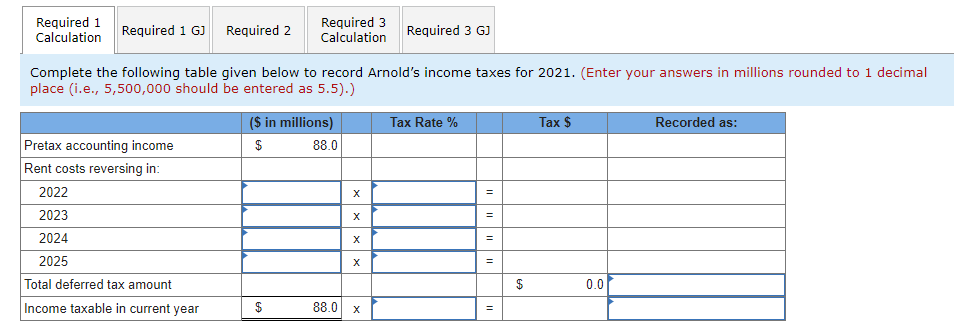

Arnold Industries has pretax accounting income of $88 million for the year ended December 31, 2021. The tax rate is 25%. The only difference between accounting income and taxable income relates to an operating lease in which Arnold is the lessee. The inception of the lease was December 28, 2021. An $64 million advance rent payment at the inception of the lease is tax-deductible in 2021 but, for financial reporting purposes, represents prepaid rent expense to be recognized equally over the four-year lease term. Required: 1. Complete the following table given below and prepare the appropriate journal entry to record Arnold’s income taxes for 2021. 2. Prepare the appropriate journal entry to record Arnold’s income taxes for 2022. Pretax accounting income was $120 million for the year ended December 31, 2022. 3. Assume a new tax law is enacted in 2022 that causes the tax rate to change from 25% to 15% beginning in 2023. Complete the following table given below and prepare the appropriate journal entry to record Arnold’s income taxes for 2022.

Arnold Industries has pretax accounting income of $88 million for the year ended December 31, 2021. The tax rate is 25%. The only difference between accounting income and taxable income relates to an operating lease in which Arnold is the lessee. The inception of the lease was December 28, 2021. An $64 million advance rent payment at the inception of the lease is tax-deductible in 2021 but, for financial reporting purposes, represents prepaid rent expense to be recognized equally over the four-year lease term.

Required:

1. Complete the following table given below and prepare the appropriate

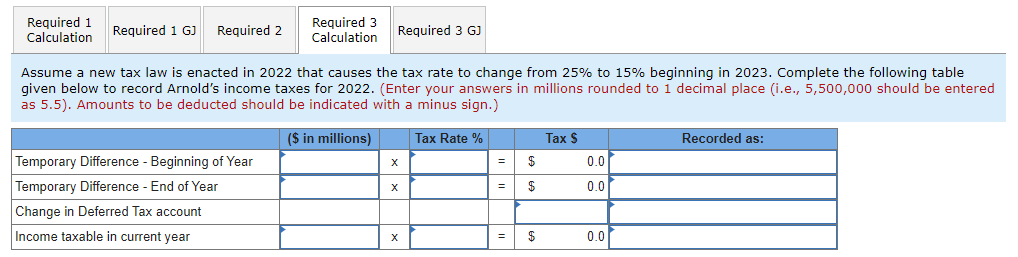

2. Prepare the appropriate journal entry to record Arnold’s income taxes for 2022. Pretax accounting income was $120 million for the year ended December 31, 2022.

3. Assume a new tax law is enacted in 2022 that causes the tax rate to change from 25% to 15% beginning in 2023. Complete the following table given below and prepare the appropriate journal entry to record Arnold’s income taxes for 2022.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps