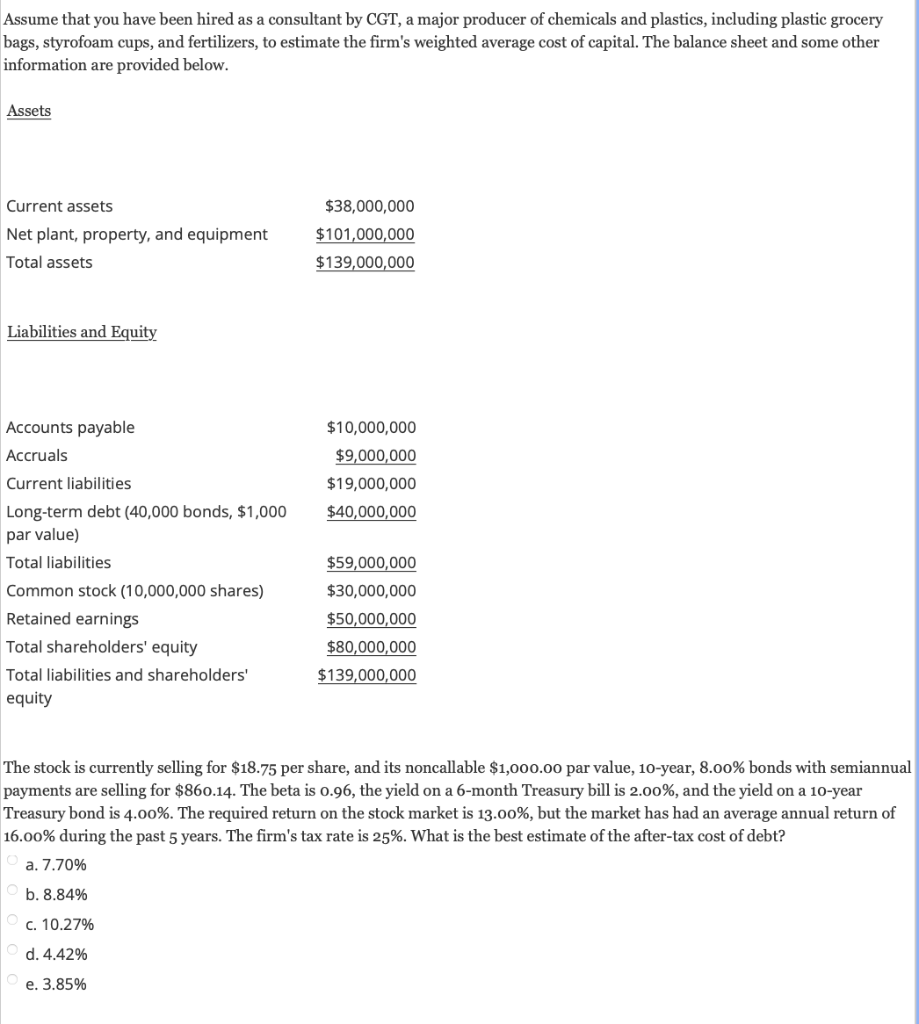

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below. Assets Current assets Net plant, property, and equipment Total assets Liabilities and Equity Accounts payable Accruals Current liabilities Long-term debt (40,000 bonds, $1,000 par value) Total liabilities Common stock (10,000,000 shares) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $38,000,000 $101,000,000 $139,000,000 $10,000,000 $9,000,000 $19,000,000 $40,000,000 $59,000,000 $30,000,000 $50,000,000 $80,000,000 $139,000,000 The stock is currently selling for $18.75 per share, and its noncallable $1,000.00 par value, 10-year, 8.00% bonds with semiannu payments are selling for $860.14. The beta is 0.96, the yield on a 6-month Treasury bill is 2.00%, and the yield on a 10-year Treasury bond is 4.00%. The required return on the stock market is 13.00%, but the market has had an average annual return of 16.00% during the past 5 years. The firm's tax rate is 25%. What is the best estimate of the after-tax cost of debt? a. 7.70% b. 8.84%

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below. Assets Current assets Net plant, property, and equipment Total assets Liabilities and Equity Accounts payable Accruals Current liabilities Long-term debt (40,000 bonds, $1,000 par value) Total liabilities Common stock (10,000,000 shares) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $38,000,000 $101,000,000 $139,000,000 $10,000,000 $9,000,000 $19,000,000 $40,000,000 $59,000,000 $30,000,000 $50,000,000 $80,000,000 $139,000,000 The stock is currently selling for $18.75 per share, and its noncallable $1,000.00 par value, 10-year, 8.00% bonds with semiannu payments are selling for $860.14. The beta is 0.96, the yield on a 6-month Treasury bill is 2.00%, and the yield on a 10-year Treasury bond is 4.00%. The required return on the stock market is 13.00%, but the market has had an average annual return of 16.00% during the past 5 years. The firm's tax rate is 25%. What is the best estimate of the after-tax cost of debt? a. 7.70% b. 8.84%

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 10P

Related questions

Question

H4.

Transcribed Image Text:Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery

bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other

information are provided below.

Assets

Current assets

Net plant, property, and equipment

Total assets

Liabilities and Equity

Accounts payable

Accruals

Current liabilities

Long-term debt (40,000 bonds, $1,000

par value)

Total liabilities

Common stock (10,000,000 shares)

Retained earnings

Total shareholders' equity

Total liabilities and shareholders'

equity

$38,000,000

$101,000,000

$139,000,000

$10,000,000

$9,000,000

$19,000,000

$40,000,000

$59,000,000

$30,000,000

$50,000,000

$80,000,000

$139,000,000

The stock is currently selling for $18.75 per share, and its noncallable $1,000.00 par value, 10-year, 8.00% bonds with semiannual

payments are selling for $860.14. The beta is 0.96, the yield on a 6-month Treasury bill is 2.00%, and the yield on a 10-year

Treasury bond is 4.00%. The required return on the stock market is 13.00%, but the market has had an average annual return of

16.00% during the past 5 years. The firm's tax rate is 25%. What is the best estimate of the after-tax cost of debt?

a. 7.70%

b. 8.84%

c. 10.27%

d. 4.42%

e. 3.85%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College