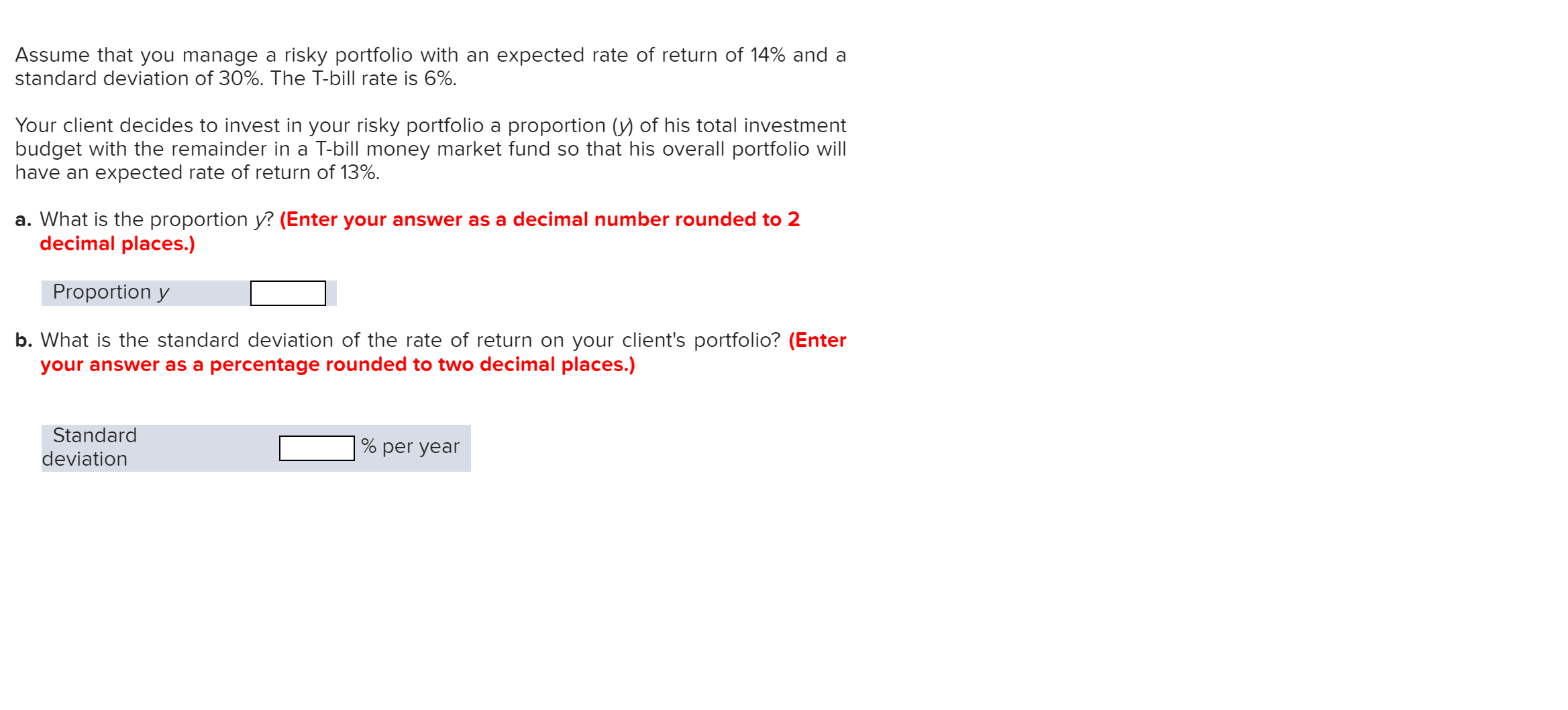

Assume that you manage a risky portfolio with an expected rate of return of 14% and a standard deviation of 30%. The T-bill rate is 6%. Your client decides to invest in your risky portfolio a proportion (y) of his total investment budget with the remainder in a T-bill money market fund so that his overall portfolio will have an expected rate of return of 13% a. What is the proportion y? (Enter your answer as a decimal number rounded to 2 decimal places.) Proportion y b. What is the standard deviation of the rate of return on your client's portfolio? (Enter your answer as a percentage rounded to two decimal places.) Standard % per year deviation

Assume that you manage a risky portfolio with an expected rate of return of 14% and a standard deviation of 30%. The T-bill rate is 6%. Your client decides to invest in your risky portfolio a proportion (y) of his total investment budget with the remainder in a T-bill money market fund so that his overall portfolio will have an expected rate of return of 13% a. What is the proportion y? (Enter your answer as a decimal number rounded to 2 decimal places.) Proportion y b. What is the standard deviation of the rate of return on your client's portfolio? (Enter your answer as a percentage rounded to two decimal places.) Standard % per year deviation

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 9PROB

Related questions

Question

Transcribed Image Text:Assume that you manage a risky portfolio with an expected rate of return of 14% and a

standard deviation of 30%. The T-bill rate is 6%.

Your client decides to invest in your risky portfolio a proportion (y) of his total investment

budget with the remainder in a T-bill money market fund so that his overall portfolio will

have an expected rate of return of 13%

a. What is the proportion y? (Enter your answer as a decimal number rounded to 2

decimal places.)

Proportion y

b. What is the standard deviation of the rate of return on your client's portfolio? (Enter

your answer as a percentage rounded to two decimal places.)

Standard

% per year

deviation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning