An engineer borrowed $3000 from the bank, payable in six equal end-of-year payments at 8%. The bank agreed to reduce the interest on the loan if interest rates declined in the United States before the loan was fully repaid. At the end of 3 years, at the time of the third payment, the bank agreed to reduce the interest rate from 8% to 7% on the remaining debt. What was the amount of the equal annual end-of-year payments for each of the first 3 years? What was the amount of the equal annual end-of-year payments for each of the last 3 years?

An engineer borrowed $3000 from the bank, payable in six equal end-of-year payments at 8%. The bank agreed to reduce the interest on the loan if interest rates declined in the United States before the loan was fully repaid. At the end of 3 years, at the time of the third payment, the bank agreed to reduce the interest rate from 8% to 7% on the remaining debt. What was the amount of the equal annual end-of-year payments for each of the first 3 years? What was the amount of the equal annual end-of-year payments for each of the last 3 years?

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 14P

Related questions

Concept explainers

Question

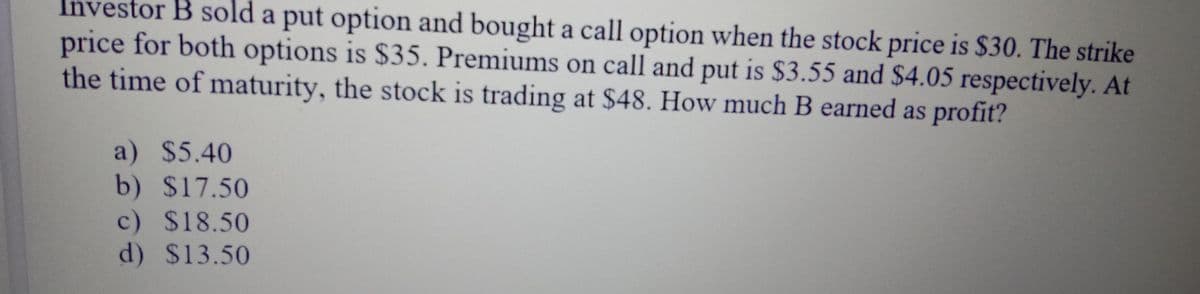

Transcribed Image Text:Investor B sold a put option and bought a call option when the stock price is $30. The strike

price for both options is $35. Premiums on call and put is $3.55 and $4.05 respectively. At

the time of maturity, the stock is trading at $48. How much B earned as profit?

a) $5.40

b) $17.50

c) $18.50

d) $13.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT