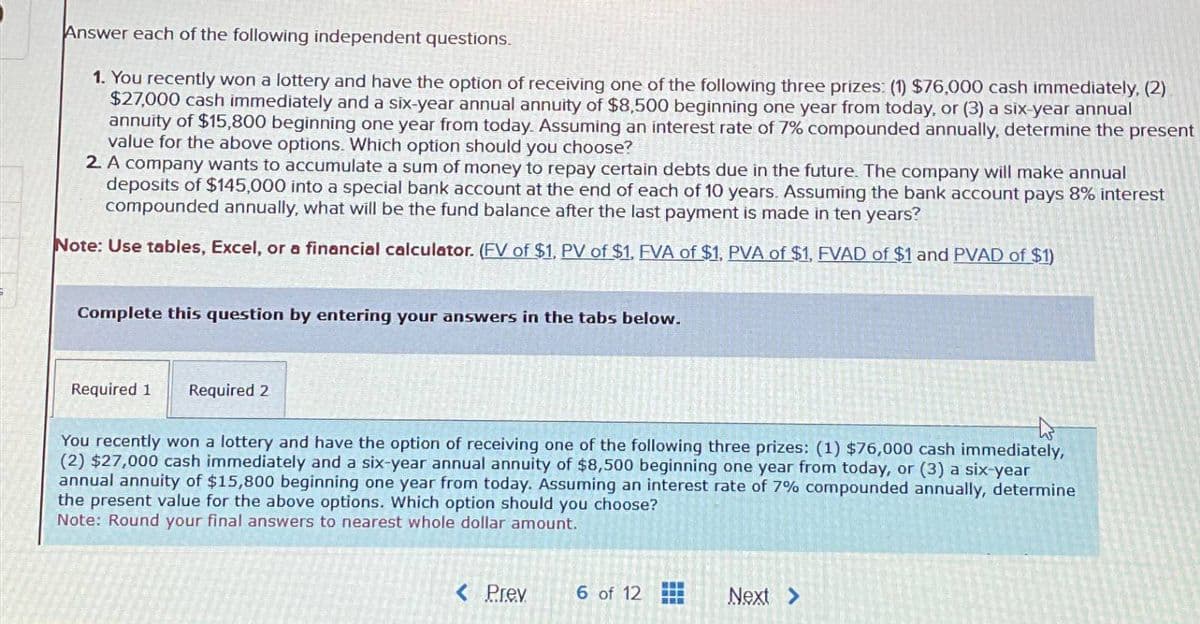

Answer each of the following independent questions. 1. You recently won a lottery and have the option of receiving one of the following three prizes: (1) $76,000 cash immediately. (2) $27,000 cash immediately and a six-year annual annuity of $8,500 beginning one year from today, or (3) a six-year annual annuity of $15,800 beginning one year from today. Assuming an interest rate of 7% compounded annually, determine the present value for the above options. Which option should you choose? 2. A company wants to accumulate a sum of money to repay certain debts due in the future. The company will make annual deposits of $145,000 into a special bank account at the end of each of 10 years. Assuming the bank account pays 8% interest compounded annually, what will be the fund balance after the last payment is made in ten years? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. Required 1 Required 2 You recently won a lottery and have the option of receiving one of the following three prizes: (1) $76,000 cash immediately, (2) $27,000 cash immediately and a six-year annual annuity of $8,500 beginning one year from today, or (3) a six-year annual annuity of $15,800 beginning one year from today. Assuming an interest rate of 7% compounded annually, determine the present value for the above options. Which option should you choose? Note: Round your final answers to nearest whole dollar amount. < Prev 6 of 12 Next >

Answer each of the following independent questions. 1. You recently won a lottery and have the option of receiving one of the following three prizes: (1) $76,000 cash immediately. (2) $27,000 cash immediately and a six-year annual annuity of $8,500 beginning one year from today, or (3) a six-year annual annuity of $15,800 beginning one year from today. Assuming an interest rate of 7% compounded annually, determine the present value for the above options. Which option should you choose? 2. A company wants to accumulate a sum of money to repay certain debts due in the future. The company will make annual deposits of $145,000 into a special bank account at the end of each of 10 years. Assuming the bank account pays 8% interest compounded annually, what will be the fund balance after the last payment is made in ten years? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. Required 1 Required 2 You recently won a lottery and have the option of receiving one of the following three prizes: (1) $76,000 cash immediately, (2) $27,000 cash immediately and a six-year annual annuity of $8,500 beginning one year from today, or (3) a six-year annual annuity of $15,800 beginning one year from today. Assuming an interest rate of 7% compounded annually, determine the present value for the above options. Which option should you choose? Note: Round your final answers to nearest whole dollar amount. < Prev 6 of 12 Next >

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 11E

Related questions

Question

Transcribed Image Text:Answer each of the following independent questions.

1. You recently won a lottery and have the option of receiving one of the following three prizes: (1) $76,000 cash immediately. (2)

$27,000 cash immediately and a six-year annual annuity of $8,500 beginning one year from today, or (3) a six-year annual

annuity of $15,800 beginning one year from today. Assuming an interest rate of 7% compounded annually, determine the present

value for the above options. Which option should you choose?

2. A company wants to accumulate a sum of money to repay certain debts due in the future. The company will make annual

deposits of $145,000 into a special bank account at the end of each of 10 years. Assuming the bank account pays 8% interest

compounded annually, what will be the fund balance after the last payment is made in ten years?

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

You recently won a lottery and have the option of receiving one of the following three prizes: (1) $76,000 cash immediately,

(2) $27,000 cash immediately and a six-year annual annuity of $8,500 beginning one year from today, or (3) a six-year

annual annuity of $15,800 beginning one year from today. Assuming an interest rate of 7% compounded annually, determine

the present value for the above options. Which option should you choose?

Note: Round your final answers to nearest whole dollar amount.

< Prev

6 of 12

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning