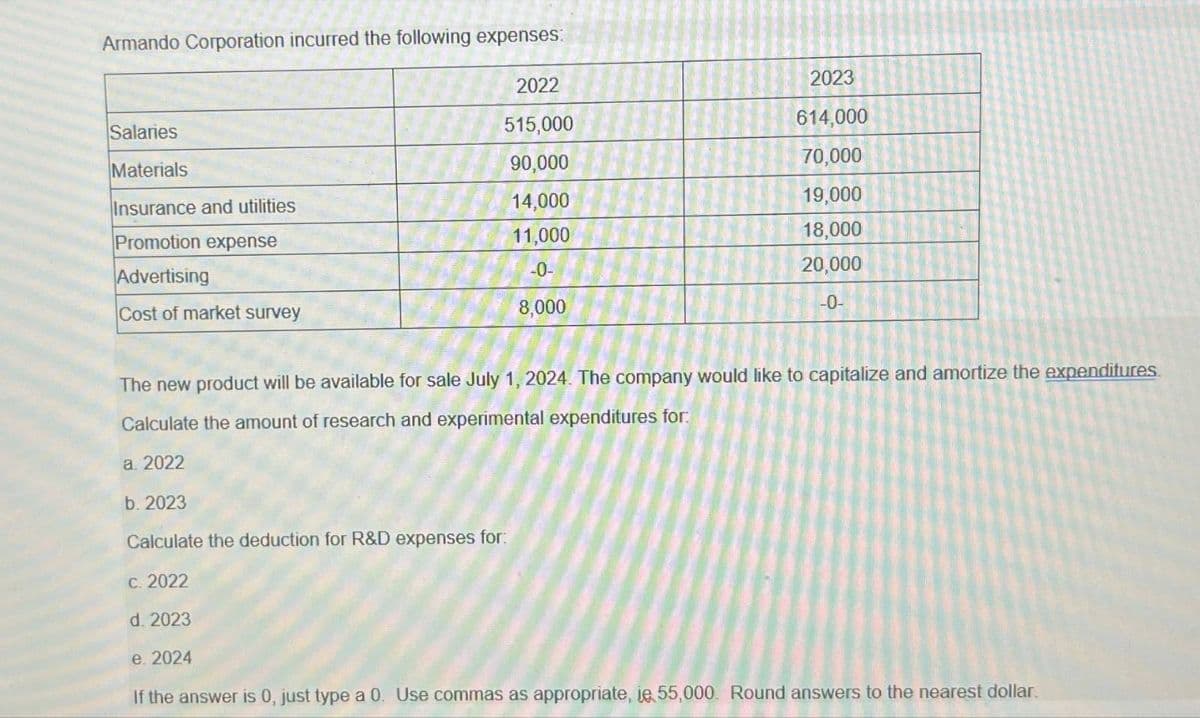

Armando Corporation incurred the following expenses: 2022 2023 Salaries 515,000 614,000 Materials 90,000 70,000 Insurance and utilities 14,000 19,000 Promotion expense 11,000 18,000 Advertising -0- 20,000 Cost of market survey 8,000 -0- The new product will be available for sale July 1, 2024. The company would like to capitalize and amortize the expenditures. Calculate the amount of research and experimental expenditures for: a. 2022 b. 2023 Calculate the deduction for R&D expenses for: C. 2022 d. 2023 e. 2024 If the answer is 0, just type a 0. Use commas as appropriate, ie 55,000. Round answers to the nearest dollar.

Armando Corporation incurred the following expenses: 2022 2023 Salaries 515,000 614,000 Materials 90,000 70,000 Insurance and utilities 14,000 19,000 Promotion expense 11,000 18,000 Advertising -0- 20,000 Cost of market survey 8,000 -0- The new product will be available for sale July 1, 2024. The company would like to capitalize and amortize the expenditures. Calculate the amount of research and experimental expenditures for: a. 2022 b. 2023 Calculate the deduction for R&D expenses for: C. 2022 d. 2023 e. 2024 If the answer is 0, just type a 0. Use commas as appropriate, ie 55,000. Round answers to the nearest dollar.

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 40P

Related questions

Question

Transcribed Image Text:Armando Corporation incurred the following expenses:

2022

2023

Salaries

515,000

614,000

Materials

90,000

70,000

Insurance and utilities

14,000

19,000

Promotion expense

11,000

18,000

Advertising

-0-

20,000

Cost of market survey

8,000

-0-

The new product will be available for sale July 1, 2024. The company would like to capitalize and amortize the expenditures.

Calculate the amount of research and experimental expenditures for:

a. 2022

b. 2023

Calculate the deduction for R&D expenses for:

C. 2022

d. 2023

e. 2024

If the answer is 0, just type a 0. Use commas as appropriate, ie 55,000. Round answers to the nearest dollar.

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT