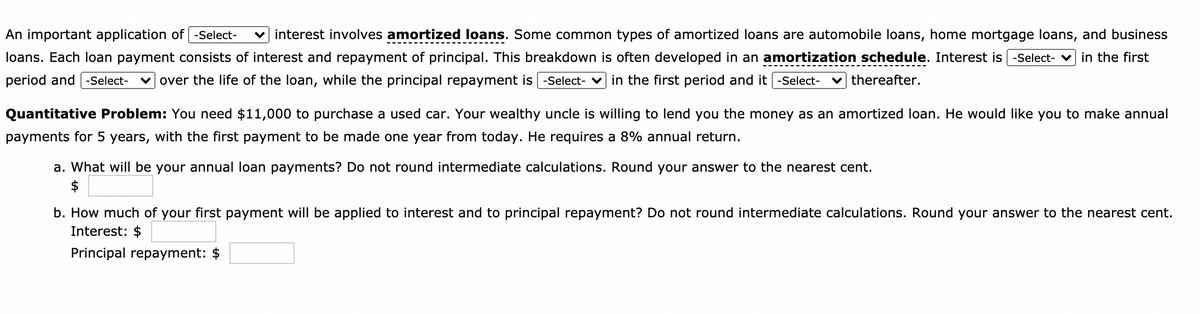

An important application of -Select- loans. Each loan payment consists of interest and repayment of principal. This breakdown is often developed in an amortization schedule. Interest is -Select- v in the first v interest involves amortized loans. Some common types of amortized loans are automobile loans, home mortgage loans, and business period and -Select- v over the life of the loan, while the principal repayment is -Select- v in the first period and it -Select- v thereafter. Quantitative Problem: You need $11,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 5 years, with the first payment to be made one year from today. He requires a 8% annual return. a. What will be your annual loan payments? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. How much of your first payment will be applied to interest and to principal repayment? Do not round intermediate calculations. Round your answer to the nearest cent. Interest: $ Principal repayment: $

An important application of -Select- loans. Each loan payment consists of interest and repayment of principal. This breakdown is often developed in an amortization schedule. Interest is -Select- v in the first v interest involves amortized loans. Some common types of amortized loans are automobile loans, home mortgage loans, and business period and -Select- v over the life of the loan, while the principal repayment is -Select- v in the first period and it -Select- v thereafter. Quantitative Problem: You need $11,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 5 years, with the first payment to be made one year from today. He requires a 8% annual return. a. What will be your annual loan payments? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. How much of your first payment will be applied to interest and to principal repayment? Do not round intermediate calculations. Round your answer to the nearest cent. Interest: $ Principal repayment: $

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 10QTD

Related questions

Question

Transcribed Image Text:An important application of -Select-

loans. Each loan payment consists of interest and repayment of principal. This breakdown is often developed in an amortization schedule. Interest is -Select- v in the first

interest involves amortized loans. Some common types of amortized loans are automobile loans, home mortgage loans, and business

period and -Select-

over the life of the loan, while the principal repayment is | -Select- v in the first period and it | -Select-

thereafter.

Quantitative Problem: You need $11,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual

payments for 5 years, with the first payment to be made one year from today. He requires a 8% annual return.

a. What will be your annual loan payments? Do not round intermediate calculations. Round your answer to the nearest cent.

$

b. How much of your first payment will be applied to interest and to principal repayment? Do not round intermediate calculations. Round your answer to the nearest cent.

Interest: $

Principal repayment: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT