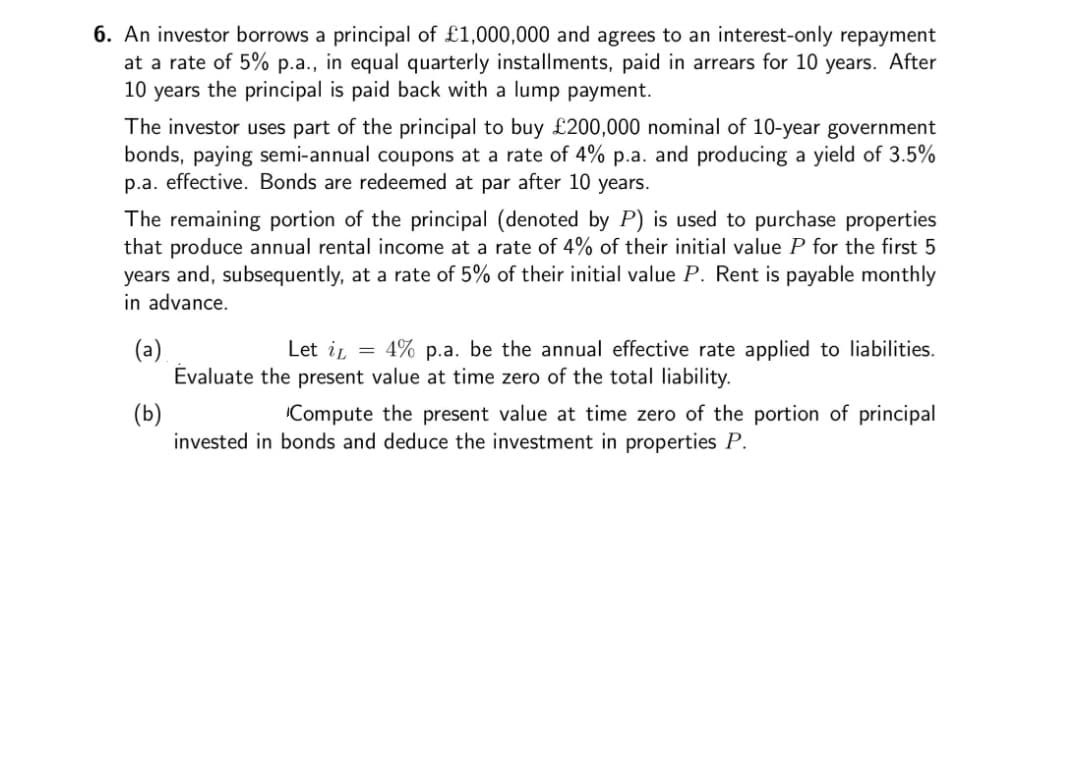

An investor borrows a principal of £1,000,000 and agrees to an interest-only repayment at a rate of 5% p.a., in equal quarterly installments, paid in arrears for 10 years. After 10 years the principal is paid back with a lump payment. The investor uses part of the principal to buy £200,000 nominal of 10-year government bonds, paying semi-annual coupons at a rate of 4% p.a. and producing a yield of 3.5% p.a. effective. Bonds are redeemed at par after 10 years. The remaining portion of the principal (denoted by P) is used to purchase properties that produce annual rental income at a rate of 4% of their initial value P for the first 5 years and, subsequently, at a rate of 5% of their initial value P. Rent is payable monthly in advance. (a) Evaluate the present value at time zero of the total liability. Let ir = 4% p.a. be the annual effective rate applied to liabilities. (b) Compute the present value at time zero of the portion of principal invected in bends and deduce the invectment in pronertios P

An investor borrows a principal of £1,000,000 and agrees to an interest-only repayment at a rate of 5% p.a., in equal quarterly installments, paid in arrears for 10 years. After 10 years the principal is paid back with a lump payment. The investor uses part of the principal to buy £200,000 nominal of 10-year government bonds, paying semi-annual coupons at a rate of 4% p.a. and producing a yield of 3.5% p.a. effective. Bonds are redeemed at par after 10 years. The remaining portion of the principal (denoted by P) is used to purchase properties that produce annual rental income at a rate of 4% of their initial value P for the first 5 years and, subsequently, at a rate of 5% of their initial value P. Rent is payable monthly in advance. (a) Evaluate the present value at time zero of the total liability. Let ir = 4% p.a. be the annual effective rate applied to liabilities. (b) Compute the present value at time zero of the portion of principal invected in bends and deduce the invectment in pronertios P

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 20P

Related questions

Question

Transcribed Image Text:6. An investor borrows a principal of £1,000,000 and agrees to an interest-only repayment

at a rate of 5% p.a., in equal quarterly installments, paid in arrears for 10 years. After

10 years the principal is paid back with a lump payment.

The investor uses part of the principal to buy £200,000 nominal of 10-year government

bonds, paying semi-annual coupons at a rate of 4% p.a. and producing a yield of 3.5%

p.a. effective. Bonds are redeemed at par after 10 years.

The remaining portion of the principal (denoted by P) is used to purchase properties

that produce annual rental income at a rate of 4% of their initial value P for the first 5

years and, subsequently, at a rate of 5% of their initial value P. Rent is payable monthly

in advance.

(a)

Evaluate the present value at time zero of the total liability.

Let ir = 4% p.a. be the annual effective rate applied to liabilities.

(b)

invested in bonds and deduce the investment in properties P.

Compute the present value at time zero of the portion of principal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT