An associated person of a broker-dealer may only share directly or indirectly in the profit or losses in a customer conditions are met. Which of these conditions do not apply in the case of an account shared with an immediate family member? A The associated person must obtain prior written approval from the broker-dealer B C D The associated person must obtain prior written opproval from the customer The associated person must share in the profit and losses in direct proportion to financial contributions made by the associated person None of these conditions apply in the case of an immediate family member

An associated person of a broker-dealer may only share directly or indirectly in the profit or losses in a customer conditions are met. Which of these conditions do not apply in the case of an account shared with an immediate family member? A The associated person must obtain prior written approval from the broker-dealer B C D The associated person must obtain prior written opproval from the customer The associated person must share in the profit and losses in direct proportion to financial contributions made by the associated person None of these conditions apply in the case of an immediate family member

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter6: Accounting Quality

Section: Chapter Questions

Problem 14QE

Related questions

Question

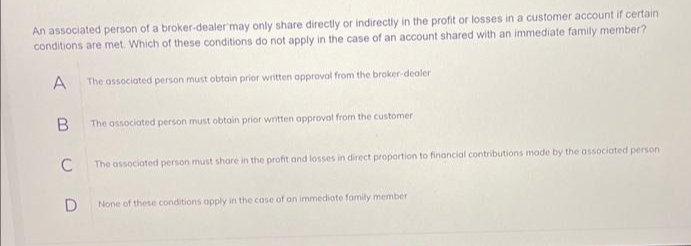

Transcribed Image Text:An associated person of a broker-dealer may only share directly or indirectly in the profit or losses in a customer account if certain

conditions are met. Which of these conditions do not apply in the case of an account shared with an immediate family member?

A The associated person must obtain prior written approval from the broker-dealer

B

C

D

The associated person must obtain prior written approval from the customer

The associated person must share in the profit and losses in direct proportion to financial contributions made by the associated person

None of these conditions apply in the case of an immediate family member

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College