AS150.000 ; Rosie's basis in property 8 S80,000 in property B ty AS150,000; Rosie's basis in property B S00,000 ty A$720,000: Rosie's basis in property B S0,000 A$200.000 Roie's basis in property B S0,000

AS150.000 ; Rosie's basis in property 8 S80,000 in property B ty AS150,000; Rosie's basis in property B S00,000 ty A$720,000: Rosie's basis in property B S0,000 A$200.000 Roie's basis in property B S0,000

Chapter6: Corporations: Redemptions And Liquidations

Section: Chapter Questions

Problem 33CE

Related questions

Question

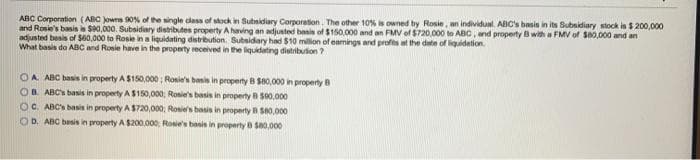

Transcribed Image Text:ABC Corporation (ABC Jowns 90N of the single class of stock in Subsidiary Corporation. The other 10% is owned by Rosie, an individual. ABC's basis in its Subsidiary stock is $ 200,000

and Rosie's basis is Se0,000. Subsidiary distributes property A having an adjusted basis of $150,000 and an FMV of $720.000 to ABC, and property B with a FMV of $80,000 and an

adjusted besis of S60,000 to Rosie in a liquidating distribution. Subsidary had $10 million of eamings and profts at the date of liquidetion.

What basis do ABC and Rosie have in the property received in the liquidating distribuion ?

OA ABC basis in property A $150,000 ; Ronie's basis in property B S80,000 in property B

B. ABC's basis in property A $150,000; Rosie's basis in property B S00,000

OC. ABC's basis in property A $720,000; Rosie's basis in property B S80,000

OD. ABC basis in property A $200.000 Rosie's basis in property B S0,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you