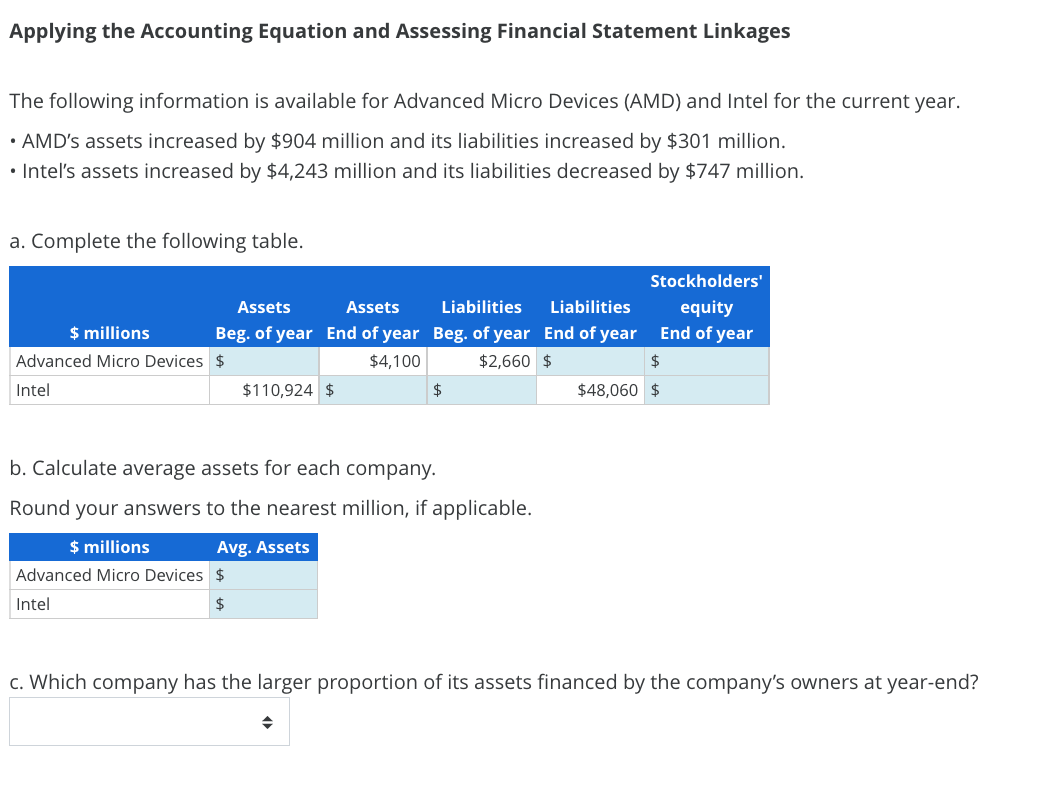

Applying the Accounting Equation and Assessing Financial Statement Linkages The following information is available for Advanced Micro Devices (AMD) and Intel for the current year. AMD's assets increased by $904 million and its liabilities increased by $301 million. Intel's assets increased by $4,243 million and its liabilities decreased by $747 million. a. Complete the following table. $ millions Advanced Micro Devices Intel Assets Assets Liabilities Liabilities Beg. of year End of year Beg. of year End of year $ $4,100 $2,660 $ $110,924 $ $ millions Advanced Micro Devices $ Intel $ $ b. Calculate average assets for each company. Round your answers to the nearest million, if applicable. Avg. Assets Stockholders' equity End of year $ $48,060 $ c. Which company has the larger proportion of its assets financed by the company's owners at year-end? ◆

Applying the Accounting Equation and Assessing Financial Statement Linkages The following information is available for Advanced Micro Devices (AMD) and Intel for the current year. AMD's assets increased by $904 million and its liabilities increased by $301 million. Intel's assets increased by $4,243 million and its liabilities decreased by $747 million. a. Complete the following table. $ millions Advanced Micro Devices Intel Assets Assets Liabilities Liabilities Beg. of year End of year Beg. of year End of year $ $4,100 $2,660 $ $110,924 $ $ millions Advanced Micro Devices $ Intel $ $ b. Calculate average assets for each company. Round your answers to the nearest million, if applicable. Avg. Assets Stockholders' equity End of year $ $48,060 $ c. Which company has the larger proportion of its assets financed by the company's owners at year-end? ◆

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.4E: The Accounting Equation Ginger Enterprises began the year with total assets of $500,000 and total...

Related questions

Question

Transcribed Image Text:Applying the Accounting Equation and Assessing Financial Statement Linkages

The following information is available for Advanced Micro Devices (AMD) and Intel for the current year.

• AMD's assets increased by $904 million and its liabilities increased by $301 million.

• Intel's assets increased by $4,243 million and its liabilities decreased by $747 million.

a. Complete the following table.

$ millions

Advanced Micro Devices

Intel

Assets

Assets Liabilities Liabilities

Beg. of year End of year Beg. of year End of year

$4,100

$

$2,660 $

$110,924 $

$ millions

Advanced Micro Devices $

Intel

$

b. Calculate average assets for each company.

Round your answers to the nearest million, if applicable.

Avg. Assets

$

◆

Stockholders'

equity

End of year

$

$48,060 $

c. Which company has the larger proportion of its assets financed by the company's owners at year-end?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub