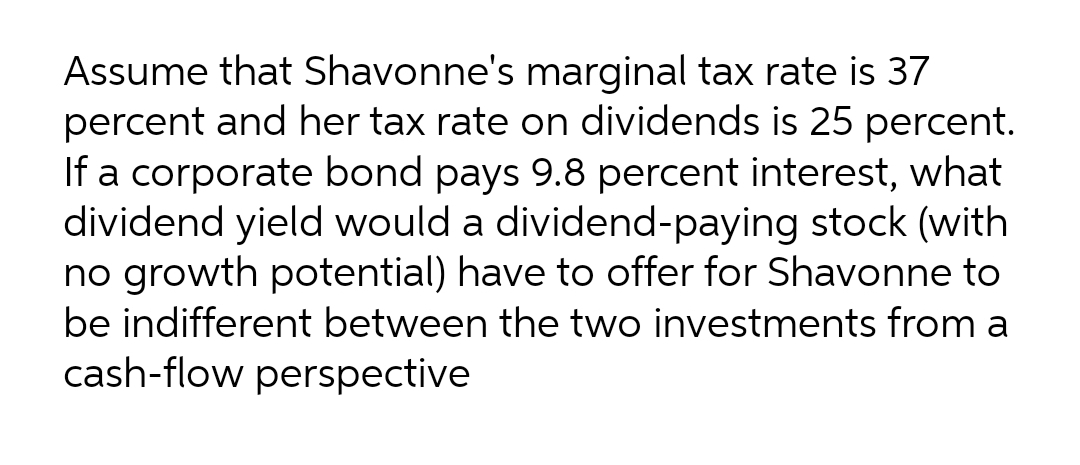

Assume that Shavonne's marginal tax rate is 37 percent and her tax rate on dividends is 25 perce If a corporate bond pays 9.8 percent interest, wh dividend yield would a dividend-paying stock (w no growth potential) have to offer for Shavonne

Q: Pangbourne Whitchurch has preferred stock outstanding. The stock pays a dividend of $9 per share,…

A:

Q: Mantle Corporation is considering two equally risky investments: ∙ A $5,000 investment in…

A: 1)

Q: Assume that Keisha's marginal tax rate is 37 percent and her tax rate on dividends is 25 percent. If…

A: Dividend yield × ( 1 - Tax rate ). = Interest

Q: Pangbourne Whitchurch has preferred stock outstanding. The stock pays a dividend of $14 per share,…

A: Given, Dividend = $14 tax rate = 21%

Q: Assume you bought a 100 shares of stock for $20 per share ten years ago and you still hold it today;…

A: Shares are issued by corporate entities to raise funds to finance certain business requirements.…

Q: Last year, Luka Dončić paid $40.71 for shares of BioSteel. Afterward, he received a dividend of…

A: Dividend yield is dividend per share divided by market price at time of purchase.

Q: You purchased CSH stock for $42 and it is now selling for $53. The company has announced that it…

A: Stock represents an investment in the capital of a company. Capital gain in stocks is generated due…

Q: Marie owns shares of Deltona Productions preferred stock which she says provides her with a constant…

A: Calculate the preference dividend as follows: Cost of preference share = Dividend / Current price

Q: Albert Einstein purchased a stock last year and sold it today for $4 a share more than his purchase…

A: Total return = Dividend yield + Capital gain yield ---------------------- Formula for capital gain…

Q: If a taxpayer's marginal tax rate is 33 percent, what is the after-tax yield on a corporate bond…

A: Marginal tax rate = 33% Before tax interest on corporate bond = 5%

Q: Mr. Johnson owns $300 shares of NYCO’s preferred stock which currently sells for $30.00 per share…

A: Given: Number of shares holding = $300 Current price = $30 Dividend per share = $2

Q: Assuming an after-tax cost of preferred stock of 10% and a corporate tax rate of 34%, a firm must…

A: The cost of preferred stock is the return that preferred stockholders demand in return for providing…

Q: You buy stock for $30 per share and sell it for $33 per share after holding it for slightly after a…

A: Since the stock is held for more than a year, both income and capital gains will be taxed…

Q: Last year, Damian Lillard paid $39.25 for shares of Gatorade. Afterwards, he received a dividend of…

A: In the given question we require to calculate the capital gains yield from following details:…

Q: You buy a stock for $46 per share and sell it for $58 after holding it for slightly over a year and…

A: The question is related to holding period return. The holding period return is calculated with the…

Q: The expected pretax return on three stocks is divided between dividends and capital gains in the…

A: Intrinsic Stock Price is determined by computing present value(PV) of all future benefits that will…

Q: buy a stock for $41 per share and sell it for $59 after holding it for slightly over a vear and…

A: Purchase price (P) = $41 Selling price (S) = $59 Dividend (D) = $4.7 Dividend income tax = 25%…

Q: One year ago you purchased 100 shares of Dog Bites common stock for $25. You received dividends of…

A: a-1) Computation:

Q: ly purchased a stock for €43 per share. The stock is now selling for €54 per share and the firm…

A: A stock (also known as equity) is a financial instrument that reflects ownership of a portion of a…

Q: You buy stock for $34 per share and sell it for $36 after you collect a $1 per share dividend, your…

A: Price of Stock = $34Selling Price of Stock = $36 Calculation of Pre-tax Capital gain is as follows:

Q: An investor has a 38 percent ordinary income tax rate and a 20 percent long-term capital gains tax…

A: Dividend after tax must be equal to increase in price after capital gains tax.

Q: Suppose that TipsNToes, Inc.'s capital structure features 75 percent common equity, 25 percent debt,…

A: Equity ratio = 75% Debt ratio = 25% Cost of equity = 12% Before tax cost of debt = 10% Tax rate =…

Q: A corporation buys a share of preferred stock at $40 and sells it at year-end at $40, andreceives a…

A: 70% of dividends excluded for tax calculation purpose

Q: A company’s preferred stock has a pre-tax dividend yield of 7%,and its debt has a pre-tax yield of…

A: The cost that a company is willing to pay to raise the fund for the business operations of the…

Q: The expected pretax return on three stocks Is divided between dividends and capital galns in the…

A: A dividend is a distribution of profits by a corporation to its shareholders. When a corporation…

Q: Suppose the capital-gain tax rate is 22%, and the dividend tax rate is 35%. The share price of Kitty…

A: The dividends are to paid by the net income of the company and but there are taxes to be paid on the…

Q: Suppose that TipsNToes, Inc.'s capital structure features 55 percent common equity, 45 percent debt…

A: Weight of common equity = 0.55 Weight of debt = 0.45 Cost of equity = 0.14 Before tax cost of debt =…

Q: Becky Martinez owns stock in GBX Corporation. The GBX stock has a current market value of $70 a…

A: The following information has been provided in the question: Current market value of GBX stock =$70…

Q: Required: Find the after-tax return to a corporation that buys a share of preferred stock at $57,…

A: Return is calculated by adding the sale value and any dividend received and reduced by the purchase…

Q: You buy a stock for $47 per share and sell it for $58 after holding it for slightly over a year and…

A:

Q: Amy bought 100 shares of ABC Co. stock for RM58.00 per share on 60% margin. Assume she holds the…

A: Bought 100 shares at RM 58. Therefore, Margin is 60%. Therefore, Stock price went down by 10%.

Q: XYZ anticipates earning $1,000,000 and paying $200,000 in dividends this year. XYZ's capital…

A: Equity breakpoint is the financial term used to determine the breaking point after which the firm…

Q: The expected pretax return on three stocks is divided between dividends and capital gains in the…

A: a) Working note: Computation: Hence, the net percentage return of stock A, B, and C are 6.06%.

Q: Pangbourne Whitchurch has preferred stock outstanding. The stock pays a dividend of $7 per share,…

A: Those stocks which are prioritized over common stocks at the time of payment of dividends but did…

Q: Boulangerie de Patisserie stock is currently trading for €48 per share and is planning to pay a €4…

A: Ex dividend is value of stock excluding dividend

Q: Find the after-tax return to a corporation that buys a share of preferred stock at $40, sells it at…

A: The question is based on the concept of calculation of after tax return in case of preference share…

Q: You buy a stock for $47 per share and sell it for $50 after holding it for slightly over a year and…

A: Holding period return is the rate of return on the asset over a period of time.

Q: Ahmad Bought A Share Ten Months Ago For $25 A Share, Got A $3.5 Dividend Per Share Last Month, And…

A: Here, Price of Share Ten months Ago is $25 Dividend per share received last month is $3.5 Price of…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Assume that Keisha's marginal tax rate is 37 percent and her tax rate on dividends is 25 percent. If a city of Atlanta bond pays 7.5 percent interest, what dividend yield would a dividend-paying stock (with no growth potential) have to offer for Keisha to be indifferent between the two investments from a cash-flow perspective?(a). An investor who is in the 28 % tax bracket is considering choosing between an investment earning a 6 % taxable return and an investment earning a 4 % tax-free yield. Advise the investor which investment he should choose and give reasons. (b) If you buy 100 common shares of ZANACO Plc, to what are you entitled? (c) What is the most money you could make over the next year? (d) If you pay K95 per share, what is the most money you could lose over the year? (e) Stock Initial Price Final Price Shares (millions) ABC K25 K30 20 XYZ K100 K90 1 (1) Determine the portfolio initial…( a ). An investor who is in the 28 % tax bracket is considering choosing between an investment earning a 6 % taxable return and an investment earning a 4 % tax-free yield. Advise the investor which investment he should choose and give reasons. (b). If you buy 100 common shares of ZANACO Plc, to what are you entitled? What is the most money you could make over the next year? If you pay K95 per share, what is the most money you could lose over the year?

- Suppose that JB Cos. has a capital structure of 78 percent equity, 22 percent debt, and that its before-tax cost of debt is 12 percent while its cost of equity is 16 percent. Assume the appropriate weighted-average tax rate is 21 percent and JB estimates that they can make full use of the interest tax shield.What will be JB’s WACC? (Round your answer to 2 decimal places.) WACC: ___.__%The Shrieves Corporation has $10,000 that it plans to invest in marketablesecurities. It is choosing among AT&T bonds, which yield 7.5%, state of Florida muni bonds, which yield 5% (but are not taxable), and AT&T preferredstock, with a dividend yield of 6%. The corporate tax rate is 35%, and 70% ofthe dividends received are tax exempt. Find the after-tax rates of return on allthree securities.A corporate investor of preferred stock receiving a before-tax preferred yield of 8.5%, and having a corporate tax rate of 21%, would receive an after-tax preferred yield of approximately _____. Assume the tax rate on dividends is 15%.

- Suppose that TipsNToes, Inc.'s capital structure features 55 percent common equity, 45 percent debt and its cost of equity is 14 percent, while its before-tax cost of debt is 10 percent. It has no preferred stock. If the appropriate tax rate is 20%, what will be TipsNToes's after-tax WACC?The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock Expected Dividend Expected Capital Gain A $0 $10 B 5 5 C 10 0 A. If each stock is priced at $160, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains? Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) B. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return of 8%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. (Do not round intermediate calculations. Round your answers to 2 decimal places.)buy a stock for $41 per share and sell it for $59 after holding it for slightly over a vear and collecting a $4.7 per share dividend, If dividend income is taxed at a 25% rate and capital gains are taxed at 29%, what is your after-tax holding period return? (Write your answer in percentage and round it to 2 decimal places)

- Suppose that JB Cos. has a capital structure of 80 percent equity, 20 percent debt, and that its before-tax cost of debt is 12 percent while its cost of equity is 16 percent. Assume the appropriate weighted-average tax rate is 21 percent and JB estimates that they can make full use of the interest tax shield. What will be JB’s WACC? (Round your answer to 2 decimal places.)You buy a stock for $47 per share and sell it for $58 after holding it for slightly over a year and collecting a $5.9 per share dividend. If dividend income is taxed at a 28% rate and capital gains are taxed at 24%, what is your after-tax holding period return?Arvo Corporation is trying to choose between three alternative investments. The three securities that the company is considering are as follows: Tax-free municipal bonds with a return of 9.30% Wooli Corporation bonds with a return of 12.90% CFI Corp. preferred stock with a return of 10.70%. The company's tax rate is 25.00%. What is the after - tax return on the best investment alternative? Assume a 50.00% dividend exclusion for taxes on dividends. (Round your final answer to 3 decimal places.) a. 9.363% b. 8.025% c. 11.288% d9.675% e. 9.300%