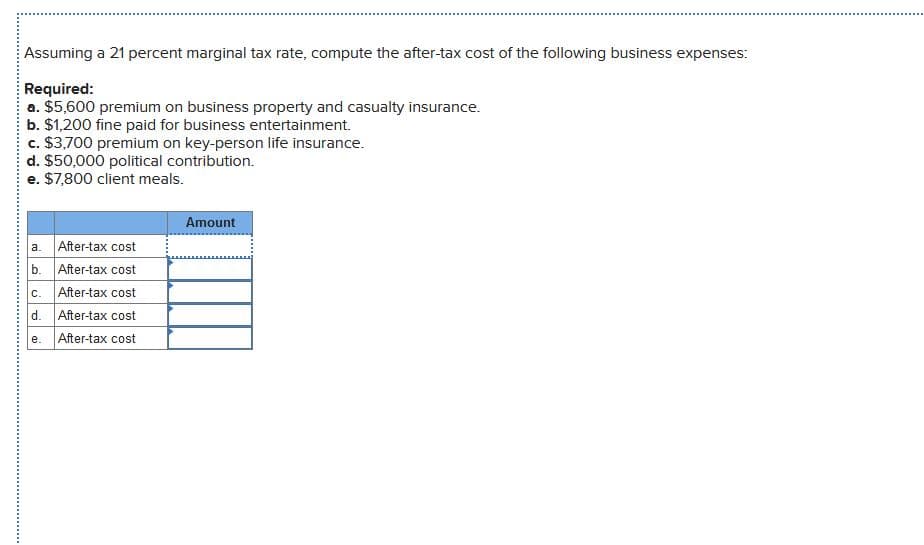

Assuming a 21 percent marginal tax rate, compute the after-tax cost of the following business expenses: Required: a. $5,600 premium on business property and casualty insurance. b. $1,200 fine paid for business entertainment. c. $3,700 premium on key-person life insurance. d. $50,000 political contribution. e. $7,800 client meals.

Assuming a 21 percent marginal tax rate, compute the after-tax cost of the following business expenses: Required: a. $5,600 premium on business property and casualty insurance. b. $1,200 fine paid for business entertainment. c. $3,700 premium on key-person life insurance. d. $50,000 political contribution. e. $7,800 client meals.

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 6DQ

Related questions

Question

100%

Please see image

Thanks

Transcribed Image Text:Assuming a 21 percent marginal tax rate, compute the after-tax cost of the following business expenses:

Required:

a. $5,600 premium on business property and casualty insurance.

b. $1,200 fine paid for business entertainment.

c. $3,700 premium on key-person life insurance.

d. $50,000 political contribution.

e. $7,800 client meals.

Amount

After-tax cost

a.

After-tax cost

After-tax cost

d. After-tax cost

e. After-tax cost

с.

b.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you