and open his own independent pharmacy. His annual expenses will include €12,000 for office rent, €1,00 equipment rental, €50,000 for supplies, €2,000 for utilities, and a €20,000 salary for part-time employee. Ar will cover some expenses by using his savings of €20,000 on which he was earning annual interest of EI Annually, Andrew pays himself the difference between revenue and expenses. 3. Andrew's implicit cost in the first year of setting up his own practice is A. €80,000 B. €81,000 C. €101,000 D. €186,000 E. €1,000 4. What revenue would Andrew's business have to earn in the first year for Andrew to be better off by €20,000 rel to working at Boots? A. €81,000 D 6101.000

and open his own independent pharmacy. His annual expenses will include €12,000 for office rent, €1,00 equipment rental, €50,000 for supplies, €2,000 for utilities, and a €20,000 salary for part-time employee. Ar will cover some expenses by using his savings of €20,000 on which he was earning annual interest of EI Annually, Andrew pays himself the difference between revenue and expenses. 3. Andrew's implicit cost in the first year of setting up his own practice is A. €80,000 B. €81,000 C. €101,000 D. €186,000 E. €1,000 4. What revenue would Andrew's business have to earn in the first year for Andrew to be better off by €20,000 rel to working at Boots? A. €81,000 D 6101.000

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 50P

Related questions

Question

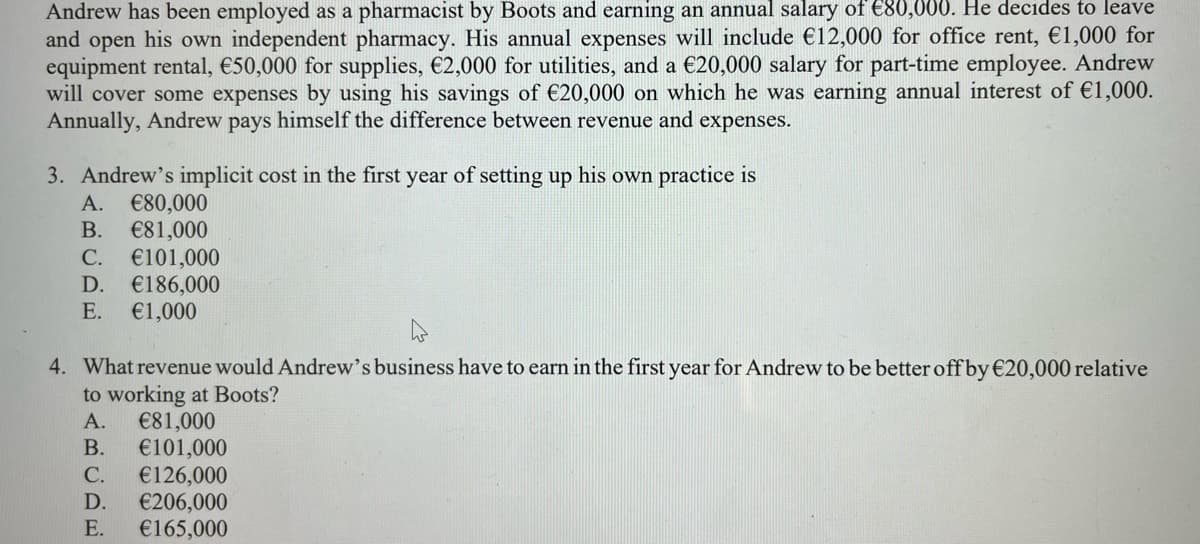

Transcribed Image Text:Andrew has been employed as a pharmacist by Boots and earning an annual salary of €80,000. He decides to leave

and open his own independent pharmacy. His annual expenses will include €12,000 for office rent, €1,000 for

equipment rental, €50,000 for supplies, €2,000 for utilities, and a €20,000 salary for part-time employee. Andrew

will cover some expenses by using his savings of €20,000 on which he was earning annual interest of €1,000.

Annually, Andrew pays himself the difference between revenue and expenses.

3. Andrew's implicit cost in the first year of setting up his own practice is

A. €80,000

B. €81,000

C. €101,000

D. €186,000

E. €1,000

4

4. What revenue would Andrew's business have to earn in the first year for Andrew to be better off by €20,000 relative

to working at Boots?

€81,000

A.

B. €101,000

C. €126,000

D. €206,000

E. €165,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning