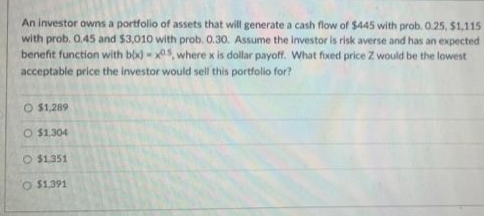

An investor owns a portfolio of assets that willl generate a cash flow of $445 with prob. 0.25, $1,115 with prob. 0.45 and $3,010 with prob. 0.30. Assume the investor is risk averse and has an expected benefit function with bo)-s where x is dollar payoff. What fxed price Z would be the lowest acceptable price the investor would sell this portfolio for? O $1,289 O $1.304 O $1.351 O $1.391

Q: You are planning to retire in 25 years time. Immediately after your retirement, you wish to go for a...

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only on...

Q: at 11 1 2% interest for four years. (Round your answers to the nearest cent.) (a) Find his month...

A: Fist we need to use loan amortization formula to calculate monthly payment of loan. PMT =P*r1-1(1+r)...

Q: If a company declares a $0.30 dividend and you own 100 shares, how much dividends will you receive?

A: A dividend is a monetary payment made by a company to its shareholders who are eligible to receive i...

Q: Finsbury Co has a cash generating unit (CGU) that suffers a large drop in income due to reduced dema...

A: Answer- Step 1 - Calculation of Total impairment Loss - Carrying Cost of Assets ...

Q: Brazil used the free float exchange rate method from 1999. Discuss the motives of Brazil's move and ...

A: Free floating exchange rate is the market determined exchange rate that is based on supply and deman...

Q: Bulldogs Inc. has forecasted that its net income will be P520,000. The company has an debt-to- equit...

A: The equity funding required for the project is calculated as the ratio of equity in the capital stru...

Q: You have taken out a loan of $32,000 to buy a new Saturn. The loan will be paid off in monthly insta...

A: A loan is an agreement between two parties where an amount is changed in return for the amount being...

Q: A proposed relaxation of credit standards of Bulldogs Inc. will increase the balance of accounts rec...

A: Solution:- Average collection period means the average days to recover money from debtors. We know, ...

Q: 1. Financial Forecasting vs. Financial Modelling. Explain the difference.

A: In finance we often use financial forecasting as well as financial modelling. Though both financial ...

Q: APR by table lookup (

A: APR stands for Annual percentage rate means the amount of interest charge over the principal amount ...

Q: Beryl's Iced Tea currently rents a bottling machine for $52,000 per year, including all maintenance...

A: The difference between the current worth of cash inflows and withdrawals over a period of time is kn...

Q: mortgage for a condominium had a principal balance of $44,900 that had to nortized over the remainin...

A: Monthly payments are done that carry the payment of principal and payment for the interest. So that ...

Q: What is the cost of new common stock if the required rate of return is 9%, the constant dividend gro...

A: The cost of issuing new securities is known as floatation cost. It includes legal expenses, registra...

Q: What is the current yield on the bonds? (Do not round intermediate calculations and enter your answe...

A: Current Yield: It represents the annual income of the bond consisting of interest payments. It is c...

Q: Bulldogs Inc. wants to analyze its variances in its actual and budgeted operation. · There is...

A: Given, Actual gross profit = Budgeted gross profit. Quantity of units sold = Budgeted units sold. A...

Q: What is the required rate of return on the new portfolio?

A: Required return is the minimum return an investor will demand on the principal amount invested. It i...

Q: Bulldogs Inc. expects to use 48,000 boxes of chocolate per year costing P12 per box. Inventory carry...

A: Cost per box = $12 Inventory carrying cost = 20% Safety stock = 2,400 boxes Order of boxes = 2,000 ...

Q: The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $1 per share, and there...

A: Dividend is that portion of the net income or earnings of a company which is distributed the shareho...

Q: Dufner Co. issued 14-year bonds one year ago at a coupon rate of 6.4 percent. The bonds make semiann...

A: Par value (FV) = $1000 Coupon rate = 6.4% Semi annual coupon amount (C) = 1000*0.064/2 = $32 Years t...

Q: Explain Briefly these five methods of dealing with risks. the risk may be avoided the risk may be r...

A: The act of discovering, analyzing, and subjugating these risks is known as pure risk management, and...

Q: A father wants to set aside money for his 5-year old son's future college education. Money can be de...

A: Present Value The present value is the value of cash flow stream or the fixed lump sum amount at ti...

Q: During 2021, Montoya (age 15) received $2,300 from a corporate bond. He also received $900 interest ...

A: Solution:- Taxable means the income on which the income tax is charged by the tax authorities.

Q: The time series line chart below shows the total return on a stock index fund over a certain time pe...

A: The time series analysis is a type of analysis which collects the data points of a stock price at re...

Q: It is assumed that the Cost of equity and rate of return are both constant under Walter’s Model of D...

A: Solution:- Walter’s Model of Dividend is a relevant dividend model, which implies that the dividend ...

Q: 2. Find the amount (in $) of interest on the loan

A: Interest: It is the monetary charge paid to the lender by the borrower for taking a loan. Interest ...

Q: You have taken a loan of $5,000.00 for 4 years at 3.6% compounded monthly. Fill in the table below: ...

A: Given: Particulars Amount Loan 5000 Years 4 Interest rate 3.60%

Q: Which of the following would best explain an increase in receivables turnover? a. The company adopt...

A: Receivable turnover is calculated by dividing the net credit sales with the average accounts receiva...

Q: If the risk-free rate is 5%, the expected market risk premium (rm- rf ) is 10%, the firm has no debt...

A: The share price which is the maximum price to be paid for share consists of dividends and terminal v...

Q: A B C D E F 1 A В C D 1 Market Capitalization, in millions YUM ZTS AAPL Market (OEX) 4 3 31/01/18 28...

A: Stock prices fluctuate over time due to various factors. Variance means changes in a particular vari...

Q: ne company's total sales are million. (Round to one decimal

A: Dupont analysis refers to the framework established by the Dupont corporation for analyzing the perf...

Q: Bulldogs Inc. is given terms of 2/10, net 45 by its suppliers. If Bulldogs Inc. forgoes the cash dis...

A: Answer- Calculation of annual interest rate cost- Cost of not taking discount- = [2% / (100% - 2%...

Q: You have a portfolio with the following: Stock Number of Shares Price Expected Return W 725 ...

A: Stock Number of share Price Investment Investment Ratio I II III = I*II IV=III/96250 W 725 46 3...

Q: The following are methods of acquiring funds through long-term financing, except a. Issuing a note ...

A: Solution:- Long term sources of capital are those sources of funds from where the funds are acquired...

Q: How many futures contracts should be added to the portolio to meet the target beta? Round to 0 decim...

A: The relative volatility of an individual stock portfolio, as assessed by a selected stocks betas of ...

Q: t up a savings plan with CIBC whereby he deposits $337 at the end of each quarter for 4 years. Inter...

A: Compund interest =Interest over original principal and interest earned.

Q: Bulldogs Inc. loaned a certain amount from a reputable bank for a term of one year at 8% quoted rate...

A: Principal = P 415000 Principal - Compensating balance = P 375000 Nominal interest rate = 8%

Q: STION. A commercial real estate developer is considering several options for developing a piece of p...

A: We will first find out the NPV for all investments then we will choose the best project with the hig...

Q: Automotive Excellence Inc. borrowed $17,000.00 on May 11 with an interest rate of 10.7% per annum. O...

A: Total Amount borrowed On May 11th is $17,000.00 Interest rate per annum is 10.7% Amount repaid on Ju...

Q: Altoona Company is considering replacing a machine with a book value of P200,000, a remaining useful...

A: Given: Cost of machine = P320,000 Life = 4 Savings operating cost = P100,000 Tax = 40%

Q: When do liquidity management solutions deliver maximum value to the firm?

A: Liquidity management is an important aspect of treasury management. Essentially treasury management ...

Q: True or false: the investor will be eligible to receive the dividends when he/she buy the company st...

A: Meaning of Dividend It is a distribution of stock or cash to the shareholders of a company. Basical...

Q: Discounted cash flow capital budgeting techniques do not O take into consideration an unconventional...

A: Discounted cash flow method is a vital capital budgeting technique. It has been explained in the nex...

Q: Write the 4 Formulas for Uniform Annuity Series 1 Find F/A 2 Find P/A 3 Find A/P 4 Fina A/F 5 P (Pr...

A: An annuity is a series of equal payments made over a set period of time. While payments in an ordina...

Q: a The value of an investment account has a doubling time of 13 years and $35,000 was originally depo...

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one...

Q: Jeffrey received a $32,950 loan from a bank that was charging interest at 5.75% compounded semi-annu...

A: Amortized Loan: Amortized loan is a type of loan in which the borrower would pay periodic payments ...

Q: A company is considering a £70,000 investment in a machine that would produce 10,000 items per year ...

A: Investment £70,000.00 Salvage Value £10,000.00 Time Period 3 Variable Cost 7 Selling price...

Q: Deposit $10,000 in account with 7% annual interest compounded monthly. What is the balance after 3 ...

A: Solution:- When some amount is deposited, it earns some interest. The amount at the end along with t...

Q: Allen Inc. took out a 1-year, 8%, $100,000 loan on March 31, 2018. Interest is due upon maturity of ...

A: Solution:- When an amount is borrowed, the lender charges interest on it and at the maturity, princi...

Q: A corporation uses net present value techniques in evaluating its capital investment projects. The c...

A: Initial cost (C) = P 100000 n = 5 years r = 12% Depreciation = 100000 / 5 = P 20000

Q: Bulldogs Inc. enters into an agreement with a firm that will factor the company’s accounts receivabl...

A: The first stage is to figure out how much money the company will get from the factoring transaction:...

Step by step

Solved in 2 steps

- APT An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate is 6%, the expected return on the first factor (r1) is 12%, and the expected return on the second factor (r2) is 8%. If bi1 = 0.7 and bi2 = 0.9, what is Crisp’s required return?An investor has an opportunity to invest in two risky assets and a risk-free asset. Theexpected return of the two risky assets are μ1 = 0.12, μ2 = 0.15. Their standarddeviations are σ1 = 0.05 and σ2 = 0.1, and the correlation coefficient between theirreturn is 0.2. The risk-free rate is 0.05. Suppose the investor has $1000 and he wantsto hold a portfolio with expected return of 0.1. If the investor is risk averse, how muchshould he invest in the two risky assets and the risk-free asset?Consider an economy with a (net) risk-free return r1 = 0:1 and a market portfolio with normally distributed return, with ErM = 0:2 and 2M = 0:02. Suppose investor A has CARA preferences, with risk aversion coe¢ cient equal to 1 and an endowment of 10. a) Write down the maximization problem for the investor. b) Determine the amount invested in the risky portfolio and in the risk-free asset. c) Suppose another investor (B) has a coe¢ cient of absolute risk aversion equal to 2 (and the same endowment 10). Compute his optimal portfolio and compare it to that of investor A. Explain the di§erent results for investors A and B. d) Finally, consider Investor C with mean-variance preferences Ec V ar(c) (and endowment 10). Compute his optimal portfolio and compare it to that of investors A and B (as obtained in questions b and c). Compare your result with those obtained for investors A and B.

- Assume for parts (a) to (h) that the Capital Asset Pricing Model holds. The marketportfolio has an expected return of 5%. Stock A’s return has a market beta of 1.5, anexpected value of 7% and a standard deviation of 10%. Stock B’s return has amarket beta of 0.5 and a standard deviation of 20%. The correlation between stockA’s and stock B’s return is 0.5.Required:a) Explain the term ‘capital asset pricing model.’b) What is the risk-free rate?c) What is the expected return on stock B?d) Draw a graph with expected return on the y-axis and beta on the x-axis. Indicate the approximate position of the risk-free asset, the market portfolio and stocks A and B on this graph. Draw the line, which connects these four points.e) Explain the term ‘Securities Market Line’, and what is the slope of the SML for this economy?f) Consider a portfolio with a weight of 50% in stock A and 50% in stock B. What are its variance and expected return?g) Where would under-priced and over-priced securities plot on…The investor has R50,000 to invest A, B and C. R12,000 will be invested into asset A. The beta for asset A and asset B is 0.90 and 1.2 respectively. Asset C represents the risk-free asset. If the investor envisages a portfolio equally as risky as the market, how much should be invested into asset B?The investor has R50,000 to invest A, B and C. R12,000 will be invested into asset A. The beta for asset A and asset B is 0.90 and 1.2 respectively. Asset C represents the risk-free asset. If the investor envisages a portfolio equally as risky as the market, how much should be invested into asset B? Which answer is correct? A. 32677 B. 32676 C. 32667 D. 32678

- Using the following information determine the expected rate of return for a risky asset using CAPM, consider the following example stocks assuming that you have already computed their betas Stocks Beta A 0.70 B 1.00 C 1.15 D 1.40 E -0.30 Assume that you expect the economy RFR to be 6% (0.06) The expected return on the market portfolio (E(Rm)) to be 8% (0.08) A market risk premium of (0.04). Question: What would be the SML required rate of return for the following stocks. A, B,C,D and ESuppose you are given the following inputs for the Fama-Frech-3-Factor model. Required Return for Stock i: bi=0.8, kRF=8%, the market risk premium is 6%, ci=-0.6, the expected value for the size factor is 5%, di=-0.4, and the expected value for the book-to-market factor is 4%. Task: Estimate the required rate of return of this asset using the Capital asset pricing model and compare it with the Fama-French-3-factor model.Suppose that the S&P 500, with a beta of 1.0, has an expected return of 12% and T-bills provide a risk-free return of 4%. a. What would be the expected return and beta of portfolios constructed from these two assets with weights in the S&P 500 of (i) 0; (ii) 0.25; (iii) 0.50; (iv) 0.75; (v) 1.0? (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Enter the value of Expected return as a percentage rounded to 2 decimal places and value of Beta rounded to 2 decimal places.) b. How does expected return vary with beta? (Do not round intermediate calculations.)

- Suppose that the S&P 500, with a beta of 1.0, has an expected return of 12% and T-bills provide a risk-free return of 3% a. What would be the expected return and beta of portfolios constructed from these two assets with weights in the S&P 500 of Expected Return Beta (i) 0 (ii) 0.25 (iii) 0.50 (iv) 0.75 (v) 1.0 (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Enter the value of Expected return as a percentage rounded to 2 decimal places and value of Beta rounded to 2 decimal places.) b. How does expected return vary with beta? (Do not round intermediate calculations.) Fill in the bolded part The expected return (increases/decrease) by ( %) for a one unit increase in beta.Using the following information determine the expected rate of return for a risky asset using CAPM, consider the following example stocks assuming that you have already computed their betas Stocks Beta A 0.70 B 1.00 C 1.15 D 1.40 E -0.30 Also assume that you expect the economy RFR to be 6% (0.06) and the expected return on the market portfolio (E(Rm)) to be 8% (0.08) which implies a market risk premium of (0.04). What would be the SML required rate of return for the following stocks: A, B, C, D and E.Assume that the CAPM is true, ?F = 5%, ?M = 15% ??? ?M = 0.1. An investor with $10,000 to invest builds a portfolio, Q, of T-bills and the market portfolio. This means that a. it would be possible for the investor to obtain a return of 17% on portfolio Q. b. if portfolio Q were composed of short-selling $2,000 in T-bills and the remainder is the market portfolio, then ρQM = 1, βQ = 1.2 and σQ = 0.12. c. to obtain a return of 17% from portfolio Q the investor would need to invest $12,000 in the market portfolio. d. all of the above are true. e. only (a) and (b) above are true.