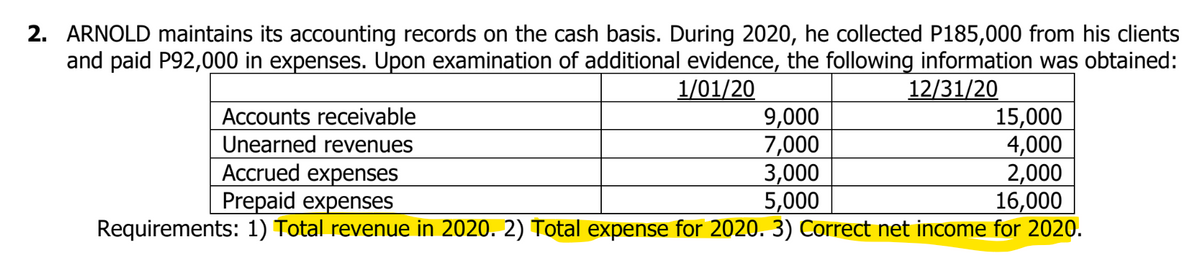

ARNOLD maintains its accounting records on the cash basis. During 2020, he collected P185,000 from his clients and paid P92,000 in expenses. Upon examination of additional evidence, the following information was obtained: 1/01/20 12/31/20 Accounts receivable Unearned revenues Accrued expenses Prepaid expenses Requirements: 1) Total revenue in 2020. 2) Total expense for 2020. 3) Correct net income for 2020. 9,000 7,000 3,000 5,000 15,000 4,000 2,000 16,000

ARNOLD maintains its accounting records on the cash basis. During 2020, he collected P185,000 from his clients and paid P92,000 in expenses. Upon examination of additional evidence, the following information was obtained: 1/01/20 12/31/20 Accounts receivable Unearned revenues Accrued expenses Prepaid expenses Requirements: 1) Total revenue in 2020. 2) Total expense for 2020. 3) Correct net income for 2020. 9,000 7,000 3,000 5,000 15,000 4,000 2,000 16,000

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter12: Corporations: Organization, Capital Structure, And Operating Rules

Section: Chapter Questions

Problem 34P

Related questions

Question

Transcribed Image Text:2. ARNOLD maintains its accounting records on the cash basis. During 2020, he collected P185,000 from his clients

and paid P92,000 in expenses. Upon examination of additional evidence, the following information was obtained:

1/01/20

12/31/20

Accounts receivable

Unearned revenues

Accrued expenses

9,000

7,000

3,000

Prepaid expenses

5,000

Requirements: 1) Total revenue in 2020. 2) Total expense for 2020. 3) Correct net income for 2020.

15,000

4,000

2,000

16,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT