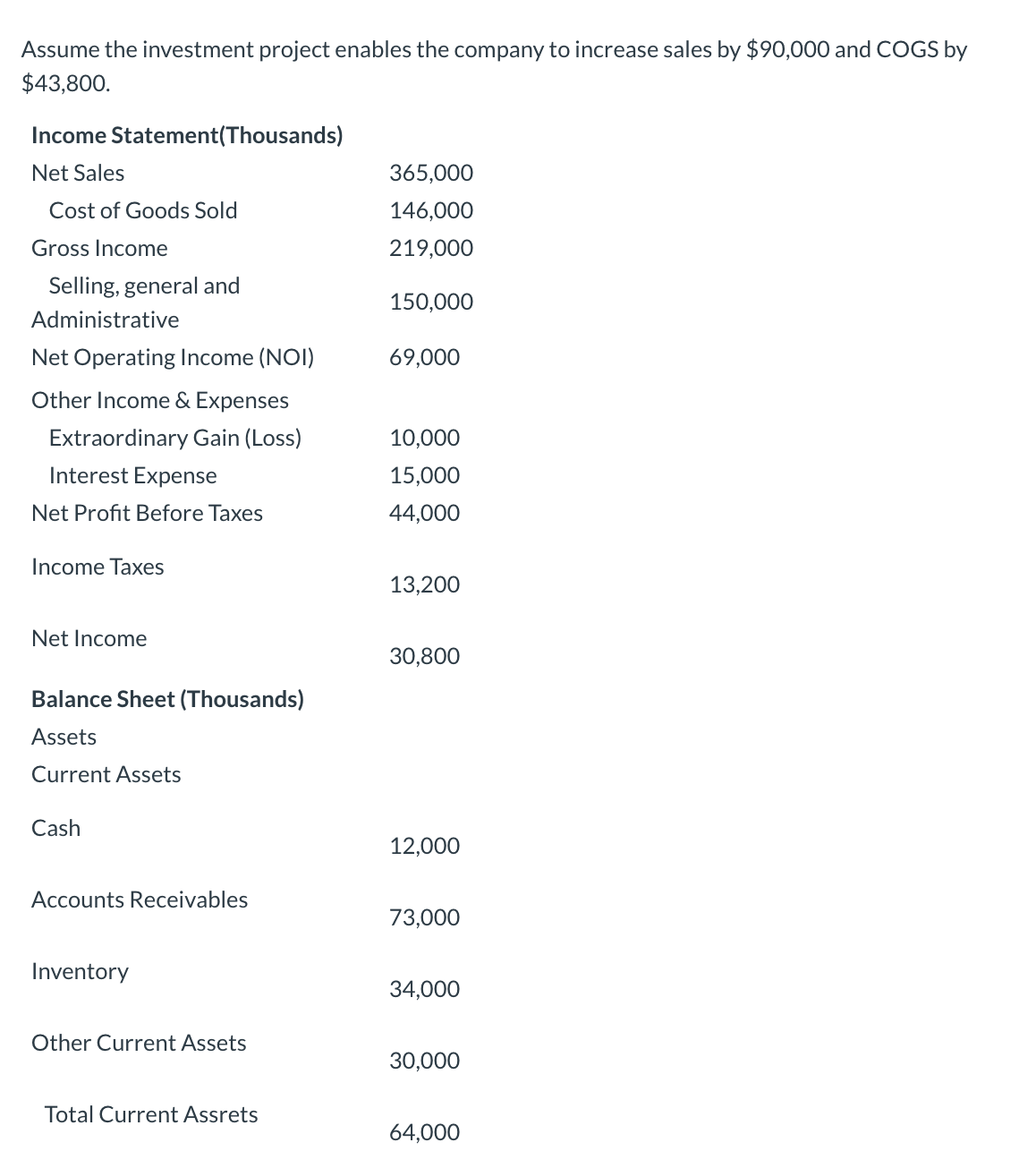

Assume the investment project enables the company to increase sales by $90,000 and COGS by $43,800. Income Statement(Thousands) Net Sales 365,000 Cost of Goods Sold 146,000 Gross Income 219,000 Selling, general and 150,000 Administrative Net Operating Income (NOI) 69,000 Other Income & Expenses Extraordinary Gain (Loss) 10,000 Interest Expense 15,000 Net Profit Before Taxes 44,000 Income Taxes 13,200 Net Income 30,800 Balance Sheet (Thousands) Assets Current Assets Cash 12,000 Accounts Receivables 73,000 Inventory 34,000 Other Current Assets 30,000 Total Current Assrets

Assume the investment project enables the company to increase sales by $90,000 and COGS by $43,800. Income Statement(Thousands) Net Sales 365,000 Cost of Goods Sold 146,000 Gross Income 219,000 Selling, general and 150,000 Administrative Net Operating Income (NOI) 69,000 Other Income & Expenses Extraordinary Gain (Loss) 10,000 Interest Expense 15,000 Net Profit Before Taxes 44,000 Income Taxes 13,200 Net Income 30,800 Balance Sheet (Thousands) Assets Current Assets Cash 12,000 Accounts Receivables 73,000 Inventory 34,000 Other Current Assets 30,000 Total Current Assrets

Chapter12: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 2STP

Related questions

Question

Transcribed Image Text:Assume the investment project enables the company to increase sales by $90,000 and COGS by

$43,800.

Income Statement(Thousands)

Net Sales

365,000

Cost of Goods Sold

146,000

Gross Income

219,000

Selling, general and

150,000

Administrative

Net Operating Income (NOI)

69,000

Other Income & Expenses

Extraordinary Gain (Loss)

10,000

Interest Expense

15,000

Net Profit Before Taxes

44,000

Income Taxes

13,200

Net Income

30,800

Balance Sheet (Thousands)

Assets

Current Assets

Cash

12,000

Accounts Receivables

73,000

Inventory

34,000

Other Current Assets

30,000

Total Current Assrets

64,000

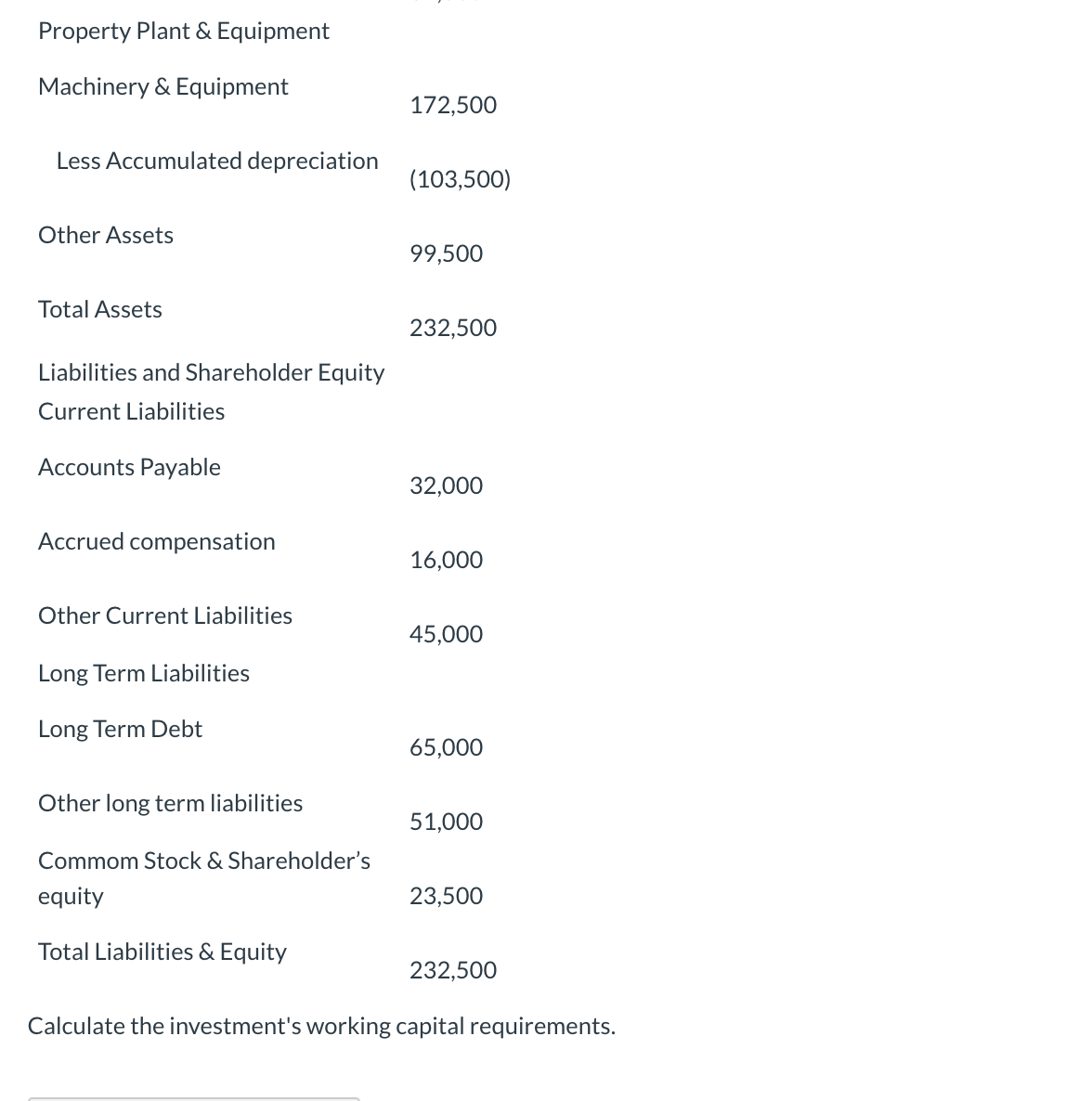

Transcribed Image Text:Property Plant & Equipment

Machinery & Equipment

172,500

Less Accumulated depreciation

(103,500)

Other Assets

99,500

Total Assets

232,500

Liabilities and Shareholder Equity

Current Liabilities

Accounts Payable

32,000

Accrued compensation

16,000

Other Current Liabilities

45,000

Long Term Liabilities

Long Term Debt

65,000

Other long term liabilities

51,000

Commom Stock & Shareholder's

equity

23,500

Total Liabilities & Equity

232,500

Calculate the investment's working capital requirements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT