Apply the concept from page 8-9 practice 4 of the VLN: How much could you borrow today if you make monthly payments of $300.00 for the next 5 years with a market rate of interest of 3%? Round your answer to the nearest dollar.________

Apply the concept from page 8-9 practice 4 of the VLN: How much could you borrow today if you make monthly payments of $300.00 for the next 5 years with a market rate of interest of 3%? Round your answer to the nearest dollar.________

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter7: Using Consumer Loans

Section: Chapter Questions

Problem 9FPE

Related questions

Question

Apply the concept from page 8-9 practice 4 of the VLN: How much could you borrow today if you make monthly payments of $300.00 for the next 5 years with a market rate of interest of 3%? Round your answer to the nearest dollar.________

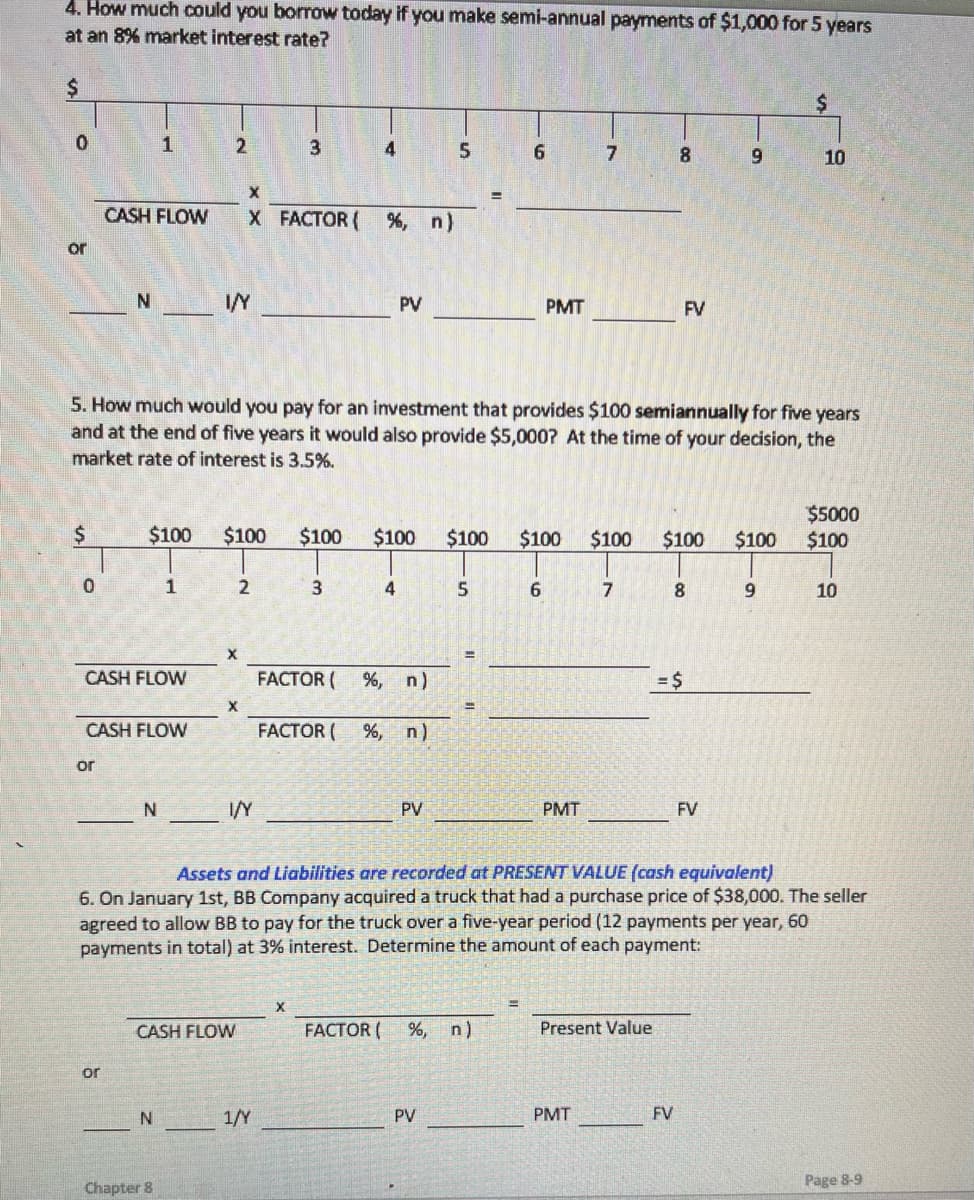

Transcribed Image Text:4. How much could you borrow today if you make semi-annual payments of $1,000 for 5 years

at an 8% market interest rate?

%24

4

7

10

%3D

CASH FLOW

X FACTOR (

%, n)

or

N

IY

PV

PMT

FV

5. How much would you pay for an investment that provides $100 semiannually for five years

and at the end of five years it would also provide $5,000? At the time of your decision, the

market rate of interest is 3.5%.

$5000

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

1

4

5

6

7

9.

10

%3D

CASH FLOW

FACTOR (

%, n)

CASH FLOW

FACTOR (

%, n)

or

I/Y

PV

PMT

FV

Assets and Liabilities are recorded at PRESENT VALUE (cash equivalent)

6. On January 1st, BB Company acquired a truck that had a purchase price of $38,000. The seller

agreed to allow BB to pay for the truck over a five-year period (12 payments per year, 60

payments in total) at 3% interest. Determine the amount of each payment:

CASH FLOW

FACTOR (

%, n)

Present Value

or

1/Y

PV

PMT

FV

Page 8-9

Chapter 8

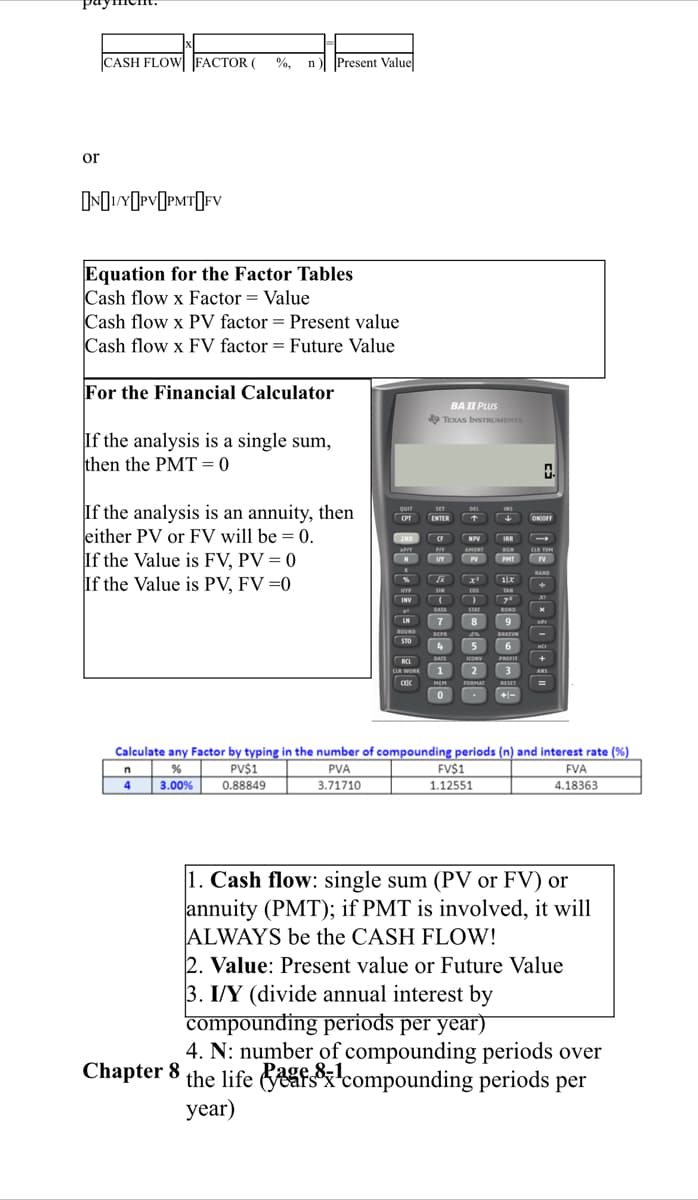

Transcribed Image Text:CASH FLOW| FACTOR ( %, n )| |Present Value|

or

Equation for the Factor Tables

Cash flow x Factor = Value

Cash flow x PV factor = Present value

Cash flow x FV factor = Future Value

For the Financial Calculator

BAII PLUS

* TEXAS INSTRUMENTS

If the analysis is a single sum,

then the PMT=0

If the analysis is an annuity, then

either PV or FV will be = 0.

If the Value is FV, PV = 0

If the Value is PV, FV =0

QuIT

SET

ENTER

DEL

CPT

ONIOFF

2ND

CF

IRR

AMORT

CR TVH

N

PHT

IV

RAND

+

HYP

SIN

Cos

TAN

INV

DATA

STAT

BOND

8

LN

7

9

ROUND

DEPR

BREEVH

STO

4

6

DATE

ICONV

PROFIT

+

RCL

CIR WORE

1

3

ANS

CEC

MEM

FORMAT

RESET

+|-

Calculate any Factor by typing in the number of compounding periods (n) and interest rate (%)

FVA

4.18363

PV$1

PVA

FV$1

4

3.00%

1.12551

0.88849

3.71710

1. Cash flow: single sum (PV or FV) or

annuity (PMT); if PMT is involved, it will

ALWAYS be the CASH FLOW!

2. Value: Present value or Future Value

3. I/Y (divide annual interest by

compounding periods per year)

4. N: number of compounding periods over

Chapter 8 the life afs'compounding periods per

Page 8-1

year)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning