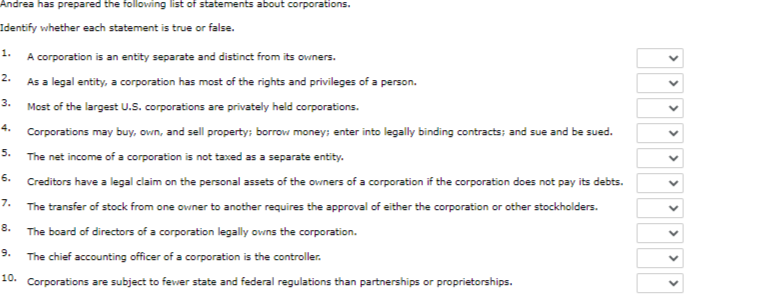

Andrea has prepared the folloving list of statements about corporations. Identify whether each statement is true or false. 1. A corporation is an entity separate and distinct from its ovners. As a legal entity, a corporation has most of the rights and privileges of a person. Most of the largest U.S. corporations are privately held corporations. 2. 3. 4. Corporations may buy, ovin, and sell property; borrow money; enter into legally binding contracts; and sue and be sued. 5. The net income of a corporation is not taxed as a separate entity. 6. Creditors have a legal claim on the personal assets of the ovners of a corporation if the corporation does not pay its debts. 7. The transfer of stock from one ovner to another requires the approval of either the corporation or other stockholders. 8. The board of directors of a corporation legally owns the corporation. 9. The chief accounting officer of a corporation is the controller. 10. Corporations are subject to fewer state and federal regulations than partnerships or proprietorships. > >

Andrea has prepared the folloving list of statements about corporations. Identify whether each statement is true or false. 1. A corporation is an entity separate and distinct from its ovners. As a legal entity, a corporation has most of the rights and privileges of a person. Most of the largest U.S. corporations are privately held corporations. 2. 3. 4. Corporations may buy, ovin, and sell property; borrow money; enter into legally binding contracts; and sue and be sued. 5. The net income of a corporation is not taxed as a separate entity. 6. Creditors have a legal claim on the personal assets of the ovners of a corporation if the corporation does not pay its debts. 7. The transfer of stock from one ovner to another requires the approval of either the corporation or other stockholders. 8. The board of directors of a corporation legally owns the corporation. 9. The chief accounting officer of a corporation is the controller. 10. Corporations are subject to fewer state and federal regulations than partnerships or proprietorships. > >

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 14MCQ

Related questions

Question

true or false? check pic

Transcribed Image Text:Andrea has prepared the folloving list of statements about corporations.

Identify whether each statement is true or false.

1.

A corporation is an entity separate and distinct from its ovners.

As a legal entity, a corporation has most of the rights and privileges of a person.

Most of the largest U.S. corporations are privately held corporations.

2.

3.

4.

Corporations may buy, owin, and sell property; borrow money; enter into legally binding contracts; and sue and be sued.

5.

The net income of a corporation is not taxed as a separate entity.

6.

Creditors have a legal claim on the personal assets of the ovners of a corporation if the corporation does not pay its debts.

7.

The transfer of stock from one ovner to another requires the approval of either the corporation or other stockholders.

8.

The board of directors of a corporation legally owns the corporation.

9.

The chief accounting officer of a corporation is the controller.

10.

Corporations are subject to fewer state and federal regulations than partnerships or proprietorships.

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning