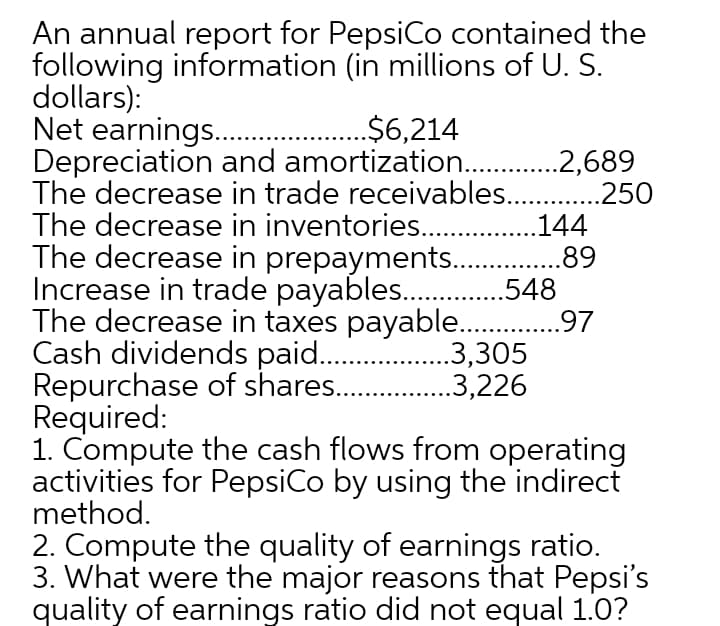

An annual report for PepsiCo contained the following information (in millions of U. S. dollars): Net earnings.. Depreciation and amortization. .2,689 The decrease in trade receivables. .250 The decrease in inventories. .144 The decrease in prepayments ..89 Increase in trade payables. .548 .$6,214 Th

An annual report for PepsiCo contained the following information (in millions of U. S. dollars): Net earnings.. Depreciation and amortization. .2,689 The decrease in trade receivables. .250 The decrease in inventories. .144 The decrease in prepayments ..89 Increase in trade payables. .548 .$6,214 Th

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 11MCQ: Chasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital...

Related questions

Topic Video

Question

Transcribed Image Text:An annual report for PepsiCo contained the

following information (in millions of U. S.

dollars):

Net earnings..

Depreciation and amortization .2,689

The decrease in trade receivables. .250

The decrease in inventories.

The decrease in prepayments.

Increase in trade payables..

The decrease in taxes payable .9,7

Cash dividends paid..

Repurchase of shares..

Required:

1. Compute the cash flows from operating

activities for PepsiCo by using the indirect

method.

.$6,214

.144

.89

.548

.3,305

.3,226

2. Compute the quality of earnings ratio.

3. What were the major reasons that Pepsi's

quality of earnings ratio did not equal 1.0?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning