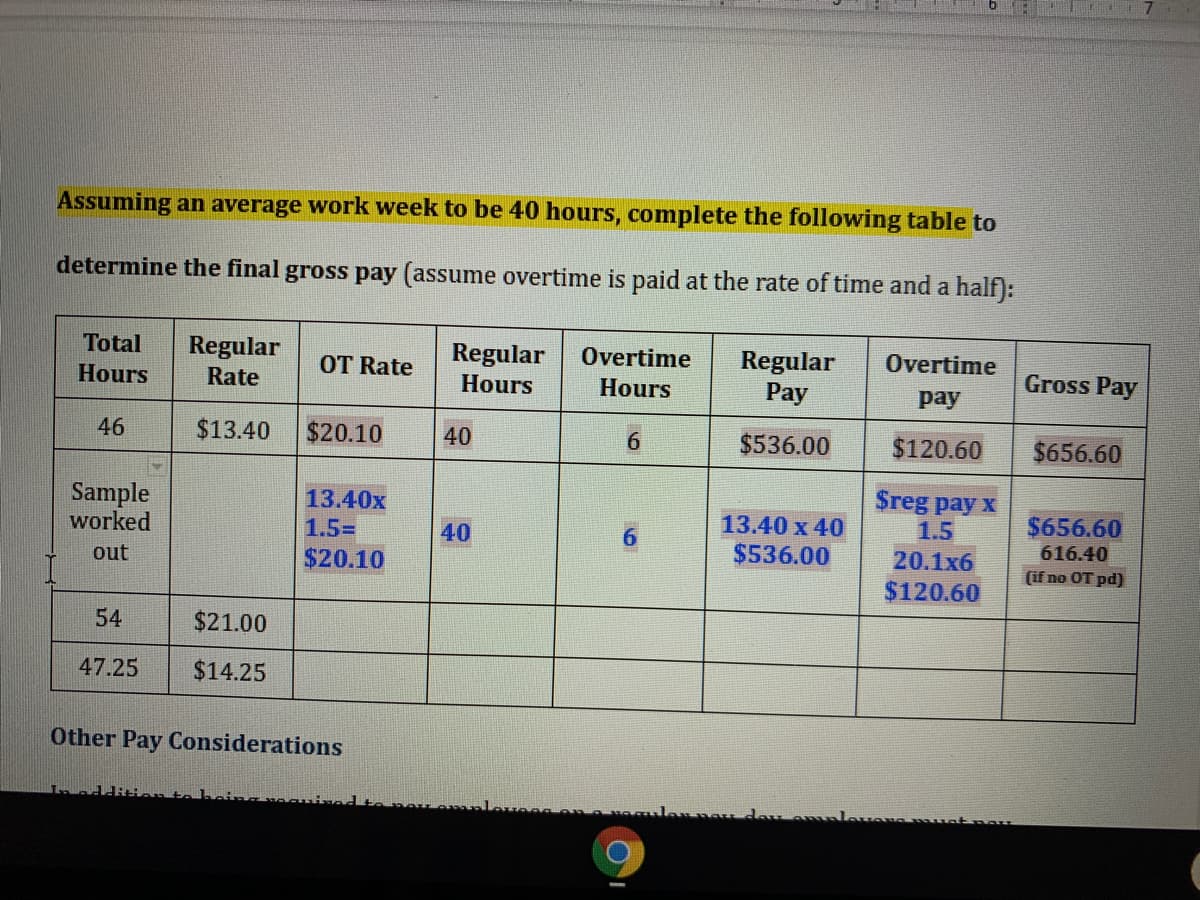

Assuming an average work week to be 40 hours, complete the following table to determine the final gross pay (assume overtime is paid at the rate of time and a half): Total Regular Regular Overtime Regular Pay Overtime Hours OT Rate Gross Pay Rate Hours Hours рay 46 $13.40 $20.10 40 6. $536.00 $120.60 $656.60 Sample worked Sreg pay x 1.5 13.40x 13.40 x 40 $656.60 1.5%= 40 $536.00 616.40 20.1x6 $120.60 out $20.10 (if no OT pd) 54 $21.00 47.25 $14.25 Other Pay Considerations

Assuming an average work week to be 40 hours, complete the following table to determine the final gross pay (assume overtime is paid at the rate of time and a half): Total Regular Regular Overtime Regular Pay Overtime Hours OT Rate Gross Pay Rate Hours Hours рay 46 $13.40 $20.10 40 6. $536.00 $120.60 $656.60 Sample worked Sreg pay x 1.5 13.40x 13.40 x 40 $656.60 1.5%= 40 $536.00 616.40 20.1x6 $120.60 out $20.10 (if no OT pd) 54 $21.00 47.25 $14.25 Other Pay Considerations

Chapter2: Computing Wages And Salaries

Section: Chapter Questions

Problem 12PA: Kyle Forman worked 47 hours during the week for Erickson Company at two different jobs. His pay rate...

Related questions

Question

100%

Transcribed Image Text:Assuming an average work week to be 40 hours, complete the following table to

determine the final gross pay (assume overtime is paid at the rate of time and a half):

Total

Regular

Regular

Hours

Overtime

Regular

Рay

Overtime

Hours

OT Rate

Gross Pay

Rate

Hours

рay

46

$13.40

$20.10

40

$536.00

$120.60

$656.60

Sample

worked

13.40x

1.5%=

$reg pay x

1.5

13.40 x 40

$656.60

40

6.

$536.00

616.40

20.1x6

$120.60

out

$20.10

(if no OT pd)

54

$21.00

47.25

$14.25

Other Pay Considerations

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College