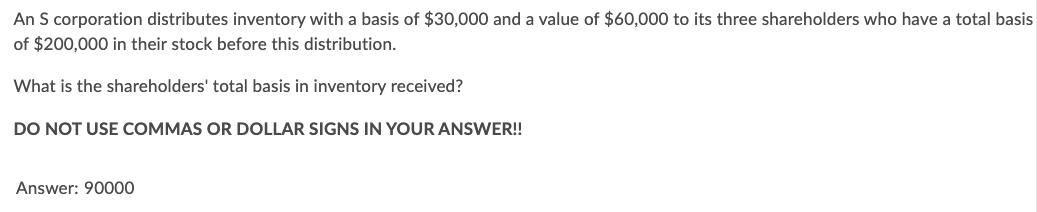

An S corporation distributes inventory with a basis of $30,000 and a value of $60,000 to its three shareholders who have a total basis of $200,000 in their stock before this distribution. What is the shareholders' total basis in inventory received? DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!!

Q: Prepare a monthly operating budget for the first quarter with the following schedules: 1. Sales…

A: The budget is prepared to estimate the requirements during the period and sales revenue that would…

Q: Jack’s Dog Sanctuary performs three services: housing and finding homes for stray and unwanted dogs,…

A: GIVEN Jack’s Dog Sanctuary performs three services: housing and finding homes for stray and unwanted…

Q: Shaffer Corporation issued 140, $1,000, 10% convertible bonds in 2019 at face value. Each bond is…

A: EPS termed as Earnings per share which refers to the monetary value of the earnings per share…

Q: 500 preference shares and 800

A: Share Subscription In the share subscription which are involved with the preference shares and…

Q: Beluga tap industries has started to produce taps with different sizes and it has high level of…

A: Depreciation is an accounting method where organisation assets are depreciated over the life of the…

Q: SLO-3.3. Liabilities are reported on the OIncome Statement Ostatement of Owner's Equity Ostatement…

A: Solution 3.3 Liabilities are the present obligation as a result of past event that requires outflow…

Q: During the year, the following transactions occurred at Sandberg, Inc. Instructions Journalize the…

A: Journal entries of investment transactions are as under:

Q: Input Data (USD) Budgeted sales April (units) May (units) June (units) July (units) August (units)…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: 2Part B PTI Inc., located in a country which has a capital gains tax, conducted the following…

A: Capital Gain Taxes It is important to calculate the capital gain taxes which are incurred in the…

Q: Rizzo Co. has Net Income of $279,000 for 2024. Over the past two years, the company had outstanding…

A: Earnings per share indicate the profits per share of common stockholders. It can be calculated by…

Q: hat does it mean when a company has zero net income but its stock price has increased? How do you…

A: Basic Concept of equity method of accounting of Investment

Q: X 回 Prepare journal entries to record the following transactions. Descriptions are not required but…

A: Common stockholders are the owners of the company. They have voting rights for…

Q: 1-Cinemar Productions bought a piece of equipment for $150,847 that will last for 5 years. The…

A: Payback period is the period in which the cash outflow of the company is recovered.

Q: Problem 1-13 (PHILCPA Adapted) At year-end, ABC Company reported cash account per ledger at P4,…

A: Option B 3,950,000

Q: Lithium Co.'s current liabilities totaled USD1,600,000 as of December 31, 2014, before any necessary…

A: Current Liabilities are the total debts of an entity which are to be repaid within a span of 1 year…

Q: Montello Inc. purchases a delivery truck for $14,000. The truck has a salvage value of $2,000 and is…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: Which of the following terms is correctly linked with either IFRS or GAAP? Share premium…

A: Ans. Accumulated losses-IFRS (correct) Other three items linked wrong

Q: On September 1, 2022, Darren Co. borrowed P150,000 from BPI by issuing 8% note due August 31, 2023,…

A: Note: Interest amount should be recognized on the amount borrowed. Accounts receivables pledged as…

Q: Which of the following is included in a job description? Oa. Education, credentials required Ob.…

A: The description of a job is called as Job Description. The Job Description of a Job includes the…

Q: Which one of the following is the date on which the board of directors agrees to pay a dividend and…

A: The dividend is paid to shareholders from the retained earnings of the business.

Q: What is the unadjusted trial balance?

A: Trial balance is the summary of all general ledger accounts being used in the business. It shows…

Q: Current Assets Current Liabilities Case 1 $ 75,000 $30,000

A: Introduction: Current ratio: It tells the ability of the company to pay its short term obligations…

Q: Accounting Property and equipment, at cost, consisted of the following: December 31,…

A: Fixed assets means those assets which is used for the business purpose for many year to come and…

Q: The company reported a current ratio of 2.1 and 2.22 as of December 31, 2020 and December 31, 202…

A: Liability is an obligation that an entity has to pay on some future date.

Q: Prepare Income statement Sales Accounts payable Selling expenses Administrative expenses Other…

A: Introduction: Income statement: All revenues and expenses are shown in Income statement. It tells…

Q: orb overheads based on output levels. During the period the company over-absorbed overheads by…

A: Selling price of the product include the profit margin needed and all other cost direct material and…

Q: Selling price (per unit) R 116 Units in opening inventory 600 Units manufactured 2 550 Units sold 3…

A: Absorption costing: Absorption costing is also called traditional costing. This method of costing…

Q: Assume that an individual owns a bond that they purchased for $100,000. The bond has a 10% coupon.…

A: Bonds- A bond is a fixed-income tool that represents a loan made by a shareholder to a borrower…

Q: Account Title Cash Prepaid insurance Notes receivable (due in 5 years) Buildings Accumulated…

A: The balance sheet is one of the important financial statements of the business which tells about the…

Q: SLO-1.1. The principle of Accounting that requires revenue recorded as soon as it is earned is…

A: Principle of accounting means the fundamental of accounting system which is followed while preparing…

Q: Red, Incorporated has book income of $500,000 before federal income tax expense which includes…

A: The deferred tax asset would arise on difference between book income qnd taxable income of $10000…

Q: trate the effects of accepting the note from Valley Designs on the accounts and financial statements…

A: Concept of Accounting of note

Q: PROBLEM-05 The Aeronautical Ltd. has production facility specializing in jobs for the aircraft…

A: Under traditional costing system, overhead costs are allocated on the basis of single allocation…

Q: On February 1, Crown Company purchased $2,000 of merchandise, terms 2/10, n/30. Crown uses the gross…

A: Under the Gross method of purchases, Purchases are booked at Gross value. Discount amounts are not…

Q: _______ It illustrates how operating, investing, and financing activities affect cash.

A: Cash inflow and cash outflow are the two measure aspects in the business which is to be accounted…

Q: Yeopay Plumbing Supply accepts bank credit cards and offers established plumbers charge accounts…

A: The question is based on the concept of Cost Accounting.

Q: What does the future of audit look like? Critically discuss this question from the perspective…

A: Answer:- a Future of audit from the perspective of The UK Government:- When big companies failed,…

Q: On the date of incorporation, the condensed balance sheet of Alom Partnership showed the following:…

A: Share Subscription In the share subscription which are involved with the preference shares and…

Q: Required information [The following information applies to the questions displayed below.] The…

A: The Social Security tax is a tax paid on both employers and employees in the United States to pay…

Q: On the date of incorporation, the condensed balance sheet of Alom Partnership showed the following:…

A: Shareholders equity is the total amount attributable to the shareholders of the company. It includes…

Q: Make a Ledger

A: Based on the transactions given, the ledger accounts need to be prepared. Ledger is the second step…

Q: Sales and Production Budgets

A: Solution;- 1)Prepare a sales budget for each quarter and for the year in total. Show sales by…

Q: SA Construction Limited currently operates in Trinidad. The company is considering setting up…

A: The concept of income tax is to levy tax on the income of an individual or a corporate. In this…

Q: 7. Suppose the First National Bank of Naboo has a T-account as follows: Assets Liabilities Reserves…

A: After all of a company's liabilities have been deducted, capital is defined as the remaining stake…

Q: Flyer Company has provided the following information. Cash sales, $325,000 Credit sales, $850.000…

A: Formula: Total sales = Cash sales + Credit sales. Cash and credit sales combined called as Credit…

Q: Surewin Company provided the following information at year-end: Cash…

A: Current assets are those assets which can be sold, consumed or exhausted in the normal operating…

Q: Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can…

A: Answer 1) Calculation of Accounting Rate of Return Accounting Rate of return = Average Annual Net…

Q: (GAAP) a

A: GAAP refers to the set of accounting principles, procedures, or systems that aim to bring clarity,…

Q: The formula to calculate EVA is Net operating profit - (invested capital x weighted average cost of…

A: EVA, or economic value profit, is a measure of a corporation's economic success that is based on…

Q: Rizzo Corp. began operations on Jan. 1, 2023. Rizzo Corp. is authorized to issue 250,000 shares of…

A: Treasury stock is to be measured at cost (cost of repurchase value) Any difference between reissue…

This answer is wrong . please give me the right answer.

Step by step

Solved in 2 steps

- Bloom Company had beginning unadjusted retained earnings of 400,000 in the current year. At the beginning of the current year, Bloom changed its inventory method from LIFO to FIFO, and the cumulative effect (net of taxes) of this change was 28,000. In addition, Bloom earned net income of 150,000 and paid dividends of 30,000 in the current year. Prepare Blooms retained earnings statement for the current year.What is the double entry when: During 20x0, Subsea Co will sell inventory which it bought for $40,000 to Paron Co for $60,000. As at 31 December 20x0, 50% of the inventory bought from Subsea Co was not sold to external parties and remained in the store of Paron Co. (a) If Paron Co acquires all the shares of Subsea Co (b) if Paron Co acquires 70% of the shares of Subsea Co,Gotham City acquires $25,000 of inventory on November 1, 20X7, having held no inventory previously. On December 31, 20X7, the end of Gotham City's fiscal year, a physical count shows $8,000 still in stock.Based on the preceding information, what would be the correct Expenditures amount for 20X7 if Gotham City used the consumption method of accounting? 8000 17,000 25,000 Can not be determine

- Esquire Inc. uses the LIFO method to report its inventory. Inventory at January 1, 2021, was $500,000 (20,000 units at $25 each). During 2021, 80,000 units were purchased, all at the same price of $30 per unit. 85,000 units were sold during 2021. Assuming an income tax rate of 25%, what is LIFO liquidation profit or loss that the company would report in a disclosure note accompanying its financial statements?Jarvis owns 30% of McLintock. During the year to 31 December 20X4 McLintock sold $2 million of goods to Jarvis, of which 40% were still held in inventory by Jarvis at the year end. McLintock applies a mark-up of 25% on all goods sold. What effect would the above transactions have on group inventory at 31 December 20X4? A Debit group inventory $48,000 B Debit group inventory $160,000 C Credit group inventory $48,000 D No effect on group inventoryDuring year 3, Mayorca Corp. decided to change from the FIFOmethod of inventory valuation to the weighted-average method. Inventory balances under each method were as follows: FIFO Weighted-average January 1, year 3 P71,000 P77,000 December 31, year 3 79,000 83,000 Orca’s income tax rate is 30%. In its year 3 financial statements, what amount should Mayorca report as the gain or loss on the cumulative effect of this accounting change?

- B Limited sells inventory to its parent, W Limited at cost price plus 125% mark-up. • Closing inventories in the records of W Limited on 30 June 2022 amount to R157 500.• Net realisable value of inventory on hand in the books of W limited amounts to R107 500 on 30 June 2022. • Ignore tax implications Clearly illustrate how write-down of inventory will be with regard to the above information, showing inventory at selling price, value according to the group, net realisable value, write-down in W Limited’s records, Unrealised profit from the group’s perspective and additional elimination of unrealised profit required through pro forma consolidation journal.2. Martindale Company, a 100% owned subsidiary of Weisman Corporation, sells inventory to Weisman at a 20% profit on selling price. The following data are available pertaining to inter-company purchases by Weisman: Inter-company sales: Unsold at year end (based on selling price): 2020: $18,000 2020: $4,000 2021: $19,400 2021: $6,000 2022: $21,500 2022: $8,000 Martindale's profit numbers were $125,000, $142,000 and $265,000 for 2020, 2021, and 2022, respectively. Weisman received dividends from Martindale of $25,000 for 2020 and 2021, and $30,000 for 2022. Assume Weisman uses the equity method to account for its investment in Martindale. What is the balance in pre-consolidation Income (loss) from subsidiary for 2022? Select one: A. $268,600 B. $235,000 C. $265,400 D. $264,600Lorn Corporation purchased inventory from Dresser Corporation for P 120,000 on September 20, 20x2, and resold 80% of the purchased inventory to unaffiliated companies prior to December 31, 20x2, for P140,000. Dresser produced the inventory sold to Lorn for P75,000. Lorn owns 70% of Dresser’s voting common stock. The companies had no other transactions during 20x2. What amount of cost of goods sold will be reported in the 20x2 consolidated income statement? A. P60, 000 B. P75, 000 C. P96, 000 D. P120, 000 E. P171, 000

- Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin’s intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020. 2020 2021 2022 Purchases by Philbin $ 8,000 $ 12,000 $ 15,000 Ending inventory on Philbin’s books 1,200 4,000 3,000 Assume the equity method is used. The following data are available pertaining to Anderson’s income and dividends. 2020 2021 2022 Anderson’s net income $ 70,000 $ 85,000 $ 94,000 Dividends paid by Anderson 10,000 10,000 15,000 For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2020 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2020 intra-entity transfer of merchandise?Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin’s intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020. 2020 2021 2022 Purchases by Philbin $ 8,000 $ 12,000 $ 15,000 Ending inventory on Philbin’s books 1,200 4,000 3,000 Assume the equity method is used. The following data are available pertaining to Anderson’s income and dividends. 2020 2021 2022 Anderson’s net income $ 70,000 $ 85,000 $ 94,000 Dividends paid by Anderson 10,000 10,000 15,000 For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2022 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 intra-entity transfer of merchandise? Multiple Choice $3,000.…Palm Company owns 100% of Soso Company. During year X1, Soso sold merchandise costing $50,000 to Palm for $80,000. As of 12/31/X1, 40% of the merchandise remained in Palm's inventory. Assuming that Soso reported a $100,000 net income an paid $20,000 of dividends in year X1, how much investment income should should Palm recognize in year X1?