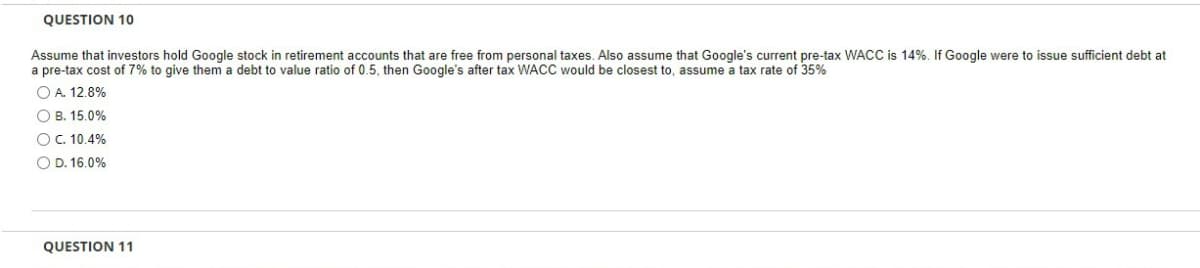

Assume that investors hold Google stock in retirement accounts that are free from personal taxes. Also assume that Google's current pre-tax WACC is 14%. If Google were to issue sufficient debt at a pre-tax cost of 7% to give them debt to value ratio of 0.5, then Google's after tax WACC would be closest to, assume a tax rate of 35% OA. 12.8% OB. 15.0% O C. 10.4% O D. 16.0%

Q: Consider a bond that has a price of $1000.00, a coupon rate of 6.4%, a yield to maturity of 6.4%, a…

A: YTM is also known as Yield to maturity. It is a capital budgeting technique which helps in decision…

Q: a pension fund is making an investment of $100,000 today and expects to receive $1,600 at the end of…

A: The internal rate of return is a financial metric use to assess the profitabilityof an investment…

Q: A 10-year, 12% semiannual coupon bond with a par value of $1,000 may be called in 4 years at a call…

A: Par value = $1,000Number of years = 10 yearsBond's price = $1,100Coupon rate = 12%Number of…

Q: 3. The following is known about a company and a financial market: company: Be = 1.2, ra= 0.0,6, D/E…

A: Part (a): To calculate the Cost of Equity (re), we use the Capital Asset Pricing Model (CAPM). Given…

Q: How do you research debt credit ratings for the town you live in? How to find the impacts the…

A: Understanding how to research debt credit ratings for your town involves exploring the financial…

Q: steel Pier Company has issued bonds that pay semiannually Coupon Yield to Maturity Maturity McCaulay…

A: Duration of bond shows the weighted period of bond required to receive all cash flow from the bond…

Q: You are considering buying a car (sticker price of $43,000) but need financing. The car dealership…

A: The amortization is the systematic repayment of loan and the payment includes both interest and…

Q: Ying Import has several bond issues outstanding, each making semiannual Interest payments. The bonds…

A: Yield to maturity is the rate of return that the bondholders will get if they invest and bond and…

Q: If the two-year bond purchased one year from now pays 11 percent annually, Jacques will choose Which…

A: The question is based on the concept of interest rate term structure by use of pure expectation…

Q: Bethesda Mining Company reports the following balance sheet information for 2021 and 2022. Prepare…

A: A common sized balance sheet is that balance sheet in which each line item of the balance sheet is…

Q: Mr. John Backster, a retired executive, desires to invest a portion of his assets in rental…

A: Variables in the question: Windy AcresProbabilityYearly Aftertax Cash Inflow…

Q: Eight months ago, the Zeus Fund entered into a short position in a one - year forward contract on…

A: A forward contract is a financial arrangement between two parties to buy or sell an asset at an…

Q: Assume that the yield curve is YT = 0.04 + 0.001 T. (a) What is the price of a par - $1,000 zero -…

A: The objective of the question is to calculate the price of a zero-coupon bond given the yield curve…

Q: Paula Boothe, president of the Culver Corporation, has mandated a minimum 7% return on investment…

A: Residual income refers to the returns over and above the minimum required return from the…

Q: The Rumpel Felt Company purchased a felt press last year at a cost of $15,000. The division manager…

A: The issue pertains to the financial assessment of investment and capital budgeting choices. It…

Q: In many countries lottery prizes are not taxed. Is this consistent with Hicks’s definition of…

A: Taxes can be referred to as a fixed amount of money that individuals have to pay to the government.

Q: On January 1st, Kevin bought a house for $950, 000. He paid $250,000 in cash at the time of the…

A: Given:House purchase price: $950,000Cash payment at the time of purchase: $250,000Interest rate:…

Q: In 2021, the BowWow Company purchased 19,910 units from its supplier at a cost of $13.00 per unit.…

A: Cost of goods sold (COGS) refers to the total direct costs incurred by a company to produce goods or…

Q: Current Attempt in Progress Your answer is incorrect. Ben deposits $3,000 now into an account that…

A: Time Value of Money is a concept that develops a relationship between the present and future value…

Q: Jennifer deposits $1000 into a bank account. The bank credits interest at a nominal annual rate of i…

A: First we need to calculate interest rate bu using future value formula below.FV = PV*(1 + i)n FV =…

Q: What is the present value of $1,300 due in 14 years at a 7 percent interest rate and 12 percent…

A: Presnet value refers to the current value of an investment that will be present at some future date…

Q: You will discuss credit from the lenders point of view. What factors do lenders consider when making…

A: A credit score is a numerical representation of a person's creditworthiness and indicates how well…

Q: uppose you are the human resource manager for a cellular phone company with 700 employees. Top…

A: Life insurance cost=$390 per quarter and company contribution=40%Legal cost=$312 per semi annual…

Q: ur company has 60 bonds outstanding with an 8% annual coupon. The bonds have two years to maturity…

A: Duration of bond shows the weighted period required to receive cash flow from bond and shows how…

Q: The Hub Store at a university in eastern Canada is considering purchasing a self-serve checkout…

A: Net present value refers to the method of capital budgeting used for estimating the viability of the…

Q: 63. In a statement of cash flows, a company investing in short-term financial investments and in…

A: The Statement of cash flow has 3 sections:(1)Cash flow from Operating Activities(2) Cash flow from…

Q: duction to Finance (1) K Question 4 of 34 > a. The price she would be willing to pay for the bond is…

A: The objective of the question is to determine the price an investor should be willing to pay for a…

Q: You Answered orrect Answer A one-year floating-rate note pays 6-month Libor plus 119 bps. The…

A: The information given is as follows:Time to maturity= 1 year6-Month Libor= 1.78%Quoted margin= 119…

Q: Alan inherited $101,000 with the stipulation that he "invest it to financially benefit his family."…

A: Investment=$50500Future value after 5 years=$67500Future value after 18 years=$165000Capital gain…

Q: TIME FOR A LUMP SUM TO DOUBLE How long will it take $200 to double if it earns the following rates?…

A: We need to use NPER function in Excel to calculate taken to double the investment. =NPER(RATE,…

Q: Jon, age 48, earns $65,000 per year from his employer. Jon saves $15,000 per year for retirement and…

A:

Q: A stock portfolio has the following returns under the market conditions listed below. Market…

A: Expected value is the most likely value that is going to be happen based on the different probable…

Q: Income Statement Bullseye, Incorporated's 2021 income statement lists the following income and…

A: Earnings per share (EPS) is a measure of a company's profitability and is calculated by dividing net…

Q: uppose the continuous forward rate is r(t) = 0.04 + 0.001t when a 8 year zero coupon bond is…

A: Zero coupon bonds are bonds that are not paid any coupon payments and par value of bond is paid on…

Q: An insurance company found that 2.5% of male drivers between the ages of 18 and 25 are involved in…

A: An insurance policy is an contractual agreement between the policyholder and insurance company,…

Q: Top Corporation has ending inventory of $468,200, and cost of goods sold for the just ended was…

A: Cost of goods sold=$3815830Average inventory=$468200Calculate inventory turnover ratio.

Q: You are considering an investment in Fields and Struthers, Inc., and want to evaluate the firm's…

A: To increase production capacity, boost operational effectiveness, or advance technology, businesses…

Q: A project has an initial cost of $55,000, expected net cash inflows of $15,000 per year for 8 years,…

A: > Given data:> Intial investment = -55000> Cash flow per annum = 15000> Number of years…

Q: Before boarding his flight to Zurich, Switzerland, Ian purchased CHF900 from his bank when the…

A: Variables in the question:When buying CHF, exchange rate was C$1=CHF0.9753When selling CHF,exchange…

Q: Tyler owns a two-stock portfolio that invests in Blue Llama Mining Company (BLM) and Hungry Whale…

A: The expected rate of return is a calculated estimate of the average gain or loss that an investment…

Q: For the four mutually exclusive projects shown, the one or ones to select using a MARR of 14% per…

A: IRR is also known as Internal Rate of Return.. It is a capital budgeting technique which helps in…

Q: A person has an individual retirement account that they contribute | . $2,150 to annually at the end…

A: Payment = p = $2150Time = t = 35Interest Rate = r = 12%

Q: Your parents will retire in 26 years. They currently have $230,000 saved, and they think they will…

A: Interest rate refers to the charge that is paid by the borrower to the lender on the amount of…

Q: Lights, Camera, and More sells filmmaking equipment. The company offers three purchase options: (1)…

A: The concept of time value of money will be used here. As per the concept of time value of money the…

Q: Suppose you buy car for $67,000 today with an interest rate of 12% over 5 years what is your monthly…

A: Time value of money is a financial concept which is used to calculate the value of money in present…

Q: Assume that a $55 strike call has a 1.5% continuous dividend, r = 0.05 and the stock price is…

A: Vega:when there is sensitivity to change in the volatility of the underlying asset of an option's…

Q: Excel Online Structured Activity: TIE ratio MPI Incorporated has $6 billion in assets, and its tax…

A: TIE ratio stands for Time Interest Earned ratio. It is one of the solvency ratios used by analysts…

Q: You bought a house and need a mortgage for $1,014,597. The interest rate on the mortgage is 2.5% and…

A: Compound = 24Principal Amount = p = $1,014,597Interest Rate = r = 2.5 / 24 %Number of Payment = n =…

Q: You have just taken out a $23,000 car loan with a 7% APR, compounded monthly. The loan is for five…

A: Loan is a type of facility which is usually provided by banking institutions, in which the bank…

Q: Sami buys a used truck for $1,500. After using it for 3 years, he expects to sell it for $800. If i…

A: Here, in this question we are given, Sami's initial investment(P) = $1500usage period(n) = 3…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- Question 7 Gioanni Inc., has GH¢1 million in earnings before interest and taxes. Currently it is all-equity-financed. It may issue GH¢3 million in perpetual debt at 15 percent interest in order to repurchase stock, thereby recapitalizing the corporation. There are no personal taxes. If the corporate tax rate is 40 percent, what is the income available to all security holders if the company remains all-equity-financed? If it is recapitalized? What is the present value of the debt tax-shield benefits? The equity capitalization rate for the company’s common stock is 20 percent while it remains all-equity-financed. What is the value of the firm if it remains all-equity financed? What is the firm’s value if it is recapitalized?Problem CThe financial breakeven point of Soil Inc. is P90,000, while the tax rate applicable to the company is 30%. The company pays 10% interest on the P200,000 outstanding loan. How much is the total preferred dividends distributed?Answer format: "PHP XXX,XXX.XX"K1. The Lazy Corporation has marginal corporate tax rate of 21%. Assume that investors in Lazy pay a 15% tax rate on income from equity and a 21% tax rate on interest income. Lazy wants to issue risk-free perpetual debt to reduce its corporate tax burden by $1 million per year in each subsequent year. Assume the risk-free rate is 7%. What is the value added to the firm by this debt issuance.

- Question 28: MM and Taxes Solar Industries has a debt-equity ratio of 1.25. Its WACC is 7.8 percent, and its cost of debt is 4.7 percent. The corporate tax rate is 21 percent. What is the company’s cost of equity capital? What is the company’s unlevered cost of equity capital? What would the cost of equity be if the debt-equity ratio were 2? What if it were 1? What if it were zero?chapter 9 #4 Assume that a company borrows at a cost of 0.08. Its tax rate is 0.35. What is the minimum after-tax cost of capital for a certain cash flow if 100 percent debt is used? ____________________ 100 percent common stock? ____________________ (assume that the stockholders will accept 0.08)Question 4 Weston Industries has a debt–equity ratio of 1.5. Its WACC is 11 percent, and its cost of debt is 7 percent. The corporate tax rate is 35 percent. What is Weston’s cost of equity capital? What is Weston’s unlevered cost of equity capital? What would the cost of equity be if the debt–equity ratio were 2? What if it were 1.0? What if it were zero? Shadow Corp. has no debt but can borrow at 8 percent. The firm’s WACC is currently 11 percent, and the tax rate is 35 percent. What is Shadow’s cost of equity? If the firm converts to 25 percent debt, what will its cost of equity be? If the firm converts to 50 percent debt, what will its cost of equity be? What is Shadow’s WACC in part (b)? In part (c)?

- A2 cede and cos expect its ebit = 11000 every year forever. the company can borrow at 8% the company has no debt and its cost of equity is 12% and tax rate 22% The company borrows 165000. what is the cost of equity and waccCh. 13. For questions 7, 8, and 9, use the following information: Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. What is the aftertax cost of debt? Format as a percentage and round to two places past the decimal point as "X.XX"D4) Finance The Grant Corporation is considering permanently adding $500 million of debt to its capital structure. Grant's corporate tax rate is 35% and investors pay a tax rate of 40% on their interest income and 20% on their income from capital gains and dividends. Using Miller’s (1977) model calculate the present value of the interest tax shield provided by this new debt. Please round your answer to the nearest 0.01. 33.33 million 50.00 million 66.67 million 80 million None of the above

- 15. Paws Inc is a new company that is financed with 60% debt and 40% equity. Paws pays 6%interest on its debt and its equity investors expect a 15% return. Assuming no taxes, based on the above what is Paws WACC? a. 8.8%b. 9.2%c. 9.6%d. 10.0%Q.An unlevered company that has a current value of $1,600,000 is considering borrowing $700,000 and using the borrowed funds to repurchase shares. The company can borrow at 5% and has a cost of equity of 13%. EBIT is expected to remain the same every year forever. Assume all available earnings are immediately distributed to common shareholders and all the M&M assumptions are satisfied. What is the company's EBIT according to M&M Proposition I without taxes?Please do your own work, don't copy from the internet Q5) Calculate the aftertax cost of debt under each of the following conditions: Yield Corporate Tax Rate a. 8.0% 18% b. 12.0% 34% c. 10.6% 15% Solution: Kd = Yield (1 – T) Yield (1 – T) Yield (1 – T) 8.0% (1 – .18) 12.0% (1 – .34)