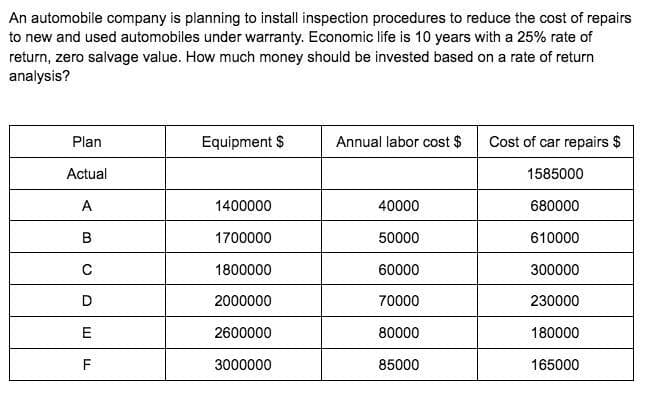

An automobile company is planning to install inspection procedures to reduce the cost of repairs to new and used automobiles under warranty. Economic life is 10 years with a 25% rate of return, zero salvage value. How much money should be invested based on a rate of return analysis? Plan Equipment $ Annual labor cost $ Cost of car repairs $ Actual 1585000 A 1400000 40000 680000 B 1700000 50000 610000 C 1800000 60000 300000 D 2000000 70000 230000 E 2600000 80000 180000 3000000 85000 165000 LL F

An automobile company is planning to install inspection procedures to reduce the cost of repairs to new and used automobiles under warranty. Economic life is 10 years with a 25% rate of return, zero salvage value. How much money should be invested based on a rate of return analysis? Plan Equipment $ Annual labor cost $ Cost of car repairs $ Actual 1585000 A 1400000 40000 680000 B 1700000 50000 610000 C 1800000 60000 300000 D 2000000 70000 230000 E 2600000 80000 180000 3000000 85000 165000 LL F

Chapter9: Capital Budgeting And Cash Flow Analysis

Section9.A: Depreciation

Problem 1P

Related questions

Question

A2)

Transcribed Image Text:An automobile company is planning to install inspection procedures to reduce the cost of repairs

to new and used automobiles under warranty. Economic life is 10 years with a 25% rate of

return, zero salvage value. How much money should be invested based on a rate of return

analysis?

Plan

Equipment $

Annual labor cost $

Cost of car repairs $

Actual

1585000

A

1400000

40000

680000

B

1700000

50000

610000

C

1800000

60000

300000

D

2000000

70000

230000

E

2600000

80000

180000

3000000

85000

165000

LL

F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning