Applying Financial Statement Relations to Compute Dividends a. Fill in the amounts for the Norfolk Southern statement of changes in retained earnings. Note: Use negative signs with your answers, when appropriate. Norfolk Southern Inc. Consolidated Statements of Changes in Retained Income Beginning Balance at Dec. 31, 2015 $10,191 Net income Dividends on Common Stock Share repurchases Other Ending Balance at Dec. 31, 2016 Net income Dividends on Common Stock Share repurchases Other Ending Balance at Dec. 31, 2017 Net Dividends on Common Stock Share repurchases Other Ending Balance at Dec. 31, 2018 0 (695) (731) (8) 10,425 5,404 0 (945) (5) 14,176 2,666 (844) 0 81 $13,440 b. Is it true (or false) that Norfolk Southern purchased its own shares back during each year from 2016 to 2018? ◆

Applying Financial Statement Relations to Compute Dividends a. Fill in the amounts for the Norfolk Southern statement of changes in retained earnings. Note: Use negative signs with your answers, when appropriate. Norfolk Southern Inc. Consolidated Statements of Changes in Retained Income Beginning Balance at Dec. 31, 2015 $10,191 Net income Dividends on Common Stock Share repurchases Other Ending Balance at Dec. 31, 2016 Net income Dividends on Common Stock Share repurchases Other Ending Balance at Dec. 31, 2017 Net Dividends on Common Stock Share repurchases Other Ending Balance at Dec. 31, 2018 0 (695) (731) (8) 10,425 5,404 0 (945) (5) 14,176 2,666 (844) 0 81 $13,440 b. Is it true (or false) that Norfolk Southern purchased its own shares back during each year from 2016 to 2018? ◆

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 18E

Related questions

Question

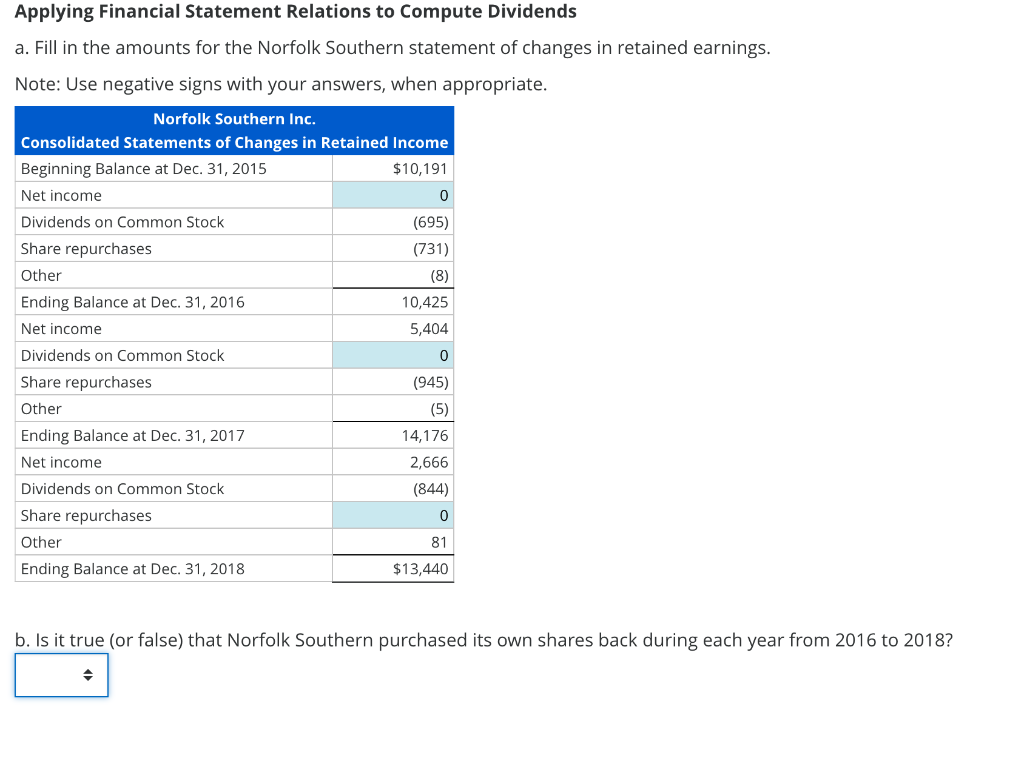

Transcribed Image Text:Applying Financial Statement Relations to Compute Dividends

a. Fill in the amounts for the Norfolk Southern statement of changes in retained earnings.

Note: Use negative signs with your answers, when appropriate.

Norfolk Southern Inc.

Consolidated Statements of Changes in Retained Income

Beginning Balance at Dec. 31, 2015

$10,191

Net income

Dividends on Common Stock

Share repurchases

Other

Ending Balance at Dec. 31, 2016

Net income

Dividends on Common Stock

Share repurchases

Other

Ending Balance at Dec. 31, 2017

Net

Dividends on Common Stock

Share repurchases

Other

Ending Balance at Dec. 31, 2018

0

(695)

(731)

(8)

10,425

5,404

0

(945)

(5)

14,176

2,666

(844)

0

81

$13,440

b. Is it true (or false) that Norfolk Southern purchased its own shares back during each year from 2016 to 2018?

◆

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning