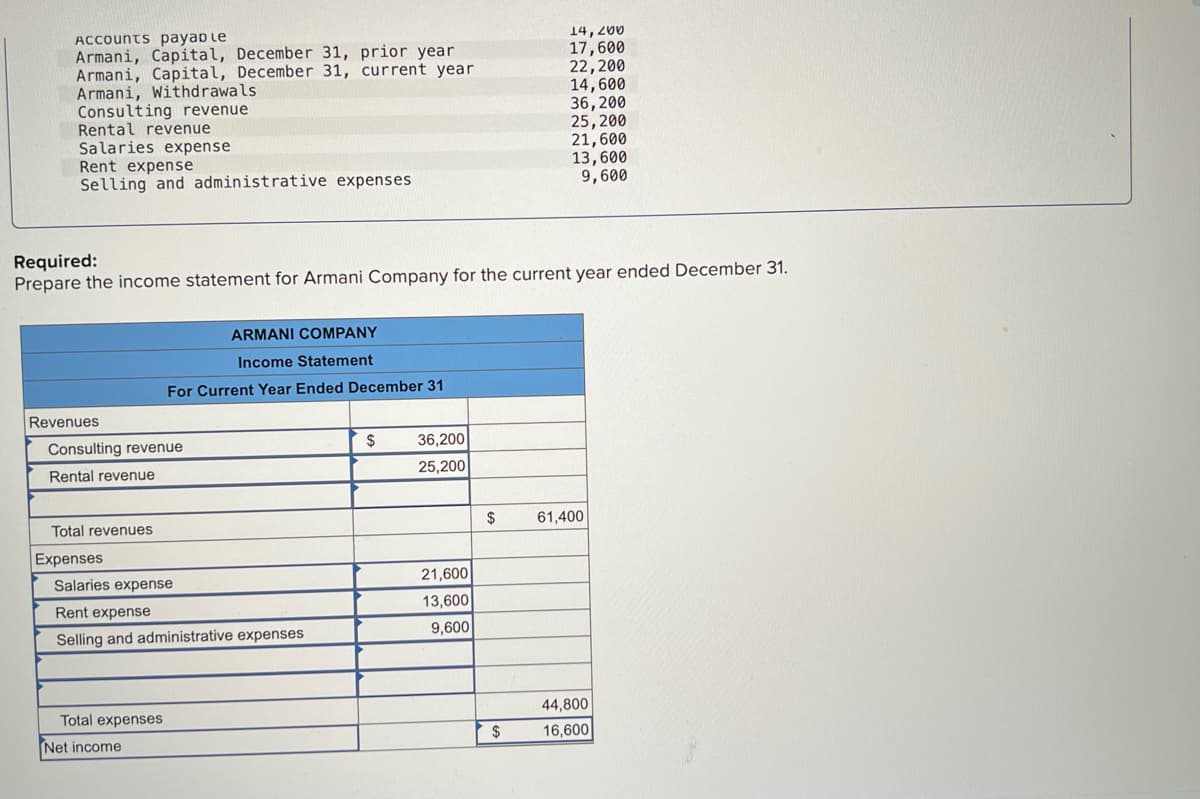

As of December 31 of the current year, Armani Company's records show the following. Hint. The owner invested $2,6 cash during the year. $ 11,600 10,600 7,600 6,600 14,200 17,600 22,200 14,600 36,200 25,200 21,600 13,600 9,600 Cash Accounts receivable Supplies Equipment Accounts payable Armani, Capital, December 31, prior year Armani, Capital, December 31, current year Armani, Withdrawals Consulting revenue Rental revenue Salaries expense Rent expense Selling and administrative expenses

As of December 31 of the current year, Armani Company's records show the following. Hint. The owner invested $2,6 cash during the year. $ 11,600 10,600 7,600 6,600 14,200 17,600 22,200 14,600 36,200 25,200 21,600 13,600 9,600 Cash Accounts receivable Supplies Equipment Accounts payable Armani, Capital, December 31, prior year Armani, Capital, December 31, current year Armani, Withdrawals Consulting revenue Rental revenue Salaries expense Rent expense Selling and administrative expenses

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.2DC

Related questions

Topic Video

Question

![Required information

[The following information applies to the questions displayed below.]

As of December 31 of the current year, Armani Company's records show the following. Hint. The owner invested $2,600

cash during the year.

Cash

Accounts receivable

Supplies

Equipment

Accounts payable

Armani, Capital, December 31, prior year

Armani, Capital, December 31, current year

Armani, Withdrawals

Consulting revenue

Rental revenue

Salaries expense

Rent expense

Selling and administrative expenses

$ 11,600

10,600

7,600

6,600

14,200

17,600

22,200

14,600

36,200

25,200

21,600

13,600

9,600

Required:

Prepare the income statement for Armani Company for the current year ended December 31.

ARMANI COMPANY

Income Statement

For Current Year Ended December 31

Revenues

Consulting revenue

2$

36,200

Rental revenue

25,200

Total revenues

2$

61,400](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F3def57fe-6b1d-478a-8732-dae2293a2fb5%2Fbfeccbbb-ab2f-4b75-a4e8-c6e4fbab5686%2Fve5lk7w_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

As of December 31 of the current year, Armani Company's records show the following. Hint. The owner invested $2,600

cash during the year.

Cash

Accounts receivable

Supplies

Equipment

Accounts payable

Armani, Capital, December 31, prior year

Armani, Capital, December 31, current year

Armani, Withdrawals

Consulting revenue

Rental revenue

Salaries expense

Rent expense

Selling and administrative expenses

$ 11,600

10,600

7,600

6,600

14,200

17,600

22,200

14,600

36,200

25,200

21,600

13,600

9,600

Required:

Prepare the income statement for Armani Company for the current year ended December 31.

ARMANI COMPANY

Income Statement

For Current Year Ended December 31

Revenues

Consulting revenue

2$

36,200

Rental revenue

25,200

Total revenues

2$

61,400

Transcribed Image Text:ACCounts payap le

Armani, Capital, December 31, prior year

Armani, Capital, December 31, current year

Armani, Withdrawals

Consulting revenue

Rental revenue

Salaries expense

Rent expense

Selling and administrative expenses

14,200

17,600

22,200

14,600

36,200

25,200

21,600

13,600

9,600

Required:

Prepare the income statement for Armani Company for the current year ended December 31.

ARMANI COMPANY

Income Statement

For Current Year Ended December 31

Revenues

Consulting revenue

$

36,200

Rental revenue

25,200

Total revenues

$

61,400

Expenses

21,600

13,600

9,600

Salaries expense

Rent expense

Selling and administrative expenses

Total expenses

44,800

Net income

$

16,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning