 10, County Bank properly filed a financing

statement that identified the collateral in the same way that it was identified in the

agreement. On April 1, Bass sold a passenger car to Dodd for family use and a truck

to Diamond Company for its hardware business. Which of the following is true?

A) The security agreement may not provide for a security interest in after-

acquired property even if the parties so agree.

D) The security interest of County Bank does not include the proceeds from the

sale of the truck to Diamond Company.

O B) County Bank's security interest is perfected as of January 10.

C) The passenger car sold by Bass to Dodd continues to be subject to the

security interest of County Bank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON