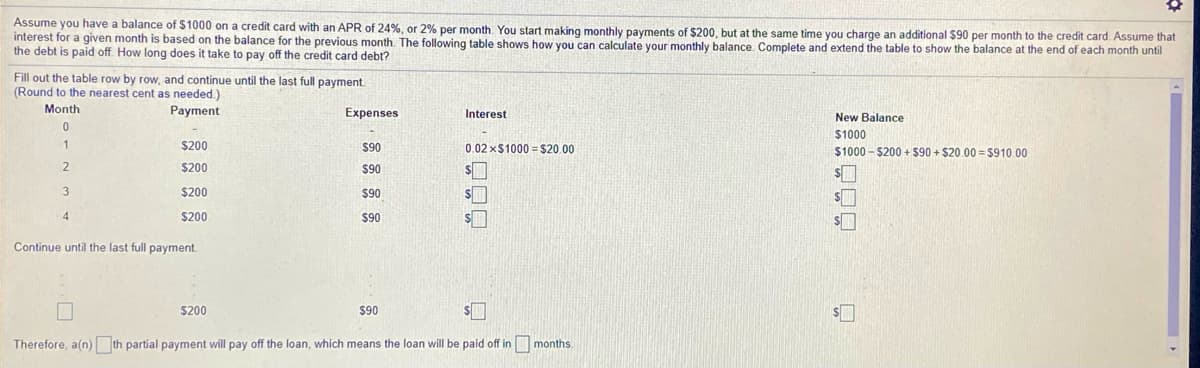

Assume you have a balance of $1000 on a credit card with an APR of 24%, or 2% per month You start making monthly payments of $200, but at the same time you charge an additional $90 per month to the credit card. Assume that interest for a given month is based on the balance for the previous month. The following table shows how you can calculate your monthly balance. Complete and extend the table to show the balance at the end of each month until the debt is paid off. How long does it take to pay off the credit card debt? Fill out the table row by row, and continue until the last full payment (Round to the nearest cent as needed.) Month Payment Expenses Interest New Balance $1000 $200 $90 0.02 x$1000 = $20.00 $1000 - $200 + $90 + $20 00 = 910.00 $200 $90 3. $200 $90 $200 $90 Continue until the last full payment $200 $90 Therefore, a(n) th partial payment will pay off the loan, which means the loan will be paid off in months కిలికిలిం

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

By using credit cards, people usually spend more money and people who actually pay their credit cards bill monthly are very less in number. As per research, it reduces emotional stability of an individual using credit card and the individual becomes unconsciously addicted to spending more. Credit card users blames the marketers for fake advertisements regarding importance of using credit cards. There are actually no advantages of using credit card. In addition, it can hit people with high cost of borrowing and it can prove defamatory to the credibility.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images