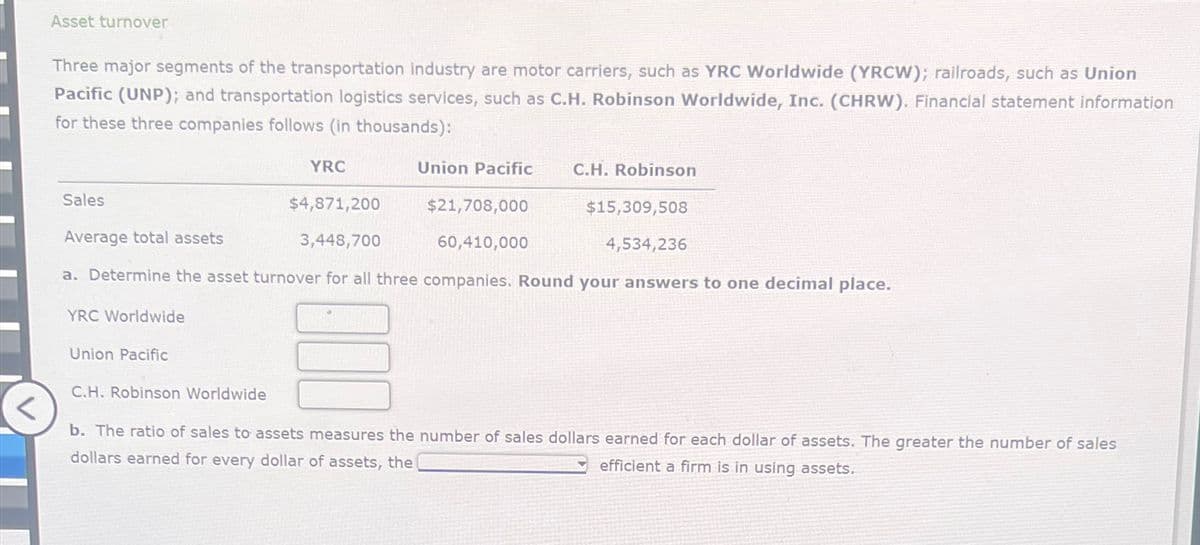

Asset turnover Three major segments of the transportation industry are motor carriers, such as YRC Worldwide (YRCW); railroads, such as Union Pacific (UNP); and transportation logistics services, such as C.H. Robinson Worldwide, Inc. (CHRW). Financial statement information for these three companies follows (in thousands): YRC Sales $4,871,200 $21,708,000 Average total assets 3,448,700 60,410,000 a. Determine the asset turnover for all three companies. Round your answers to one decimal place. YRC Worldwide Union Pacific Union Pacific C.H. Robinson $15,309,508 4,534,236 C.H. Robinson Worldwide b. The ratio of sales to assets measures the number of sales dollars earned for each dollar of assets. The greater the number of sales dollars earned for every dollar of assets, the efficient a firm is in using assets.

Asset turnover Three major segments of the transportation industry are motor carriers, such as YRC Worldwide (YRCW); railroads, such as Union Pacific (UNP); and transportation logistics services, such as C.H. Robinson Worldwide, Inc. (CHRW). Financial statement information for these three companies follows (in thousands): YRC Sales $4,871,200 $21,708,000 Average total assets 3,448,700 60,410,000 a. Determine the asset turnover for all three companies. Round your answers to one decimal place. YRC Worldwide Union Pacific Union Pacific C.H. Robinson $15,309,508 4,534,236 C.H. Robinson Worldwide b. The ratio of sales to assets measures the number of sales dollars earned for each dollar of assets. The greater the number of sales dollars earned for every dollar of assets, the efficient a firm is in using assets.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 16E

Related questions

Question

3

Transcribed Image Text:Asset turnover

Three major segments of the transportation industry are motor carriers, such as YRC Worldwide (YRCW); railroads, such as Union

Pacific (UNP); and transportation logistics services, such as C.H. Robinson Worldwide, Inc. (CHRW). Financial statement information

for these three companies follows (in thousands):

Sales

YRC Worldwide

YRC

$4,871,200

$21,708,000

$15,309,508

Average total assets

3,448,700

60,410,000

4,534,236

a. Determine the asset turnover for all three companies. Round your answers to one decimal place.

Union Pacific

Union Pacific

C.H. Robinson

C.H. Robinson Worldwide

<

b. The ratio of sales to assets measures the number of sales dollars earned for each dollar of assets. The greater the number of sales

dollars earned for every dollar of assets, the

efficient a firm is in using assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning