Arjay purchases a bond, newly issued by Amalgamated Corporation, for $5,000. The bond pays $200 to its holder at the end off first few years and pays $5,200 upon its maturity at the end of the 5 years. a. What are the principal amount, the term, the coupon rate, and the coupon payment for Arjay's bond? Instructions: Enter your responses as whole numbers. Principal amount: $ Term: years Coupon rate: % Coupon payment $[ b. After receiving the second coupon payment (at the end of the second year). Arjay decides to sell his bond in the bond market. W price can be expect for his bond if the one-year interest rate at that time is 2 percent? 8 percent? 9 percent?

Arjay purchases a bond, newly issued by Amalgamated Corporation, for $5,000. The bond pays $200 to its holder at the end off first few years and pays $5,200 upon its maturity at the end of the 5 years. a. What are the principal amount, the term, the coupon rate, and the coupon payment for Arjay's bond? Instructions: Enter your responses as whole numbers. Principal amount: $ Term: years Coupon rate: % Coupon payment $[ b. After receiving the second coupon payment (at the end of the second year). Arjay decides to sell his bond in the bond market. W price can be expect for his bond if the one-year interest rate at that time is 2 percent? 8 percent? 9 percent?

Algebra and Trigonometry (6th Edition)

6th Edition

ISBN:9780134463216

Author:Robert F. Blitzer

Publisher:Robert F. Blitzer

ChapterP: Prerequisites: Fundamental Concepts Of Algebra

Section: Chapter Questions

Problem 1MCCP: In Exercises 1-25, simplify the given expression or perform the indicated operation (and simplify,...

Related questions

Question

2

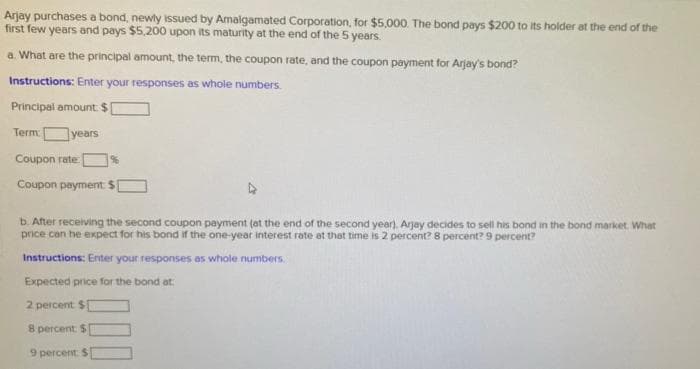

Transcribed Image Text:Arjay purchases a bond, newly issued by Amalgamated Corporation, for $5,000. The bond pays $200 to its holder at the end of the

first few years and pays $5,200 upon its maturity at the end of the 5 years.

a. What are the principal amount, the term, the coupon rate, and the coupon payment for Arjay's bond?

Instructions: Enter your responses as whole numbers.

Principal amount: $[

Term:

years

Coupon rate: 96

Coupon payment $[

b. After receiving the second coupon payment (at the end of the second year). Arjay decides to sell his bond in the bond market. What

price can he expect for his bond if the one-year interest rate at that time is 2 percent? 8 percent? 9 percent?

Instructions: Enter your responses as whole numbers.

Expected price for the bond at:

2 percent $[

8 percent $

9 percent: $

000

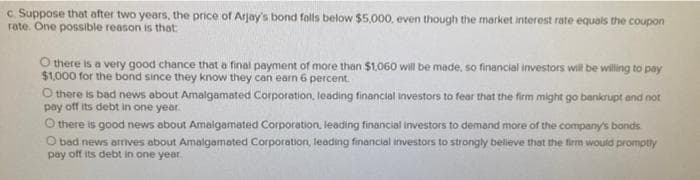

Transcribed Image Text:c. Suppose that after two years, the price of Arjay's bond falls below $5,000, even though the market interest rate equals the coupon

rate. One possible reason is that

Othere is a very good chance that a final payment of more than $1,060 will be made, so financial investors will be willing to pay

$1,000 for the bond since they know they can earn 6 percent.

O there is bad news about Amalgamated Corporation, leading financial investors to fear that the firm might go bankrupt and not

pay off its debt in one year.

Othere is good news about Amalgamated Corporation, leading financial investors to demand more of the company's bonds

O bad news arrives about Amalgamated Corporation, leading financial investors to strongly believe that the firm would promptly

pay off its debt in one year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra And Trigonometry (11th Edition)

Algebra

ISBN:

9780135163078

Author:

Michael Sullivan

Publisher:

PEARSON

Introduction to Linear Algebra, Fifth Edition

Algebra

ISBN:

9780980232776

Author:

Gilbert Strang

Publisher:

Wellesley-Cambridge Press

College Algebra (Collegiate Math)

Algebra

ISBN:

9780077836344

Author:

Julie Miller, Donna Gerken

Publisher:

McGraw-Hill Education