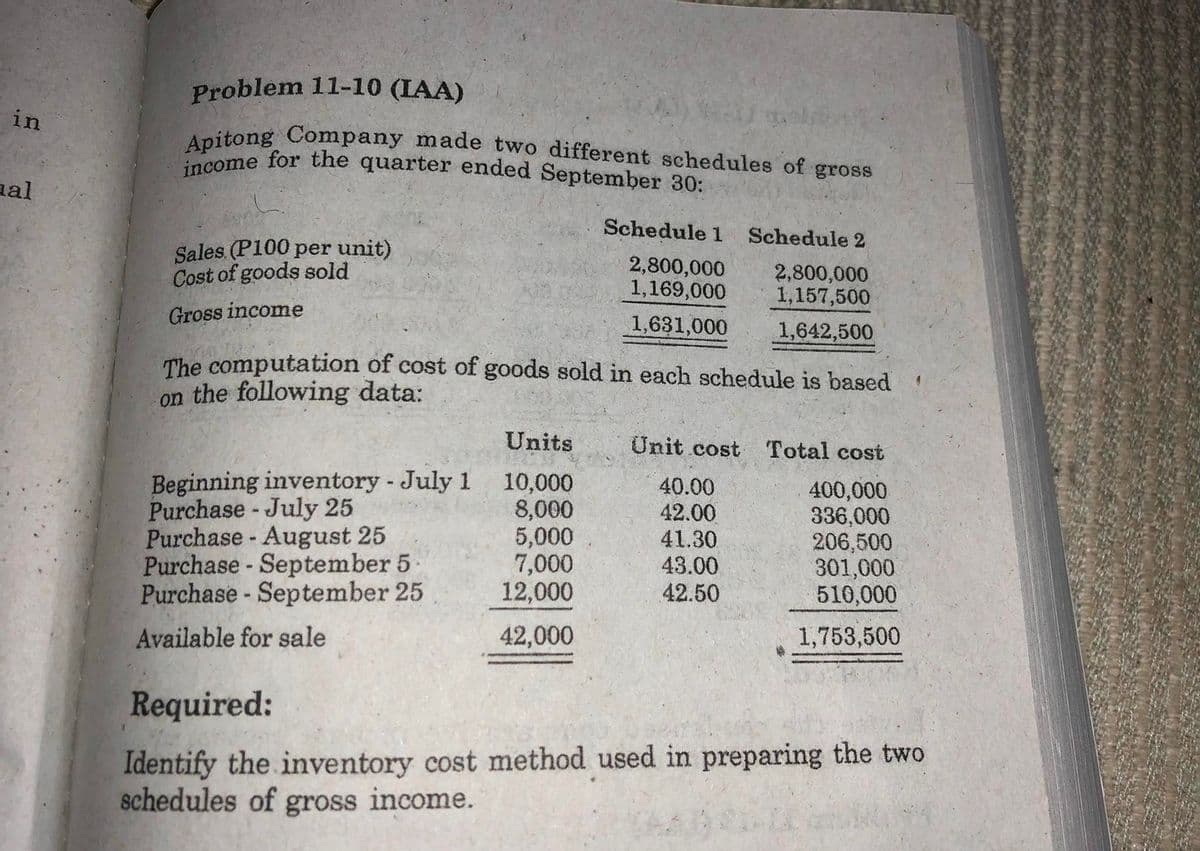

Apitong Company made two different schedules of gross income for the quarter ended September 30: Schedule 1 Schedule 2 Sales (P100 per unit) Cost of goods sold 2,800,000 1,169,000 2,800,000 1,157,500 Gross income 1,631,000 1,642,500 The computation of cost of goods sold in each schedule is based on the following data: Units Ünit cost Total cost Beginning inventory - July 1 Furchase - July 25 urchase - August 25 urchase - September 5 urchase - September 25 10,000 8,000 5,000 7,000 12,000 40.00 42.00 41.30 43.00 42.50 400,000 336,000 206,500 301,000 510,000

Apitong Company made two different schedules of gross income for the quarter ended September 30: Schedule 1 Schedule 2 Sales (P100 per unit) Cost of goods sold 2,800,000 1,169,000 2,800,000 1,157,500 Gross income 1,631,000 1,642,500 The computation of cost of goods sold in each schedule is based on the following data: Units Ünit cost Total cost Beginning inventory - July 1 Furchase - July 25 urchase - August 25 urchase - September 5 urchase - September 25 10,000 8,000 5,000 7,000 12,000 40.00 42.00 41.30 43.00 42.50 400,000 336,000 206,500 301,000 510,000

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter5: Inventories And Cost Of Goods Sold

Section: Chapter Questions

Problem 5.12AMCP

Related questions

Topic Video

Question

100%

Transcribed Image Text:Apitong Company made two different schedules of gross

income for the quarter ended September 30:

Problem 11-10 (IAA)

in

SPome for the quarter ended September 30:

al

Schedule 1 Schedule 2

Sales (P100 per unit)

Cost of goods sold

2,800,000

1,169,000

2,800,000

1,157,500

Gross income

1,631,000

1,642,500

The computation of cost of goods sold in each schedule is based

on the following data:

Units

Unit cost Total cost

Beginning inventory - July 1

Purchase - July 25

Purchase - August 25

Purchase - September 5

Purchase - September 25

10,000

8,000

5,000

7,000

12,000

40.00

42.00

41.30

43.00

42.50

400,000

336,000

206,500

301,000

510,000

Available for sale

42,000

1,753,500

Required:

Identify the inventory cost method used in preparing the two

schedules of gross income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College