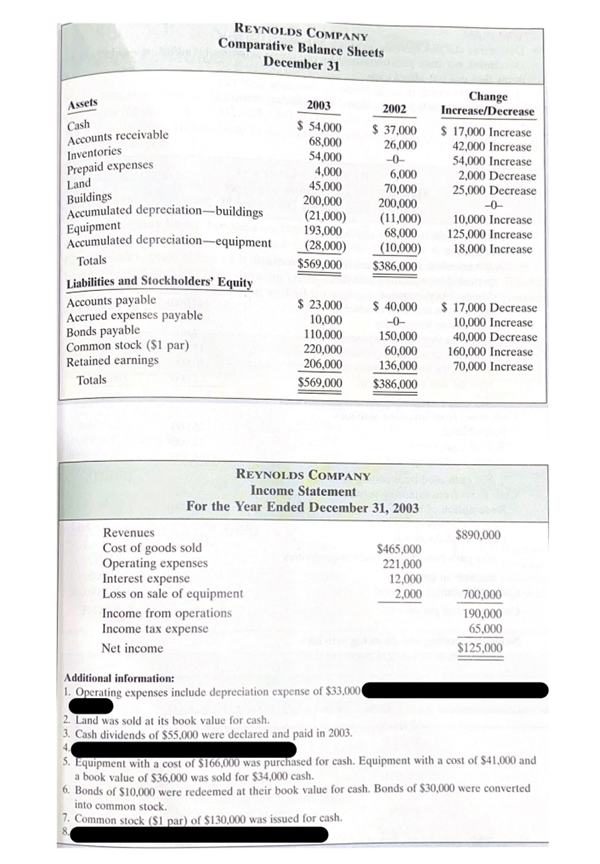

Assets Cash Accounts receivable Inventories Prepaid expenses Land REYNOLDS COMPANY Comparative Balance Sheets December 31 Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation equipment Totals Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Bonds payable Common stock ($1 par) Retained earnings Totals Revenues Cost of goods sold Operating expenses Interest expense Loss on sale of equipment 2003 $ 54,000 68,000 54,000 4,000 Income from operations Income tax expense Net income 45,000 200,000 (21,000) 193,000 (28,000) $569,000 $ 23,000 10,000 110,000 220,000 206,000 $569,000 REYNOLDS COMPANY Income Statement For the Year Ended December 31, 2003 Additional information: 1. Operating expenses include depreciation expense of $33,000 2002 $ 37,000 26,000 -0- 2. Land was sold at its book value for cash. 3. Cash dividends of $55,000 were declared and paid in 2003. 6,000 70,000 200,000 (11,000) 68,000 (10,000) $386,000 $ 40,000 -0- 150,000 60,000 136,000 $386,000 $465,000 221,000 12,000 2,000 Change Increase/Decrease $ 17,000 Increase 42,000 Increase 54,000 Increase 2,000 Decrease 25,000 Decrease -0- 10,000 Increase 125,000 Increase 18,000 Increase $ 17,000 Decrease 10,000 Increase 40,000 Decrease 160,000 Increase 70,000 Increase $890,000 700,000 190,000 65,000 $125,000 Equipment with a cost of $166,000 was purchased for cash. Equipment with a cost of $41,000 and a book value of $36,000 was sold for $34,000 cash. 6. Bonds of $10,000 were redeemed at their book value for cash. Bonds of $30,000 were converted into common stock. 7. Common stock ($1 par) of $130,000 was issued for cash.

Assets Cash Accounts receivable Inventories Prepaid expenses Land REYNOLDS COMPANY Comparative Balance Sheets December 31 Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation equipment Totals Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Bonds payable Common stock ($1 par) Retained earnings Totals Revenues Cost of goods sold Operating expenses Interest expense Loss on sale of equipment 2003 $ 54,000 68,000 54,000 4,000 Income from operations Income tax expense Net income 45,000 200,000 (21,000) 193,000 (28,000) $569,000 $ 23,000 10,000 110,000 220,000 206,000 $569,000 REYNOLDS COMPANY Income Statement For the Year Ended December 31, 2003 Additional information: 1. Operating expenses include depreciation expense of $33,000 2002 $ 37,000 26,000 -0- 2. Land was sold at its book value for cash. 3. Cash dividends of $55,000 were declared and paid in 2003. 6,000 70,000 200,000 (11,000) 68,000 (10,000) $386,000 $ 40,000 -0- 150,000 60,000 136,000 $386,000 $465,000 221,000 12,000 2,000 Change Increase/Decrease $ 17,000 Increase 42,000 Increase 54,000 Increase 2,000 Decrease 25,000 Decrease -0- 10,000 Increase 125,000 Increase 18,000 Increase $ 17,000 Decrease 10,000 Increase 40,000 Decrease 160,000 Increase 70,000 Increase $890,000 700,000 190,000 65,000 $125,000 Equipment with a cost of $166,000 was purchased for cash. Equipment with a cost of $41,000 and a book value of $36,000 was sold for $34,000 cash. 6. Bonds of $10,000 were redeemed at their book value for cash. Bonds of $30,000 were converted into common stock. 7. Common stock ($1 par) of $130,000 was issued for cash.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.12MCE

Related questions

Question

Please Solve the attached Cash flow statment problem by indirect way by using excel sheet in order to have readable answer.

Transcribed Image Text:Assets

Cash

Accounts receivable

Inventories

Prepaid expenses

Land

REYNOLDS COMPANY

Comparative Balance Sheets

December 31

Buildings

Accumulated depreciation-buildings

Equipment

Accumulated depreciation-equipment

Totals

Liabilities and Stockholders' Equity

Accounts payable

Accrued expenses payable

Bonds payable

Common stock ($1 par)

Retained earnings

Totals

Revenues

Cost of goods sold

Operating expenses

Interest expense

Loss on sale of equipment

2003

$ 54,000

68,000

54,000

4,000

45,000

200,000

(21,000)

193,000

(28,000)

$569,000

Income from operations

Income tax expense

Net income

$ 23,000

10,000

110,000

220,000

206,000

$569,000

Additional information:

1. Operating expenses include depreciation expense of $33,000

2002

$ 37,000

26,000

-0-

REYNOLDS COMPANY

Income Statement

For the Year Ended December 31, 2003

2. Land was sold at its book value for cash.

3. Cash dividends of $55,000 were declared and paid in 2003.

4.

6,000

70,000

200,000

(11,000)

68,000

(10,000)

$386,000

$ 40,000

-0-

150,000

60,000

136,000

$386,000

$465,000

221,000

12,000

2,000

Change

Increase/Decrease

$ 17,000 Increase

42,000 Increase

54,000 Increase

2,000 Decrease

25,000 Decrease

-0-

10,000 Increase

125,000 Increase

18,000 Increase

$ 17,000 Decrease

10,000 Increase

40,000 Decrease

160,000 Increase

70,000 Increase

$890,000

700,000

190,000

65,000

$125,000

5. Equipment with a cost of $166,000 was purchased for cash. Equipment with a cost of $41,000 and

a book value of $36,000 was sold for $34,000 cash.

6. Bonds of $10,000 were redeemed at their book value for cash. Bonds of $30,000 were converted

into common stock.

7. Common stock ($1 par) of $130,000 was issued for cash.

8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,