An investor deposits $100 into his credit union account that pays interest at the rate of 3.25% per year (payable at the end of each year). He leaves the money and all accrued interest in the account for 7 years. How much will he have at the end of the 7 years?

An investor deposits $100 into his credit union account that pays interest at the rate of 3.25% per year (payable at the end of each year). He leaves the money and all accrued interest in the account for 7 years. How much will he have at the end of the 7 years?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 28P

Related questions

Question

100%

Plzz solve this

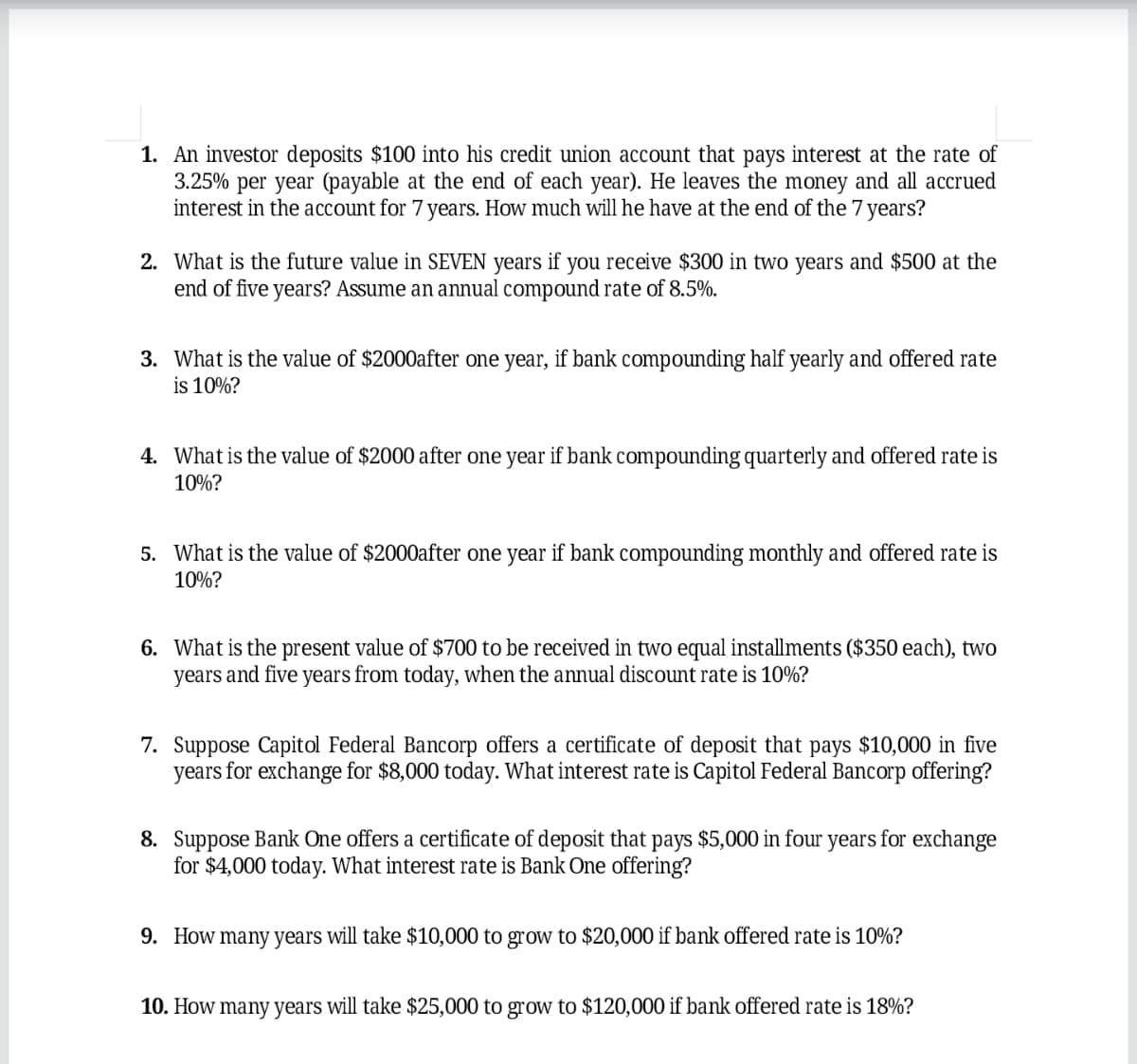

Transcribed Image Text:1. An investor deposits $100 into his credit union account that pays interest at the rate of

3.25% per year (payable at the end of each year). He leaves the money and all accrued

interest in the account for 7 years. How much will he have at the end of the 7 years?

2. What is the future value in SEVEN years if you receive $300 in two years and $500 at the

end of five years? Assume an annual compound rate of 8.5%.

3. What is the value of $2000after one year, if bank compounding half yearly and offered rate

is 10%?

4. What is the value of $2000 after one year if bank compounding quarterly and offered rate is

10%?

5. What is the value of $2000after one year if bank compounding monthly and offered rate is

10%?

6. What is the present value of $700 to be received in two equal installments ($350 each), two

years and five

years

from today, when the annual discount rate is 10%?

7. Suppose Capitol Federal Bancorp offers a certificate of deposit that pays $10,000 in five

years for exchange for $8,000 today. What interest rate is Capitol Federal Bancorp offering?

8. Suppose Bank One offers a certificate of deposit that pays $5,000 in four years for exchange

for $4,000 today. What interest rate is Bank One offering?

9. How many years will take $10,000 to grow to $20,000 if bank offered rate is 10%?

10. How many years will take $25,000 to grow to $120,000 if bank offered rate is 18%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT