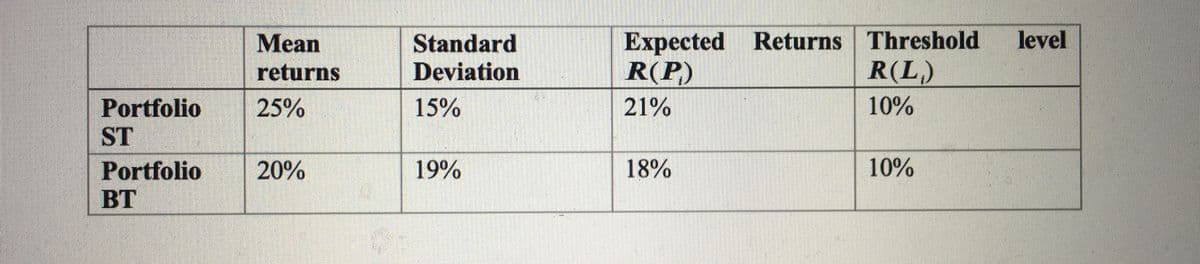

An investor is trying to decide between Portfolio ST and Portfolio BT. Portfolio ST comprises of stocksfrom the tech, financial and construction industry, while Portfolio BT includes stock from tech and financial industries only. The table below contains information on both portfolios. Which portfolio is the optimal portfolio considering the threshold level? Why do you think portfolio BT has a higher standard deviation than portfolio ST?

Q: Direct labor Direct materials Overhead Total variable overhead Total fixed overhead Expected units…

A: Formula used: Product cost per unit under Absorption costing = Direct materials + Direct labor +…

Q: AB partnership has net income of P61,000 for the year. A contributed P90,000 and B contributed…

A: Answer -24,550

Q: Overhead Cost Category (Activity Cost Pool) Supervision Driver Depreciation of machinery Assembly…

A: calculation of above requirement are as follows.

Q: At the end of an accounting period, a company's liabilities equaled $295,000, and owner's equity…

A: Introduction: The connection between a company's assets, liabilities, and capital is referred to as…

Q: Justify budgetary control solutions and their impact on organisational decision making to ensure…

A: Budgetary control is the control which is put in place by the company or the organization so that…

Q: F. The Silver Ray Corporation was organized on January 1, 2018 with authorized share capital…

A: There are two type of shares being issued by the business for raising capital. These are ordinary…

Q: what amount should be reported as vacation pay expense in 2018? 3,097,600 3,232,000

A: Vacation pay means the paid leaves provided by the company to its employees. In the vacation pay,…

Q: Moore Wholesalers is preparing its merchandise purchases budget. Budgeted sales are $420,000 for…

A: Purchase budget: Purchase budget is prepared at the beginning of the year to estimate the purchase…

Q: 9. Kohler Kleaners borrowed $50,000 on June 1, 2022, to finance the purchase of a building. The…

A: Principle amount of loan is $ 50000. Emi = $525 Interest rate = 8℅ Month opening balance of loan…

Q: both girls, and both girls live at the Princes residence. Which of the following statements is true…

A: Hemlet and Ophelia have one daughter and one taken friend of their daughter Jane, to check whether…

Q: Exercise 1- Errors Not Revealed by Trial Balance State which type of error each of the following…

A: Comment; Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Service Cost Allocation larley Corp. has two service departments, (Admin Support Dept. & It Support…

A: The production department or service department costs can be allocated to operating departments…

Q: ABC contributed P48,000 and DEF contributed P96,000 to form a partnership and they agreed to share…

A: A partnership is an arrangement between two or more people who own, control and manage the business…

Q: 2) After completion of problem 1 above, change the account balances to their adjusted totals and…

A: Income Statement - The income statement is the statement that shows the income earned during the…

Q: The following units of an inventory item were available for sale during the year: Beginning…

A: Inventory is valued on the basis of different inventory valuation methods such as LIFO, FIFO, or…

Q: Klamath Company produces a single product. The projected income statement for the coming year is as…

A: Income statement: The income statement shows the company's revenues and expenses earned during the…

Q: A taxpayer received during the taxable year the following passive income derived from within the…

A: The income is the income earned without the use of time and labor of the taxpayer. Passive income…

Q: Problem 12-1A Corporate balance sheet preparation LO2 Account Description Accounts payable Accounts…

A: Classified balance sheet is one of the financial statement of the business, which shows all assets,…

Q: Harley Corp. has two service departments, (Admin Support Dept. & It Support Dept.) and two producing…

A: Lets understand the basics. In direct method of cost allocation, service departments costs are…

Q: On February 12, Quality Carpet Inc., a carpet wholesaler, issued for cash 729,000 shares of no-par…

A: Shareholders equity balance includes common stock, preferred stock, additional paid-in capital. From…

Q: John Tripper Soft Drinks, Inc., sells 500,000 bottles of soft drinks a year. Each bottle produced…

A: Hi There, Thanks for Choosing Bartleby, as per the honor code we are supposed to answer the first…

Q: create a monthly budget. Once the budget is established, estimate how much you would be able to save…

A: Monthly budget : Monthly income (Net) = $3000 .....(A) Estimated monthly expense Estimated Cost…

Q: 17. Calapan Company provided the data in the table below. In 2011, accounts written off amounted to…

A: Dear Student, Since you have asked multiple questions, we will solve the first question for you, if…

Q: Privett Company Accounts payable Accounts receivable Accrued liabilities Cash Intangible assets Inve…

A: Introduction: Total Assets value: Sum of all the assets value derives the Total Assets value. All…

Q: Kansas Enterprises purchased equipment for $74,500 on January 1, 2021. The equipment is expected to…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: Allocation of Expenses to Departments Expense Account Bal. Purchasing Dept. Books Dept. Magazines…

A: Note: Hi! Thank you for the question As per the honor code, We’ll answer the first question since…

Q: Under absorption costing, a company had the following unit costs when 13,500 units were produced.…

A: Production Cost - Production cost is the cost required to manufacture product. It includes Direct…

Q: on March 1, 2020. The entity borrowed P3,500,000 on February 1, 2020 which had a five-year term and…

A: Liabilities in the Balance Sheet is classified into two categories: Current Non current Those…

Q: Cadbury Limited has a public traded debt (debentures) with a face value of R3 million. The coupon…

A: Calculation for present value factor : here n = number of years i = current market interest rate…

Q: 5. Journalize and post the adjusting entries using the following information: a. Insurance expired…

A: Closing Entries - Closing entries are required to close the temporary accounts after making…

Q: Z decided to withdraw from the partnership, his share in the partnership is 20%. Upon withdrawal, he…

A: Computation of total revaluation gain: Total partnership capital before withdrawal P252,000…

Q: Power Company manufactures a variety of drill bits. The company's plant is partially automated. The…

A: Plantwide rate based on direct labor-hours=Total overheadTotal direct labor-hours

Q: At the start of 2020 , XYZ Company Developed the following budgeted total cost function i.e $12.50X…

A: A flexible budget variance is any distinction between the results generated by a flexible budget…

Q: A cash budget, by quarters, is given below for a retail company (000 omitted). The company requires…

A: Cash Budget:- A Cash budget is a detailed estimate of the cash receipt from all sources and cash…

Q: Oriole Corporation has 74,000 shares of common stock outstanding. It declares a $2 per share cash…

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Journals are…

Q: how much should A received from C?

A: Given in the question: A B Initial Contribution 48,000 96,000 Drawing During…

Q: DEF Co. purchased a lot for ₱8,000,000. Immediately after the purchase, DEF Co. started the…

A: The capitalized cost of land will be equal to the initial cost of land i.e. the acquisition price…

Q: Arrow Manufacturing Co. expects to make 50,000 chairs during the year 1 accounting period. The…

A: Introduction: Manufacturing costs include all resources utilized in the creation of the product.…

Q: explain why the author's assessment of the appropriateness of the going concern assumptions is so…

A: Going Concern Assumption- As per the going concern assumption business will continue its…

Q: $231,000 during 2021. Wang applies the CECL model to account for its investment and calculates that,…

A: Current investments are the investments held for a short period of time that is., for the period of…

Q: (b) Assets $177,000 Liabilities Stockholders' Equity $70,000 +A

A: Introduction: Balance sheet: All assets and liabilities are to be shown in Balance sheet. It tells…

Q: On April 30, 2019, Winona Company purchased for cash 18,000 of the 60,000 voting shares of Chico…

A: Goodwill is the amount of excess consideration paid over and above the fair value of the investment…

Q: the descriptions provided, identify the type of power in each instance. 1. Archie Ngidi is widely…

A: Explanation of Concept We can understand the Audit as per their definition which describe Audit as…

Q: Carter Stark started Gulf Corp. on October 1, 2014. The adjusted trial balance shown below has been…

A: Financial statements: The business needs various types of financial statements to function. The…

Q: The Mazzanti Wholesale Food Company's fiscal year-end is June 30. The company issues quarterly…

A: Journalizing - Journalizing refers to the act of recording the exchange of goods in a journal, and…

Q: Total Assets value a Privett Company Accounts payable $30,000 Accounts receivable 35,000 Accrued…

A: Asset refers to resource of a entity from which future economic benefits are expected to flow to the…

Q: Rasmussen Corporation expects to incur indirect overhead costs of $80,000 per month and direct…

A: Manufacturing expenses are simply an expenditure study that estimates how each department in your…

Q: TB MC Qu. 5-63 (Algo) Manufacturing overhead: Metal Company Metal Company budgeted $564,000…

A: Calculation of cost per direct labor hour :- Direct labor hour = Machine…

Q: ABC contributed P48,000 and DEF contributed P96,000 to form a partnership and they agreed to share…

A: The profit sharing ratio is to be calculated on the basis of their original capital contributions…

Q: 2. Computer for the Net Present Value using the present value of an annuity. Get the value using…

A: Explanation of the concept Net present value method which is used for decision making for accepting…

An investor is trying to decide between Portfolio ST and Portfolio BT. Portfolio ST comprises of stocksfrom the tech, financial and construction industry, while Portfolio BT includes stock from tech and financial industries only. The table below contains information on both portfolios.

- Which portfolio is the optimal portfolio considering the threshold level?

- Why do you think portfolio BT has a higher standard deviation than portfolio ST?

Step by step

Solved in 3 steps

- Year Risk free rate (%) Return_risk-free asset 2011 4.51 - 2012 3.11 2013 2.61 2014 2.75 2015 2.34 2016 1.78 2017 1.77 2018 2.02 2019 0.90 2020 0.02 Average Calculate return on risk free asset and its average and assume: Average (Return on Risky Portfolio) 3.86% Standard deviation (Risky Portfolio) 10.56% Expected Return (Complete Portfolio) 7% Solve for the proportions of y and (1-y) such that: E(Rc)=Rf+y[E(rp)-rf]) = 7%If E(rX)=0.12 and E(rY)=0.08, what would be the expected rate of return of a portfolio made of 30% of X and 70% of Y? A. 0.080 B. 0.120 C. 0.108 D. 0.092 E. 0.100The market portfolio's historical returns for the past three years were 10 percent, 10 percent, and 16 percent. Suppose the risk-free rate of return is 4 percent. Estimate the market risk premium: Multiple Choice: A) 12% B) 16% C) 4% D) 8%

- The following table provides information relating to Omega Ltd, as well as the market portfolio. The risk-free rate of return is 3.4% . Asset Excess Return Variance Beta Omega 12% 0.021904 1.4 M 8.1% 0.010201 1 What is Omega's M2 value? a. 7.41% b. 11.59% c. 8.99% d. 9.27% What is Omega's Sharpe Ratio? a. 0.061 b. 0.811 c. 0.086 d. 0.581 please explain the calculation step by stepConsider a single-index model economy. The index portfolio M has E(RM ) = 6%, σM = 18%.An individual asset i has an estimate of βi = 1.1 and σ2ei = 0.0225 using the single index modelRi = αi + βiRM + ei. The forecast of asset i’s return is E(ri) = 12%. rf = 4%. a) According to asset i’s return forecast, calculate αi. (b) Calculate the optimal weight of combining asset i and the index portfolio M . (c) Calculate the Sharpe ratio of the index portfolio M and the portfolio optimally combiningasset i and the index portfolio M .Portfolio Expected return Standard deviation Q 7.8% 10.5% R 10.0% 14.0% S 4.6% 5.0% T 11.7% 18.5% U 6.2% 7.5% (Q1) For each portfolio, calculate the risk premium per unit of risk (Sharpe ratio) that you expect to receive. Assume that the risk-free rate is 3.0%. (Q2) Using answers from Q1, which of these five portfolios is most likely to be the market portfolio and explain why. (200 words maximum)

- Consider the following information for four portfolios, the market, and the risk-free rate (RFR): Portfolio Return Beta SD A1 0.15 1.25 0.182 A2 0.1 0.9 0.223 A3 0.12 1.1 0.138 A4 0.08 0.8 0.125 Market 0.11 1 0.2 RFR 0.03 0 0 Refer to Exhibit 18.6. Calculate the Jensen alpha Measure for each portfolio. a. A1 = 0.014, A2 = -0.002, A3 = 0.002, A4 = -0.02 b. A1 = 0.002, A2 = -0.02, A3 = 0.002, A4 = -0.014 c. A1 = 0.02, A2 = -0.002, A3 = 0.002, A4 = -0.014 d. A1 = 0.03, A2 = -0.002, A3 = 0.02, A4 = -0.14 e. A1 = 0.02, A2 = -0.002, A3 = 0.02, A4 = -0.14Compute the expected rate of return on investment i given the followinginformation: Rf = 8%; E(RM) = 14%; βi = 1.0.b. Recalculate the required rate of return assuming βi is 1.8.25. a. Compute the expected rate of return on investment i given the followinginformation: the market risk premium is 5%; Rf = 6%; βi = 1.2.b. Compute E(RM)Portfolio A returned 9.20% p.a. over the evaluation period compared to 5.00% p.a. for the S&P 500. This equates to a difference, or outperformance of 4.20% p.a. However, according to CAPM, the annualized alpha of portfolio A is 4.74% p.a. Explain the difference between the two numbers. Need typed answer.No playgarism

- Asset P has a beta of 0.9. The risk-free rate of return is 8 percent, while the return on the market portfolio of assets is 14 percent. The asset's required rate of return isSet up the complete formula for Dollar Weighted Return (DWR) for the following portfolio including final value of the portfolio. Year 0 1 2 3 4 Actions at the ending of the year (Yr0)Starting with $1000 (Yr1)Adding $100 (Yr2)Withdrawing $200 (Yr3)Adding $300 (Yr4)Ending Value = ? ROR during each Yr (Yr0) - (Yr1) 8% (Yr2)-4% (Yr3) 9% (Yr4) 3% A. Calculate the time weighted return (TWR) Complete Questions with respect to ExcelThe discounted returns on a portfolio are normally distributed with mean 1.2% and volatility 13%. Find the 1% 10-day expected shortfall (ES) assuming the returns are i.i.d. You are given that ϕ(Φ−1(0.01))=0.02265.