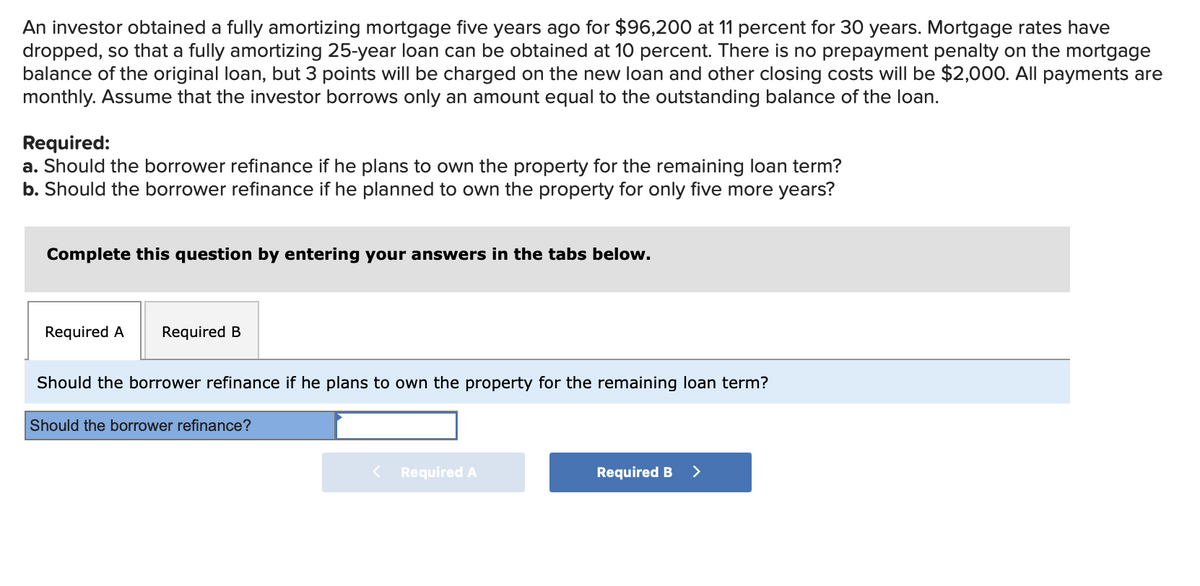

An investor obtained a fully amortizing mortgage five years ago for $96,200 at 11 percent for 30 years. Mortgage rates have dropped, so that a fully amortizing 25-year loan can be obtained at 10 percent. There is no prepayment penalty on the mortgage balance of the original loan, but 3 points will be charged on the new loan and other closing costs will be $2,000. All payments are monthly. Assume that the investor borrows only an amount equal to the outstanding balance of the loan.

An investor obtained a fully amortizing mortgage five years ago for $96,200 at 11 percent for 30 years. Mortgage rates have dropped, so that a fully amortizing 25-year loan can be obtained at 10 percent. There is no prepayment penalty on the mortgage balance of the original loan, but 3 points will be charged on the new loan and other closing costs will be $2,000. All payments are monthly. Assume that the investor borrows only an amount equal to the outstanding balance of the loan.

Chapter9: Obtaining Affordable Housing

Section: Chapter Questions

Problem 4DTM

Related questions

Question

4

Transcribed Image Text:An investor obtained a fully amortizing mortgage five years ago for $96,200 at 11 percent for 30 years. Mortgage rates have

dropped, so that a fully amortizing 25-year loan can be obtained at 10 percent. There is no prepayment penalty on the mortgage

balance of the original loan, but 3 points will be charged on the new loan and other closing costs will be $2,000. All payments are

monthly. Assume that the investor borrows only an amount equal to the outstanding balance of the loan.

Required:

a. Should the borrower refinance if he plans to own the property for the remaining loan term?

b. Should the borrower refinance if he planned to own the property for only five more years?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Should the borrower refinance if he plans to own the property for the remaining loan term?

Should the borrower refinance?

Required A

Required B

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning