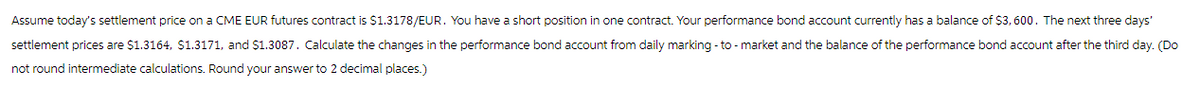

Assume today's settlement price on a CME EUR futures contract is $1.3178/EUR. You have a short position in one contract. Your performance bond account currently has a balance of $3,600. The next three days' settlement prices are $1.3164. $1.3171, and $1.3087. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. (D not round intermediate calculations. Round your answer to 2 decimal places.)

Q: Compute working capital and the current ratio. (Er

A: The working capital measures the short-term financial efficiency of a business.It means the…

Q: On the issue date, you bought a 15 year maturity, 6.55% semi - annual coupon bond. The bond then…

A: A bond refers to an instrument the issuing organization uses to raise debt capital from…

Q: Compute the PV of a perpetuity with monthly payments of $1,000, given an annual discount rate of 4%…

A: Present value refers to the current worth of a future sum of money or cash flow. It accounts for the…

Q: In a particular bond market, the two- year par yield at time t = 0 is 4.15% and the issue price at…

A: 2-Year par yield = 4.15%Coupon rate = 8%Fixed income stock price = 8%Price = $105.40Redemption value…

Q: Aaron Heath is seeking part-time employment while he attends school. He is considering purchasing…

A: Net Present Value is used to evaluate the investment and financing decisions that involve cash flows…

Q: erest rate tree for the next 2 years: Time 0 (%) Time 1 (

A: Given that the bond pays a coupon rate of 4.3% annually and matures in 2 years, let's denote:C =…

Q: out tion Johnny wants to save some money for his daughter Alexis's education. Tuition costs $12,500…

A: The objective of the question is to find out how much Johnny needs to save each year for his…

Q: On the issue date, you bought a 15 year maturity, 6.55% semi - annual coupon bond. The bond then…

A: The objective of the question is to calculate the realized rate of return for a 7-year holding…

Q: Assume that Social Security promises you $43,000 per year starting when you retire 45 years from…

A: Present value is the current worth of a future sum of money, discounted back to the present. It…

Q: An investment has the following expected cash flows: Year 2 3 Cash Flows $10,033 $20,003 30,000 The…

A: Variables in the question: Year Cash Flow ($)110033220003330000Discount…

Q: help with this requirement Scenarios\\n $8,550 per year at the end of each of the next six…

A: The money and resources that a person or family receives during their retirement years are referred…

Q: Bhupatbhai

A: The objective of this question is to find out the time period in which the loan was settled. This…

Q: Which of the following do/does NOT describe how shareholders accrue investment returns (Select all…

A: The objective of the question is to identify the options that do not represent ways in which…

Q: Thompson Trucking has $9 billion in assets, and its tax rate25%. Its basic earning power (BEP)…

A: TIF is the ratio of EBIT to the interest. It show the ability of company to pay debt and interest on…

Q: A 9.0% semiannual coupon bond matures in 15 years. The bond has a face value of $1,000 and a current…

A: ParticularAmountCoupon Rate0.09No. of years (NPER)=15*2Face Value (FV)1000Semi-annual Rate…

Q: Show your work. Your firm, New Sunrise, has just leased a $75,000 BMW for you. The lease requires…

A: ParticularAmountLeased (PV) $75,000.00Monthly Rate (RATE)=5%/120.00416667No. of years (NPER)=5*12=60

Q: Determine the annualised return, including all its components, from the following bond transaction:…

A: The objective of this question is to calculate the annualised return from a bond transaction. The…

Q: The price of a stock is $55 at the beginning of the year and $50 at the end of the year. If the…

A: The real holding period return of a stock is the total return on the stock during its holding…

Q: Suppose you are a euro-based investor who just sold Microsoft shares that you had bought six months…

A: First we need to determine the number of shares bought using the formula below:Now we can determine…

Q: What is the Sharpe ratio of the best feasible CAL? Sharpe ratio

A: The Sharpe ratio calculates performance adjusted for risk by dividing the extra profit earned on a…

Q: Suppose a certain car audio manufacturer receives an order of a certain brand of satellite radios…

A: Trade discount is the discount provided on the retail price of goods and services. This is done to…

Q: a minus sign. Do not round intermediate calculations and round your

A: To calculate the External Financing Needed (EFN) for different growth rates, we can use the…

Q: CX Enterprises has the following expected dividends: $1.15 in one year, $1.25 in two years, and…

A: Stock refers to ownership shares in a business.A company's ownership is split up into shares, each…

Q: 19 00:48:34 You take out $10,000 loan for seven years at an annual interest rate of 5% and with…

A: Fixed annual payment refers to a yearly instalment against the loan amount. This payment includes…

Q: A loan of $10,000 is taken out on November 7, 2020 at a simple interest rate of r = 9%. The loan…

A: As per the Banker's Rule, interest is calculated as per the exact time (in days), taking 360 days…

Q: The Clark family began savings for their child's college 18 years ago. Each year they contributed…

A: Future value refers to the total value of an investment or deposit at a specified date in the…

Q: Bond A $1,000 twenty-year 4% coupon bond with the interest rate of 6% A $1,000 ten-year 7% coupon…

A: A portfolio's duration indicates how vulnerable to changes in interest rates that affect its value.…

Q: Related to Checkpoint 5.4) (Present-value comparison) You are offered $90,000 today or $340,000 in…

A: We have to do present value comparisons here. For that we will use and apply the time value of money…

Q: son.2

A: The objective of this question is to find the effective interest rate charged on a loan of $138,160…

Q: Calculate the future value of an investment of $1, 000 at an interest rate of 5% after 5 years. (…

A: Future value refers to the worth of the investment after a defined period of time, it constitutes…

Q: year. The security pays half-yearly coupons of 4% per annum. The security is redeemable at 11 buys…

A: calculate the present value of the coupons and the redemption value, and then we'll use the formula…

Q: BillyBob Corporation deposits $40,000 at the beginning of every quarter in a savings account for the…

A: Compound = Quarterly = 4Payment = p = $40,000Time = t = 5 * 4 = 20Interest Rate = r = 8 / 4 =…

Q: There are three investments being offered to you; one pays you $100,000 at the end of 10 years;…

A: The objective of the question is to determine which investment option is the best based on the…

Q: Compute the PV of a perpetuity with monthly payments of $1,000, given an annual discount rate of 4%…

A: Present worth of perpetuity can be found by using following formula:PV refers to present value here.

Q: Christopher just borrowed $19,500.00 to buy a used minivan. The terms of the loan require him to…

A: Amount borrowed, pv $ 19,500.00Equal monthly payments, pmt $ 340.10Period (years), nper6Extra…

Q: Suppose you took a long position on a put option with an exercise price of $1.95 per pound and paid…

A: A long put option is a type of options contract that gives the holder the right, but not the…

Q: (Annuity interest rate) Your folks just called and would like some advice from you. An insurance…

A: Present Value = pv = $36,828.58Payment = p = $4000Time = t = 20

Q: Problem 9-24 Dividend Growth Four years ago, Bling Diamond, Incorporated, paid a dividend of $1.95…

A: A company pays dividends to its shareholders. The dividends are paid from the profits of the…

Q: Profitability Calculations for Different Entry Options (in $000)

A: Branded Entry for Forta:Year One Forecasted Revenues: $3,200,000Year Two Forecasted Revenues:…

Q: Problem 5-26 Calculating IRR The Utah Mining Corporation is set to open a gold mine near Provo,…

A: IRR is regarded as one of the most important Capital Budgeting Techniques.Internal rate of return…

Q: son.1

A: The objective of the question is to calculate the future value of an investment of $2,000 compounded…

Q: You want to buy a car, and a local bank will lend you $40,000. The loan will be fully amortized over…

A: An amortization schedule is a table or chart that provides a detailed breakdown of each periodic…

Q: An industrial engineering consulting firm signed a lease agreement for simulation software.…

A: Present value refers to the current worth of a future sum of money or cash flow. It accounts for the…

Q: Prepare an amortization schedule for a three-year loan of $84,000. The interest rate is 9 percent…

A: Loans have to be paid in the form of fixed periodic payments. The periodicity can be monthly,…

Q: Suppose a bank enters a repurchase agreement in which it agrees to buy Treasury securities from a…

A: Yield on repo can be found by using the following formula:

Q: A 10% cupon, annual payme bond maturing in 10 years, is expected to make all coupon

A: Price of bond is the present value of coupon payments plus present value of par value of the bond.

Q: Look at the futures listings for corn in Figure 2.11. Suppose you buy one contract for December 2020…

A: December-20 (last price) = $3.9725 per bushelTarget price = $4.05 per bushel Number of contracts =…

Q: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a…

A: Expected ReturnStandard deviationStock Funds16%38%Bond Funds12%21%Risk free rate7%Correlation…

Q: Suppose you borrowed $25, 000 at a rate of 9.0% and must repay it in 4 equal installments at the end…

A: Present Value = pv = $25,000Interest rate = r = 9%Time = t = 4

Q: Problem 5-27 Spreadsheet Problem: Future Value of Multiple Annuities (LG5-2) Assume that you…

A: Future value refers to the value of future cash flow at some future date. It can be determined as…

vvk.7

Step by step

Solved in 3 steps

- Assume today’s settlement price on a CME EUR futures contract is $1.3144 per euro. You have a short position in one contract. EUR125,000 is the contract size of one EUR contract. Your performance bond account currently has a balance of $1,900. The next three days’ settlement prices are $1.3130, $1.3137, and $1.3053. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. Required: Note: Do not round intermediate calculations. Round your answer to 2 decimal places.Assume today’s settlement price on a CME EUR futures contract is $1.3140/EUR. You have a long position in one contract. Your performance bond account currently has a balance of $1,700. The next three days’ settlement prices are $1.3126, $1.3133, and $1.3049. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. (Do not round intermediate calculations. Round your answer to 2 decimal places.)Assume today’s settlement price on a CME EUR futures contract is $1.3158/EUR. You have a long position in one contract. Your performance bond account currently has a balance of $2,600. The next three days’ settlement prices are $1.3144, $1.3151, and $1.3067. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. (Do not round intermediate calculations. Round your answer to 2 decimal places.) What is the change in the performance bond account?

- Assume that on Friday August 1, you sell one Chicago Board of Trade September Treasury bond futures contract at the opening price of $97000. The initial margin requirement is $2500 and the maintenance margin requirement is $2000. The settlement price of the contract at closing on that day is $97500. Your margin account balance at the end of the day is $ . Question 15 options:Yesterday, you entered into a futures contract to buy €62,500 at $1.50 per €. Your initial performance bond is $1,500 and your maintenance level is $500. At what settle price will you get a demand for additional funds to be posted? ANSWER D IS CORRECT BUT WHAT IS THE PROCEDURE BUT HOW DO I GET THERE? a) $1.5160 per €. b)$1.208 per €. c)$1.1920 per €. d)$1.4840 per €. CorrectPlease help and explain. Consider the Mark-to-Market Settlements for 1 gold futures contracts maturing in 5 months. Assume that the risk-free rate available to investors is 6% per annum with quarterly compounding and that no arbitrage relationship between spot and futures prices (Futures-Spot parity) with continuous compounding holds in all months. Also assume that the initial margin is $18,000 per contract, while the maintenance margin is $6000 per contract Month Spot Price End of Month(S) Futures Price, End of Month (F) Change in Futures Price Contract Size (ounces) Buyer/Long Position Seller/Short Position Contract Initiated 0 1307.00 1339.84 -- 100 (c) (c) Initial Margin 1 1309.00 1335.25 (b) 100 (c) (c) Monthly Adjustments 2 (a) 1336.76 (b) 100 (c) (c) 3 1332.00 1345.29 (b) 100 (c) (c) 4 1325.00 (a) (b) 100 (c) (c) Delivery 5…

- On a particular day, the S&P 500 futures settlement price was 899.30. You buy one contract at the settlement price at around the close of the market. The next day the contract opens at 899.70, and the settlement price at the close of the day is 899.10. Determine the value of the futures contract at the opening, an instant before the close, and after the close. Remember that the S&P futures contract has a $250 multiplier.Today's settlement price on a Chicago Mercantile Exchange (CME) Yen futures contract is $0.8011/¥100. Your margin account currently has a balance of $2,000. The next three days' settlement prices are $0.8057/¥100, $0.7996/¥100, and $0.7997/¥100. (The contractual size of one CME Yen contract is ¥12,500,000). If you have a short position in one futures contract, the changes in the margin account from daily marking-to-market will result in the balance of the margin account after the third day to beIf the initial speculative margin of a futures contract is $2,000, the maintenance margin is $1,800 and your trading account balance has increased to $2,300, how much must you deposit to comply with your margin requirement?

- On August 1, the one-month LIBOR rate is 2.0 percent and the two-month LIBOR rate is 2.5 percent. The 30-day fed funds futures is quoted at 96.75. Assuming no basis risk between fed funds and one-month LIBOR at the start of the delivery month, identify whether an arbitrage opportunity is available. The contract size of the fed funds futures is $5,000,000.On Monday morning you sell one June T-bond futures contract at $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700, and the maintenance margin requirement is $2,000 per contract. Use the following price data to determine the balance on your margin account after Monday's close. Day Settle Monday $ 97,406.25 Tuesday $ 98,000.00 Wednesday $ 100,000.00 $2,700 $2,000 $3,137.50 $2,262.50 97406.25You have taken a short position in a futures contract on corn at $2.60 per bushel. Over the next 5 days the contract settled at 2.52, 2.57, 2.62, 2.68, and 2.70. You then decide to reverse your position in the futures market on the fifth day at close. What is the net amount you receive at the end of 5 days? A. $0.00 B. $2.60 C. $2.70 D. $2.80 E. Must know the number of contracts