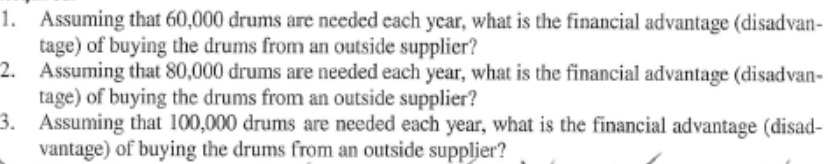

Assuming that 60,000 drums are needed each year, what is the financial advantage (disadvan- tage) of buying the drums from an outside supplier? Assuming that 80,000 drums are needed each year, what is the financial advantage (disadvan- tage) of buying the drums from an outside supplier? Assuming that 100,000 drums are needed each year, what is the financial advantage (disad- vantage) of buying the drums from an outside supplier?

Assuming that 60,000 drums are needed each year, what is the financial advantage (disadvan- tage) of buying the drums from an outside supplier? Assuming that 80,000 drums are needed each year, what is the financial advantage (disadvan- tage) of buying the drums from an outside supplier? Assuming that 100,000 drums are needed each year, what is the financial advantage (disad- vantage) of buying the drums from an outside supplier?

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter26: Lean Manufacturing And Activity Analysis

Section: Chapter Questions

Problem 26.1APR

Related questions

Question

Transcribed Image Text:1. Assuming that 60,000 drums are needed each ycar, what is the financial advantage (disadvan-

tage) of buying the drums from an outside supplier?

2. Assuming that 80,000 drums are needed each year, what is the financial advantage (disadvan-

tage) of buying the drums from an outside supplier?

3. Assuming that 100,000 drums are needed each year, what is the financial advantage (disad-

vantage) of buying the drums from an outside suppljer?

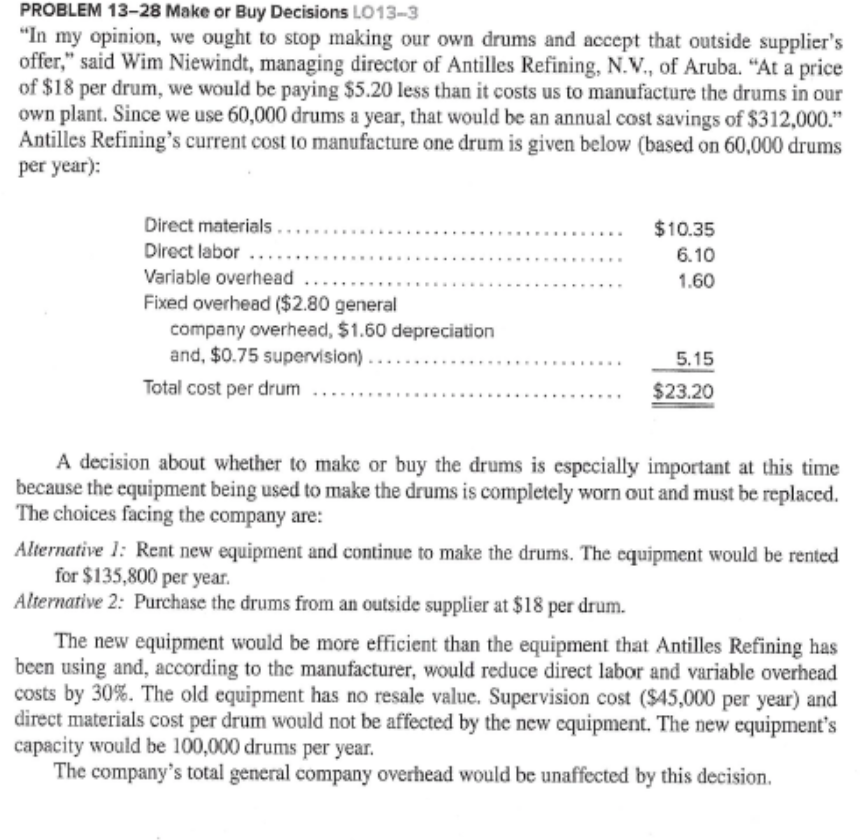

Transcribed Image Text:PROBLEM 13-28 Make or Buy Decisions LO13-3

"In my opinion, we ought to stop making our own drums and accept that outside supplier's

offer," said Wim Niewindt, managing director of Antilles Refining, N.V., of Aruba. "At a price

of $18 per drum, we would be paying $5.20 less than it costs us to manufacture the drums in our

own plant. Since we use 60,000 drums a year, that would be an annual cost savings of $312,000."

Antilles Refining's current cost to manufacture one drum is given below (based on 60,000 drums

per year):

Direct materials.

$10.35

Direct labor

6.10

Variable overhead....

Fixed overhead ($2.80 general

company overhead, $1.60 depreciation

and, $0.75 supervision)

1.60

5.15

Total cost per drum

$23.20

A decision about whether to make or buy the drums is especially important at this time

because the equipment being used to make the drums is completely worn out and must be replaced.

The choices facing the company are:

Alternative 1: Rent new equipment and continue to make the drums. The equipment would be rented

for $135,800 per year.

Alternative 2: Purchase the drums from an outside supplier at $18 per drum.

The new equipment would be more efficient than the equipment that Antilles Refining has

been using and, according to the manufacturer, would reduce direct labor and variable overhead

costs by 30%. The old equipment has no resale value. Supervision cost ($45,000 per year) and

direct materials cost per drum would not be affected by the new equipment. The new equipment's

capacity would be 100,000 drums per year.

The company's total general company overhead would be unaffected by this decision.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning