Assume that Western Exploration Corp. is considering the acquisition of Ogden Drilling Company. The latter has a $500,000 tax loss carryforward. Projected earnings for the Western Exploration Corp. are as follows: Before-tax income Taxes (40%) Income available to stockholders Reduction in taxes 2011 $210,000 84,000 $126,000 a. How much will the total taxes of Western Exploration Corp. be reduced as a result of the tax loss carryforward? (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Income available to stockholders 2012 2013 $420,000 $250,000 100,000 165,000 $150,000 $252,000 b. How much will the total income available to stockholders be for the three years if the acquisition occurs? (Do not round intermediate calculations and round your answers to the nearest whole dollar) 2011 Total Values $880,000 352,000 $520,000 2012 2013 Total

Assume that Western Exploration Corp. is considering the acquisition of Ogden Drilling Company. The latter has a $500,000 tax loss carryforward. Projected earnings for the Western Exploration Corp. are as follows: Before-tax income Taxes (40%) Income available to stockholders Reduction in taxes 2011 $210,000 84,000 $126,000 a. How much will the total taxes of Western Exploration Corp. be reduced as a result of the tax loss carryforward? (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Income available to stockholders 2012 2013 $420,000 $250,000 100,000 165,000 $150,000 $252,000 b. How much will the total income available to stockholders be for the three years if the acquisition occurs? (Do not round intermediate calculations and round your answers to the nearest whole dollar) 2011 Total Values $880,000 352,000 $520,000 2012 2013 Total

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter6: Accounting For Financial Management

Section: Chapter Questions

Problem 8P

Related questions

Question

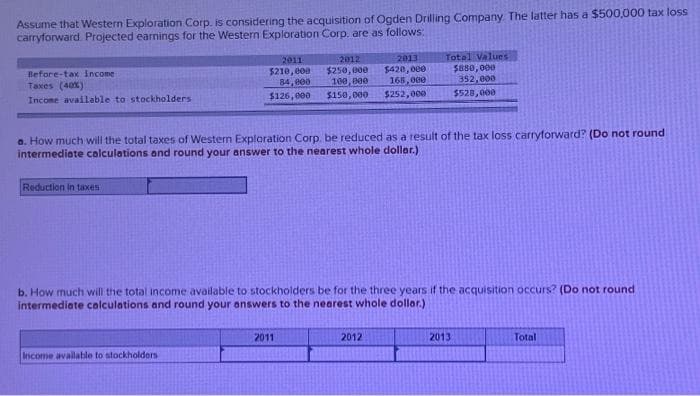

Transcribed Image Text:Assume that Western Exploration Corp. is considering the acquisition of Ogden Drilling Company. The latter has a $500,000 tax loss

carryforward. Projected earnings for the Western Exploration Corp. are as follows:

Before-tax income

Taxes (40%)

Income available to stockholders.

Reduction in taxes

2011

$210,000

84,000

$126,000

a. How much will the total taxes of Western Exploration Corp. be reduced as a result of the tax loss carryforward? (Do not round

intermediate calculations and round your answer to the nearest whole dollar.)

Income available to stockholders

2012

$250,000

2013

$420,000

165,000

100,000

$150,000 $252,000

b. How much will the total income available to stockholders be for the three years if the acquisition occurs? (Do not round

intermediate calculations and round your answers to the nearest whole dollar.)

2011

Total Values

$880,000

352,000

$528,000

2012

2013

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT