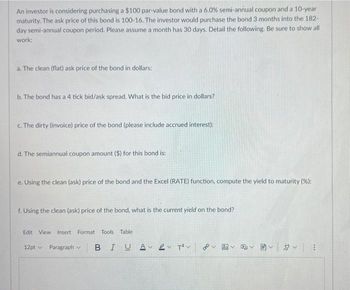

An investor is considering purchasing a $100 par-value bond with a 6.0% semi-annual coupon and a 10-year maturity. The ask price of this bond is 100-16. The investor would purchase the bond 3 months into the 182- day semi-annual coupon period. Please assume a month has 30 days. Detail the following. Be sure to show all work: a. The clean (flat) ask price of the bond in dollars: b. The bond has a 4 tick bid/ask spread. What is the bid price in dollars? c. The dirty (invoice) price of the bond (please include accrued interest): d. The semiannual coupon amount ($) for this bond is: e. Using the clean (ask) price of the bond and the Excel (RATE) function, compute the yield to maturity (%): f. Using the clean (ask) price of the bond, what is the current yield on the bond? Edit View Insert Format Tools Table 12pt Paragraph BIU A✓ l✓ T² OP 24 Ev D M $ ⠀

An investor is considering purchasing a $100 par-value bond with a 6.0% semi-annual coupon and a 10-year maturity. The ask price of this bond is 100-16. The investor would purchase the bond 3 months into the 182- day semi-annual coupon period. Please assume a month has 30 days. Detail the following. Be sure to show all work: a. The clean (flat) ask price of the bond in dollars: b. The bond has a 4 tick bid/ask spread. What is the bid price in dollars? c. The dirty (invoice) price of the bond (please include accrued interest): d. The semiannual coupon amount ($) for this bond is: e. Using the clean (ask) price of the bond and the Excel (RATE) function, compute the yield to maturity (%): f. Using the clean (ask) price of the bond, what is the current yield on the bond? Edit View Insert Format Tools Table 12pt Paragraph BIU A✓ l✓ T² OP 24 Ev D M $ ⠀

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts are unable to provide you with a solution at this time. Try rewording your question, and make sure to submit one question at a time. We've credited a question to your account.

Your Question:

Transcribed Image Text:An investor is considering purchasing a $100 par-value bond with a 6.0% semi-annual coupon and a 10-year

maturity. The ask price of this bond is 100-16. The investor would purchase the bond 3 months into the 182-

day semi-annual coupon period. Please assume a month has 30 days. Detail the following. Be sure to show all

work:

a. The clean (flat) ask price of the bond in dollars:

b. The bond has a 4 tick bid/ask spread. What is the bid price in dollars?

c. The dirty (invoice) price of the bond (please include accrued interest):

d. The semiannual coupon amount ($) for this bond is:

e. Using the clean (ask) price of the bond and the Excel (RATE) function, compute the yield to maturity (%):

f. Using the clean (ask) price of the bond, what is the current yield on the bond?

Edit View Insert Format Tools Table

12pt Paragraph

BIU A✓ l✓ T²

OP

24 Ev D M

$

⠀

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning