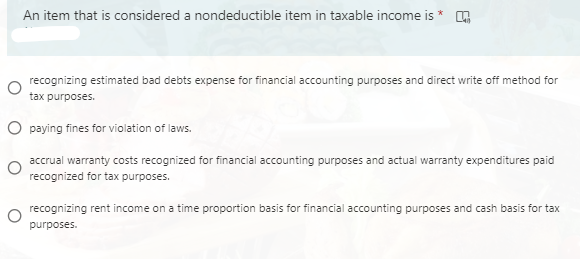

An item that is considered a nondeductible item in taxable income is recognizing estimated bad debts expense for financial accounting purposes and direct write off method for tax purposes. O paying fines for violation of laws. accrual warranty costs recognized for financial accounting purposes and actual warranty expenditures paid recognized for tax purposes. recognizing rent income on a time proportion basis for financial accounting purposes and cash basis for tax purposes.

An item that is considered a nondeductible item in taxable income is recognizing estimated bad debts expense for financial accounting purposes and direct write off method for tax purposes. O paying fines for violation of laws. accrual warranty costs recognized for financial accounting purposes and actual warranty expenditures paid recognized for tax purposes. recognizing rent income on a time proportion basis for financial accounting purposes and cash basis for tax purposes.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 15DQ

Related questions

Question

34

Transcribed Image Text:An item that is considered a nondeductible item in taxable income is *

recognizing estimated bad debts expense for financial accounting purposes and direct write off method for

tax purposes.

O paying fines for violation of laws.

accrual warranty costs recognized for financial accounting purposes and actual warranty expenditures paid

recognized for tax purposes.

o recognizing rent income on a time proportion basis for financial accounting purposes and cash basis for tax

purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you