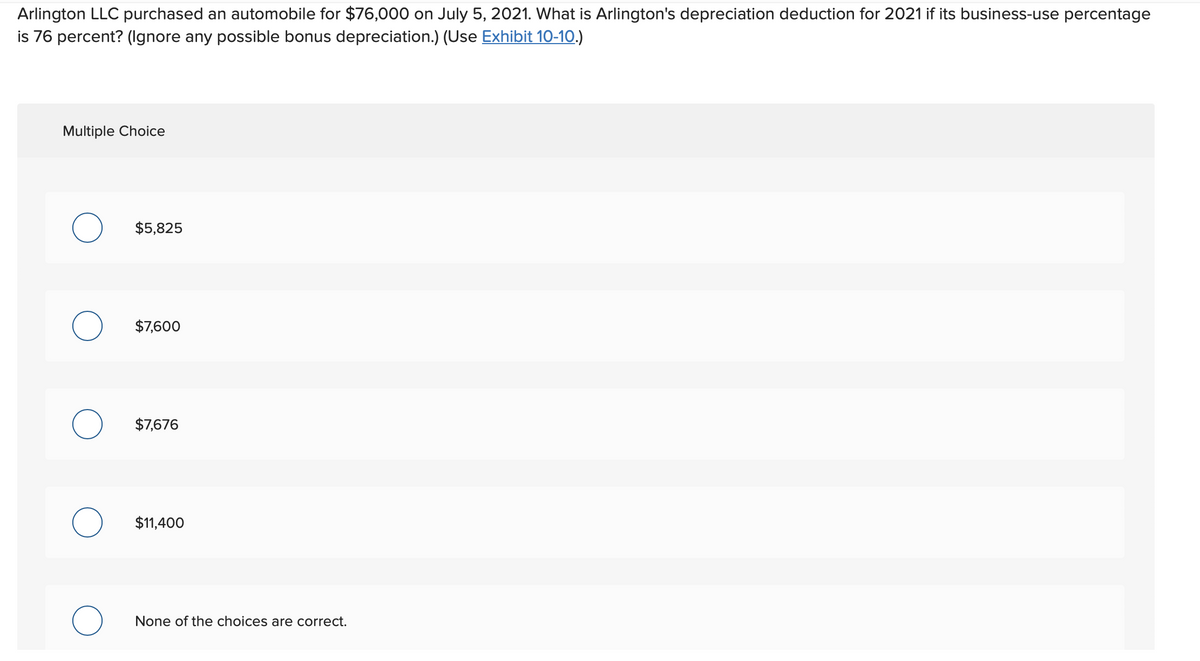

Arlington LLC purchased an automobile for $76,000 on July 5, 2021. What is Arlington's depreciation deduction for 2021 if its business-use percentage is 76 percent? (Ignore any possible bonus depreciation.) (Use Exhibit 10-10.)

Arlington LLC purchased an automobile for $76,000 on July 5, 2021. What is Arlington's depreciation deduction for 2021 if its business-use percentage is 76 percent? (Ignore any possible bonus depreciation.) (Use Exhibit 10-10.)

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 64P

Related questions

Question

![EXHIBIT 10-10 Automobile Depreciation Limits

Recovery

Year

Year Placed in Service

2021*

10,100**

16,100

2020

2019

2018

10,000**

16,000

9,600

1

10,100**

16,100

9,700

5,760

10,100**

16,100

9,700

5,760

2

3

9,700

4 and after

5,760

5,760

*As of press date, the IRS had not released the 2021 limitations for automobiles, so throughout the chapter we use the same limitations as in 2020 for 2021.

**$8,000 additional depreciation is allowed when bonus depreciation is claimed [§168(k)(2)(F)].](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fb19ac792-f274-4206-9191-c46f3b775258%2Fbd201dcb-9bbe-4385-93fe-46baf810934e%2Froo3d2_processed.png&w=3840&q=75)

Transcribed Image Text:EXHIBIT 10-10 Automobile Depreciation Limits

Recovery

Year

Year Placed in Service

2021*

10,100**

16,100

2020

2019

2018

10,000**

16,000

9,600

1

10,100**

16,100

9,700

5,760

10,100**

16,100

9,700

5,760

2

3

9,700

4 and after

5,760

5,760

*As of press date, the IRS had not released the 2021 limitations for automobiles, so throughout the chapter we use the same limitations as in 2020 for 2021.

**$8,000 additional depreciation is allowed when bonus depreciation is claimed [§168(k)(2)(F)].

Transcribed Image Text:Arlington LLC purchased an automobile for $76,000 on July 5, 2021. What is Arlington's depreciation deduction for 2021 if its business-use percentage

is 76 percent? (lgnore any possible bonus depreciation.) (Use Exhibit 10-10.)

Multiple Choice

$5,825

$7,600

$7,676

$11,400

None of the choices are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning