As a firm takes on more debt, its probability of bankruptcy ___ . Other factors held constant, a firm whose earnings are relatively volatile faces a ____ chance of bankruptcy. Therefore, when other factors are held constant, a firm whose earnings are relatively volatile should use ____ debt than a more stable firm. When bankruptcy costs become more important, they ____ the tax benefits of debt. Blue Ram Brewing Company currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm’s unlevered beta is 1.05, and its cost of equity is 12.40%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.40%. The risk-free rate of interest (rRFrRF) is 4%, and the market risk premium (RPMRPM) is 8%. Blue Ram’s marginal tax rate is 25%. Blue Ram is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete the following table. D/Cap Ratio E/Cap Ratio D/E Ratio Bond Rating Before-Tax Cost of Debt (rdrd) Levered Beta (b) Cost of Equity (rsrs) WACC 0.0 1.0 0.00 — — 1.05 12.40% 12.40% 0.2 0.8 0.25 A 8.4% 13.976% 12.441% 0.4 0.6 0.67 BBB 8.9% 1.575 16.600% 0.6 0.4 1.50 BB 11.1% 2.231 13.734% 0.8 0.2 C 14.3% 4.200 37.600%

As a firm takes on more debt, its probability of bankruptcy ___ . Other factors held constant, a firm whose earnings are relatively volatile faces a ____ chance of bankruptcy. Therefore, when other factors are held constant, a firm whose earnings are relatively volatile should use ____ debt than a more stable firm. When bankruptcy costs become more important, they ____ the tax benefits of debt. Blue Ram Brewing Company currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm’s unlevered beta is 1.05, and its cost of equity is 12.40%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.40%. The risk-free rate of interest (rRFrRF) is 4%, and the market risk premium (RPMRPM) is 8%. Blue Ram’s marginal tax rate is 25%. Blue Ram is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete the following table. D/Cap Ratio E/Cap Ratio D/E Ratio Bond Rating Before-Tax Cost of Debt (rdrd) Levered Beta (b) Cost of Equity (rsrs) WACC 0.0 1.0 0.00 — — 1.05 12.40% 12.40% 0.2 0.8 0.25 A 8.4% 13.976% 12.441% 0.4 0.6 0.67 BBB 8.9% 1.575 16.600% 0.6 0.4 1.50 BB 11.1% 2.231 13.734% 0.8 0.2 C 14.3% 4.200 37.600%

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter15: Capital Structure Decisions

Section: Chapter Questions

Problem 11P: The Rivoli Company has no debt outstanding, and its financial position is given by the following...

Related questions

Question

Please help solve and show work.

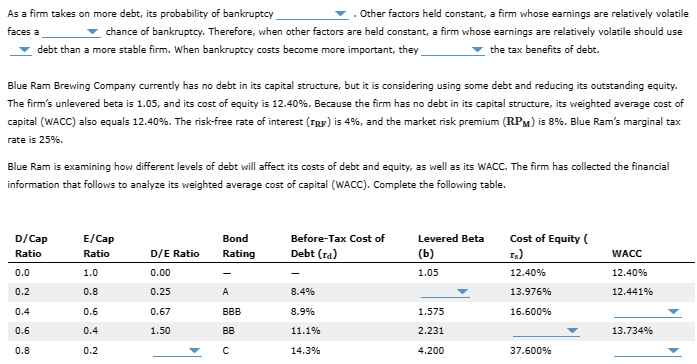

As a firm takes on more debt, its probability of bankruptcy ___ . Other factors held constant, a firm whose earnings are relatively volatile faces a ____ chance of bankruptcy. Therefore, when other factors are held constant, a firm whose earnings are relatively volatile should use ____ debt than a more stable firm. When bankruptcy costs become more important, they ____ the tax benefits of debt.

Blue Ram Brewing Company currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm’s unlevered beta is 1.05, and its cost of equity is 12.40%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.40%. The risk-free rate of interest (rRFrRF) is 4%, and the market risk premium (RPMRPM) is 8%. Blue Ram’s marginal tax rate is 25%.

Blue Ram is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete the following table.

|

D/Cap Ratio

|

E/Cap Ratio

|

D/E Ratio

|

Bond Rating

|

Before-Tax Cost of Debt (rdrd)

|

Levered Beta (b)

|

Cost of Equity (rsrs)

|

WACC

|

|---|---|---|---|---|---|---|---|

| 0.0 | 1.0 | 0.00 | — | — | 1.05 | 12.40% | 12.40% |

| 0.2 | 0.8 | 0.25 | A | 8.4% | 13.976% | 12.441% | |

| 0.4 | 0.6 | 0.67 | BBB | 8.9% | 1.575 | 16.600% | |

| 0.6 | 0.4 | 1.50 | BB | 11.1% | 2.231 | 13.734% | |

| 0.8 | 0.2 | C | 14.3% | 4.200 | 37.600% |

Transcribed Image Text:As a firm takes on more debt, its probability of bankruptcy

faces a

. Other factors held constant, a firm whose earnings are relatively volatile

chance of bankruptcy. Therefore, when other factors are held constant, a firm whose earnings are relatively volatile should use

debt than a more stable firm. When bankruptcy costs become more important, they

the tax benefits of debt.

Blue Ram Brewing Company currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity.

The firm's unlevered beta is 1.05, and its cost of equity is 12.40%. Because the firm has no debt in its capital structure, its weighted average cost of

capital (WACC) also equals 12.40%. The risk-free rate of interest (TRF) is 4%, and the market risk premium (RPM) is 8%. Blue Ram's marginal tax

rate is 25%.

Blue Ram is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial

information that follows to analyze its weighted average cost of capital (WACC). Complete the following table.

D/Cap

Ratio

0.0

0.2

0.4

0.6

0.8

E/Cap

Ratio

1.0

0.8

0.6

0.4

0.2

D/E Ratio

0.00

0.25

0.67

1.50

▶

Bond

Rating

-

A

BBB

BB

с

Before-Tax Cost of

Debt (ra)

8.4%

8.9%

11.1%

14.3%

Levered Beta

(b)

1.05

1.575

2.231

4.200

Cost of Equity (

IS)

12.40%

13.976%

16.600%

37.600%

WACC

12.40%

12.441%

13.734%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 5 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT