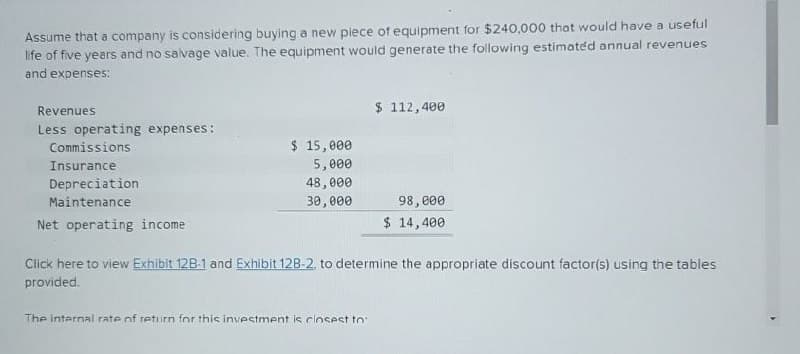

Assume that a company is considering buying a new piece of equipment for $240,000 that would have a useful life of five years and no salvage value. The equipment would generate the following estimated annual revenues and expenses: Commissions Insurance Revenues $ 112,400 Less operating expenses: $ 15,000 5,000 48,000 30,000 98,000 $ 14,400 Depreciation Maintenance Net operating income Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. The internal rate of return for this investment is closest to

Assume that a company is considering buying a new piece of equipment for $240,000 that would have a useful life of five years and no salvage value. The equipment would generate the following estimated annual revenues and expenses: Commissions Insurance Revenues $ 112,400 Less operating expenses: $ 15,000 5,000 48,000 30,000 98,000 $ 14,400 Depreciation Maintenance Net operating income Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. The internal rate of return for this investment is closest to

Related questions

Question

Transcribed Image Text:Assume that a company is considering buying a new piece of equipment for $240,000 that would have a useful

life of five years and no salvage value. The equipment would generate the following estimated annual revenues

and expenses:

Commissions

Insurance

Revenues

$ 112,400

Less operating expenses:

$ 15,000

5,000

48,000

30,000

98,000

$ 14,400

Depreciation

Maintenance

Net operating income

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables

provided.

The internal rate of return for this investment is closest to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps