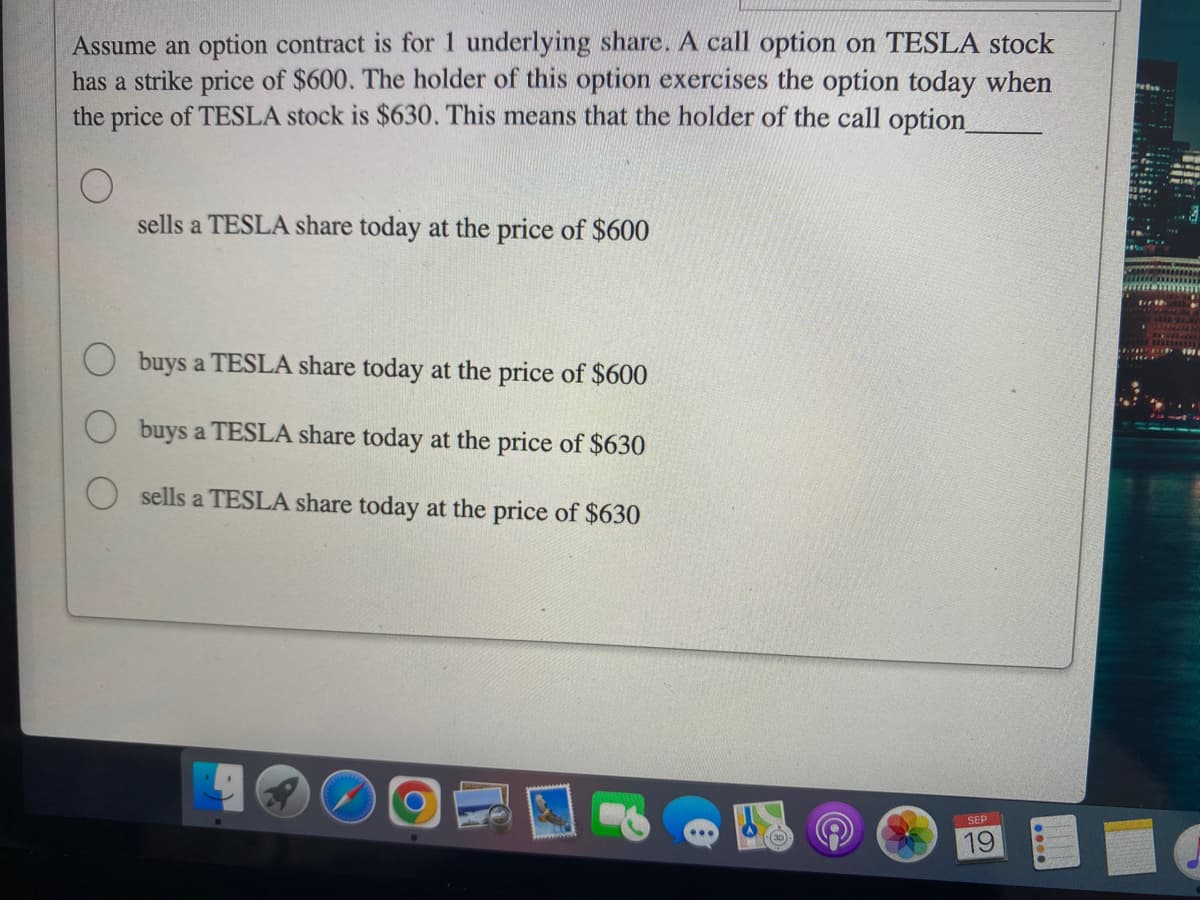

Assume an option contract is for I underlying share. A call option on TESLA stock has a strike price of $600. The holder of this option exercises the option today when the price of TESLA stock is $630. This means that the holder of the call option_

Q: In recording adjusting entries, Reagan Financial Advisors failed to record the adjusting entries for…

A: According to the given question, we are required to prepare the statement of adjusting entries that…

Q: Pop Corp owns 200 shares of stock in Small Corp, which represents 35% in Small Corp. The value of…

A: Pop Corp owns 35% in Small Corp that is 200 shares of stock = $100 Market value = $500 End of 2021,…

Q: The Home Office in Manila shipped merchandise costing P30,000 to Baguio Branch and paid for the…

A: Branch Accounting Branch accounting is a type of bookkeeping where distinct accounts are maintained…

Q: 1. The Accounting Cycle: The Mechanics of Accounting Required: Show the effects of the previous…

A: Accounting equation is one of the fundamental concept in accounting, which says that total assets…

Q: On November 1, 2022, SAN JOSE receives an order from a customer for a computer as well as 12 months…

A: Unearned sales Revenue: Unearned sales Revenue means money received from the customer in advance for…

Q: How much is shareholders’ equity, beg. assuming that the cash balance, ending amounted to P50,000?

A: Shareholders’ equity is the amount of the money or the worth which has been invested by the owners…

Q: On November 1, 2022, SAN JOSE receives an order from a customer for a computer as well as 12 months…

A: Unearned sales Revenue: Unearned sales Revenue means money received from the customer in advance for…

Q: BUSINESS TRANSACTIONS AND THEIR ANALYSIS AS APPLIED TO THE ACCOUNTING CYCLE OF THE a.SERVICE…

A: Service: Service is an economic activity in which an individual or a group provides expert knowledge…

Q: On November 1, 2022, SAN JOSE receives an order from a customer for a computer as well as 12 months…

A: Unearned sales Revenue: Unearned sales Revenue means money received from the customer in advance for…

Q: On January 15, 2021, X Company bought merchandise from Y Company amounting to P30,000 (VAT…

A: FOB Shipping Point Free on Board up to the shipping point is referred to as FOB Shipping Point.…

Q: The following is a December 31, 2024, post-closing trial balance for Almway Corporation. Debits $…

A: The balance sheet is the statement that summarizes the financial situation of a corporation as of…

Q: The following information is available for a custom manufacturer Inventories Raw materials,…

A: when overhead applied than the actual overhead that means overapplied overhead and when the overhead…

Q: * Your answer is incorrect. Calculate the inventory turnover for 2023, 2024, and 2025. (Round…

A: Inventory Turnover is the measure of no. of times the inventory is sold during the year. Inventory…

Q: You would like to purchase a car with a negotiated price of $39,000, and the dealer offers financing…

A: Given: - Price: - $39,000 Period: - 4 years Rate: - 6% Payment: - monthly

Q: Do not produce the extra 10,000 units. The increase in operating income under absorption costing is…

A: Comparison of Methods Complete the following table after reviewing the income figures on the…

Q: X Company collected P12350 in interest during 2019 X showed P1,850 in interest on its December 31,…

A: Accrual Basis of Accounting: A technique of accounting known as accrual accounting involves…

Q: The June 30, 2022 statement of financial position of Red Corporation shows a cash balance of…

A: According to the given question, we are required to compute the cash and cash equivalents of Red…

Q: Required information [The following information applies to the questions displayed below.] Listed…

A: Manufacturing Cost :— It is the cost that is incurred by company in the manufacturing of product.…

Q: B) Can the government revoke the real property and income tax exemptions enjoyed by non-stock,…

A: Not-for-profit organizations (NPOs) in the Philippines are frequently set up as "non-stock…

Q: GENERAL JOURNAL Description Date 20x1 April 1 Accounts Payable Fees Income Performed services on…

A: The journal entries are prepared to record the transactions on regular basis. The correcting entries…

Q: For each of the following independent cases (1 to 4), compute the missing values. (Enter all amounts…

A: 1. Direct material used = Beginning raw material + raw material purchases + indirect material…

Q: Three different plans for financing a $4,000,000 corporation are under consideration by its…

A: Earnings per share indicate the profits per share of the common stockholders. It is the earning…

Q: 2. You are given the following information for Shinoda Corp.: Decrease in inventory $…

A: Introduction:- A balance sheet is a statement of assets, liability, and equity. It is prepared…

Q: Date December 31, 2022 Account Titles and Explanation Debit Credit

A: Lets understand the basics. When financial difficulty arise in the hand of borrower then lander…

Q: Prior to the first month of operations ending October 31, Marshall Inc. estimated the following…

A: Lets understand the basics. There are two type of costing systems are followed which are, (1)…

Q: What amount shall be presented in the statement of financial position at December 31, 2021 as…

A: Under cost model investment property is measured at cost less accumulated depreciation. fair value…

Q: XYZ Corporation reported the following shareholders equity on December 11, 2021 8% cumulative…

A: The following information given: 1. 8% cumulative preference share capital, P50 par, liquidating…

Q: On January 1, 2021, Blue company purchased P1,000,000, 12% bonds for P1,065,000, a price that yields…

A: In a table known as a bond amortisation schedule, the sum of interest paid, interest accrued, and…

Q: Background information: Campbell Inc., a retailer, began operations on October 1, 2022, and entered…

A:

Q: Partners Francia, Glenda and Harold share profits and losses at 5:3:2, respectively, and their…

A: Profit and Loss Sharing Ratio of Francia : Glenda : Harold = 5 ; 3 : 2 Capital Balances Francia =…

Q: Fuzzy Monkey Technologies, Inc., purchased as a long-term investment $130 million of 8% bonds, dated…

A: BOND Bond Is a Security which is Issued by the Companies and Government to generate fund for…

Q: If finished goods inventory decreased by P20,000 and any under-over applied overhead is immaterial,…

A: P395,000 IS CORRECT CHOICE STEP BY STEP EXPLANATION:- Raw Materials Purchased during the month…

Q: ow is materiality related to relevance base on IFRS Foundation?

A: Accounting Records - Accounting records are regarded as one of the most important sources of…

Q: PROBLEM 1-2 (L04) Preparing Financial Statements Laberge Sheathing Inc. began operations on January…

A: INCOME STATEMENT Income Statement help to analysis the Performance of the Company. It provides…

Q: Integrity Company manufactures two joint products, R and F. Integrity produced 12,000 units of…

A: Integrity produced 12,000 units of product R with a split-off sales value of P90,000. Integrity…

Q: seeking penalties settlement with state authorities to pay $1.6 million in pen 1 milion lawsuit…

A: Journal entries are those entries that are stated in the books of accounts of a company regarding…

Q: The cash flows in the table below represent the potential annual savings associated with two…

A: Annual Equivalent worth is used to determine the value of an investment by determining equal amounts…

Q: Integrity CORP uses job order costing. At Jan 31, only Job 101 was the only job in process with…

A: Adjusted cost of goods sold derives from the cost of goods sold after making adjustment for variance…

Q: Which of the following statements regarding liabilities is true? Liabilities arise through a…

A: Introduction:- Liability is someone legally responsible to pay another person or company.…

Q: A plant produces refrigerators at the rate of P units per day. The variable costs per refrigerator…

A: Variable Cost (Per Refrigerator) = $47.73 + 0.1P1.2 Daily Fixed Charges = $1750 Other Expenses =…

Q: Determine the true net income of the branch.

A: SOLUTION : The head office has billed the merchandise which was send to the branch office at 110%…

Q: Indigo Company is in the process of preparing its financial statements for 2020. Assume that no…

A: The depreciation expense is charged on fixed assets as reduction in the value of fixed assets with…

Q: For each unit of computer sold, Blue Company sells a service contract. The contract provides that…

A: Unearned Revenue: Unearned Revenue means money received from the customer in advance for the…

Q: Kubin Company's relevant range of production is 29,000 to 33,000 units. When it produces and sells…

A: Fixed manufacturing cost is the cost incurred on the making of the goods. It is the cost which do…

Q: Maroon Company’s inventory at December 31, 2021 amounts to P555,000 based on physical count of goods…

A: FOB Shipping Point means the goods are owned by the seller up to the point of shipping . The…

Q: Effect of Financing on Earnings Per Share BSF Co., which produces and sells skiing equipment, is…

A: Earnings per share=Earnings available for common stockNumber of common shares

Q: Anson Corp. manufactures a product that yields the by-product, "Yum". The only costs associated with…

A: Anson manufactures product that yields by product Yum Yum's sales = sales - selling cost

Q: Receivables amount to P150,000. Receivable turnover is 10x and inventory is maintained at a level…

A: Receivable Turnover Ratio - This Ratio indicated by how many times company collect its average…

Q: Shipments received from home office are billed at 120% of cost. During the year, the branch…

A: Branch reported a loss based on the cost of billed price it acquired the goods on. True branch…

Q: The partnership of H, M and R is liquidating and the ledger shows the following: Dr. Cash- P80,000…

A: Cash Balance Available = 80000 H Capital = 50% = 45000 M Capital = 25% = 40000 R Capital = 25% =…

Step by step

Solved in 2 steps

- A trader has a put option contract allowing her to sell 100 shares of a stock for a strike price of $75. What are the terms of this put contract if... the company pays a quarterly dividend of $1/share the company pays a 20% stock dividend the company declares a 2-for-5 reverse stock split For each number, fill in the blank: The option allows the trader to sell ________ shares of stock for $_______/share.MetaAn investor buys a put option contract for S of IBM Inc. stock, with a contract size of ton shares. The stock price is currently $35, and the exercise price is $10. What are the investor's expectations, and under what conditions does the investor make a profit? (1) Is this put option in-the-money? ii) Under what circumstances will the option be exercised? (iv) If at the expiration of the option, the stock price is $ so calculate the profit/loss of the investment and explain what the transactions are? Shall the investor exercise this option?IBM stock is currently trading at $100 per share. An investor purchases one Put option contra on IBM with a $100 strike and at a price of $3.00 per contract. Each options contract represer an interest in 100 underlying shares of stock. For each of the following scenarios determine i 7. the option is in the money, at the money, or out of the money. Show your work. A. When the option expires, IBM is trading at $98 B. When the option expires, IBM is trading at $90 C. When the option expires, IBM is trading at $97

- An investor purchases a call option at a premium of $1.25, with an exercise price of $7.50 within three months.The holder of the option will: A) B) C) D) * A. be in-the-money if the market price of the shares reaches $6.25 B. only exercise the option if the current market price reaches or exceeds $8.75 C. exercise the option at any price above $7.50. D. break even at a market price of $7.50, and will exercise the optionEmmanuel holds a one-year call option on Shoprite common stock. The call option can be exercised at K15. Assume that the expiration date has arrived. What is the value of the Shoprite call option on the expiration date if: Shoprite common stock is selling at K20 per share? Shoprite common stock is selling at K10 per share? A trader buys a European put on a share for K3. The stock price is K42 and the strike price is K40. State the circumstances under which the trader will make a profit. State the circumstances under which the option will be exercised. Draw a diagram in support of your answers above, showing the variation of the trader’s profit with the stock price at the maturity of the option.Suppose that a March call option to buy a share for $50 costs $2.50 and is held until March. The holder of the option will gain if the price of the stock is above 52.50 in March. True or False?

- Ms. Co currently own a put option on Stock A with a strike price of P45. If the current price of Stock A is P40, then what is the in-the-money amount of the option?Suppose you combine two option contracts as follows. You buy a call option on a stock with an exercise price of $65 for a premium of 9$. At the same time you sell a call option on the same stock with an exercise price of $75 for a premium of $4. Both calls expire at the same time. The stock sells currently at $72. Answer the following questions about this investment strategy: 1. Determinethevalueatexpiration(thepayoffs)andtheprofitunderthefollowingoutcomes: a. The price of the stock at expiration is $78b. The price of the stock at expiration is $69c. Thepriceofthestockatexpirationis$62 2. Determine the following:a. The maximum profit b. The maximum loss 3. Determinethebreakevenstockpriceatexpiration(thestockpriceforwhichyourstrategydeliversno profit and no loss). 4. Depictthepayoffandprofitdiagramsofyourinvestmentstrategy.An investor buys a stock for $40 per share and simultaneously sells a call option on the stock with an exercise price of $42 for a premium of $3 per share. Ignoring the dividends and transaction costs, what is the maximum profit the writer of this covered call can earn if the position is held to expiration?

- An investor sells a European Put on a share for $4. The stock price is $47 and the strike price is $50. Under what circumstances does the investor make a profit? Under what circumstances will the option be exercised? Draw a diagram showing the variation of the investor's profit with the stock price at the maturity of the option.Calculate the profit or loss per share of stock to an investor who buys a call option on a stock whose price is K90 but a call option exercise price if K100 if the stock price at expiration is K105. Calculate the profit or loss for a purchaser of a put option with the same exercise price and expiration?On July 14, an investor goes long on a put option for 100 shares of Z Corporation common stock with a strike price of ₱33 with an expiration date of August 16, at an option premium of ₱1.25 per share. The market price of ABC on July 14 is ₱32.50. On August 16, the market price of ABC is ₱35. How much has the investor gained or lost on the option transaction? Disregard any brokerage commissions involved