Arjay purchases a bond, newly issued by Amalgamated Corporation, for $1,000. The bond pays $60 to its holder at the end of the first few years and pays $1,060 upon its maturity at the end of the 3 years. a. What are the principal amount, the term, the coupon rate, and the coupon payment for Arjay's bond? Instructions: Enter your responses as whole numbers. Principal amount: $ Term:years Coupon rate: Coupon payment $[ b. After receiving the second coupon payment (at the end of the second year), Arjay decides to sell his bond in the bond market What price can he expect for his bond if the one-year interest rate at that time is 3 percent? 8 percent? 10 percent? Instructions: Enter your responses as whole numbers Expected price for the bond at 3 percent: $

Arjay purchases a bond, newly issued by Amalgamated Corporation, for $1,000. The bond pays $60 to its holder at the end of the first few years and pays $1,060 upon its maturity at the end of the 3 years. a. What are the principal amount, the term, the coupon rate, and the coupon payment for Arjay's bond? Instructions: Enter your responses as whole numbers. Principal amount: $ Term:years Coupon rate: Coupon payment $[ b. After receiving the second coupon payment (at the end of the second year), Arjay decides to sell his bond in the bond market What price can he expect for his bond if the one-year interest rate at that time is 3 percent? 8 percent? 10 percent? Instructions: Enter your responses as whole numbers Expected price for the bond at 3 percent: $

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

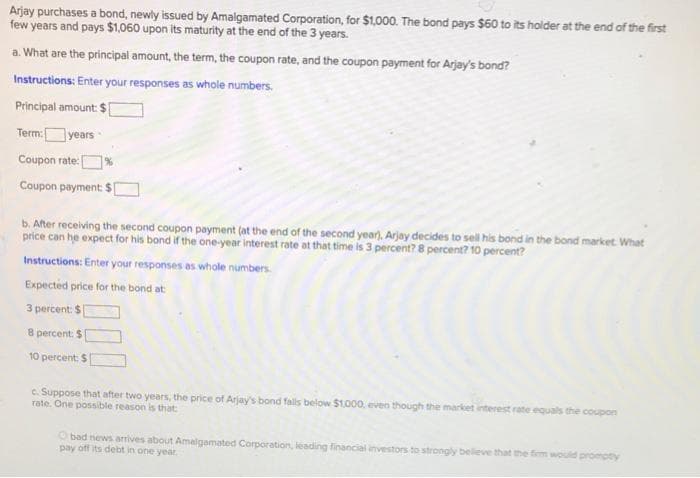

Transcribed Image Text:Arjay purchases a bond, newly issued by Amalgamated Corporation, for $1,000. The bond pays $60 to its holder at the end of the first

few years and pays $1,060 upon its maturity at the end of the 3 years.

a. What are the principal amount, the term, the coupon rate, and the coupon payment for Arjay's bond?

Instructions: Enter your responses as whole numbers.

Principal amount: $

Term:years

Coupon rate |

Coupon payment $[

b. After receiving the second coupon payment (at the end of the second year), Arjay decides to sell his bond in the bond market. What

price can he expect for his bond if the one-year interest rate at that time is 3 percent? 8 percent? 10 percent?

Instructions: Enter your responses as whaole numbers.

Expected price for the bond at

3 percent: $

8 percent: $

10 percent: $

c. Suppose that after two years, the price of Arjay's bond fals below $1.000, even though the market interest rate equals the coupon

rate. One possible reason is that

O bad news arrives about Amalgamated Corporation, leading financial investors to strongly believe that the fiem would prompty

pay off its debt in one year

Transcribed Image Text:Save &

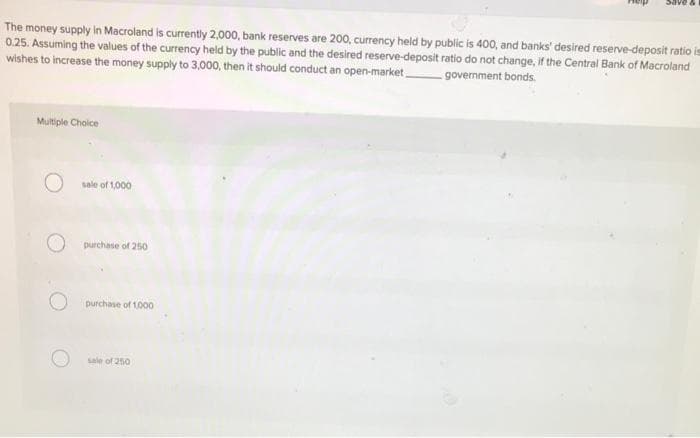

The money supply in Macroland is currently 2,000, bank reserves are 200, currency held by public is 400, and banks' desired reserve-deposit ratio is

0.25. Assuming the values of the currency held by the public and the desired reserve-deposit ratio do not change, if the Central Bank of Macroland

wishes to increase the money supply to 3,000, then it should conduct an open-market,

government bonds.

Multiple Choice

sale of 1,000

purchase of 250

purchase of 1000

sale of 250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education