Assuming that revenues stayed flat (meaning the company did not try to increase sales by the 12 percent target), by what percentage would they have to decrease purchasing expenses to equal the increased profit that would have come from a 12 percent increase to revenues? (Write your answer as a orconta go and dicplov vour oncwor to two doeimal plages

Assuming that revenues stayed flat (meaning the company did not try to increase sales by the 12 percent target), by what percentage would they have to decrease purchasing expenses to equal the increased profit that would have come from a 12 percent increase to revenues? (Write your answer as a orconta go and dicplov vour oncwor to two doeimal plages

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Please provide the answer to the last question. Do not provide solution steps to the questions marked on green. I already know how to do those!!!

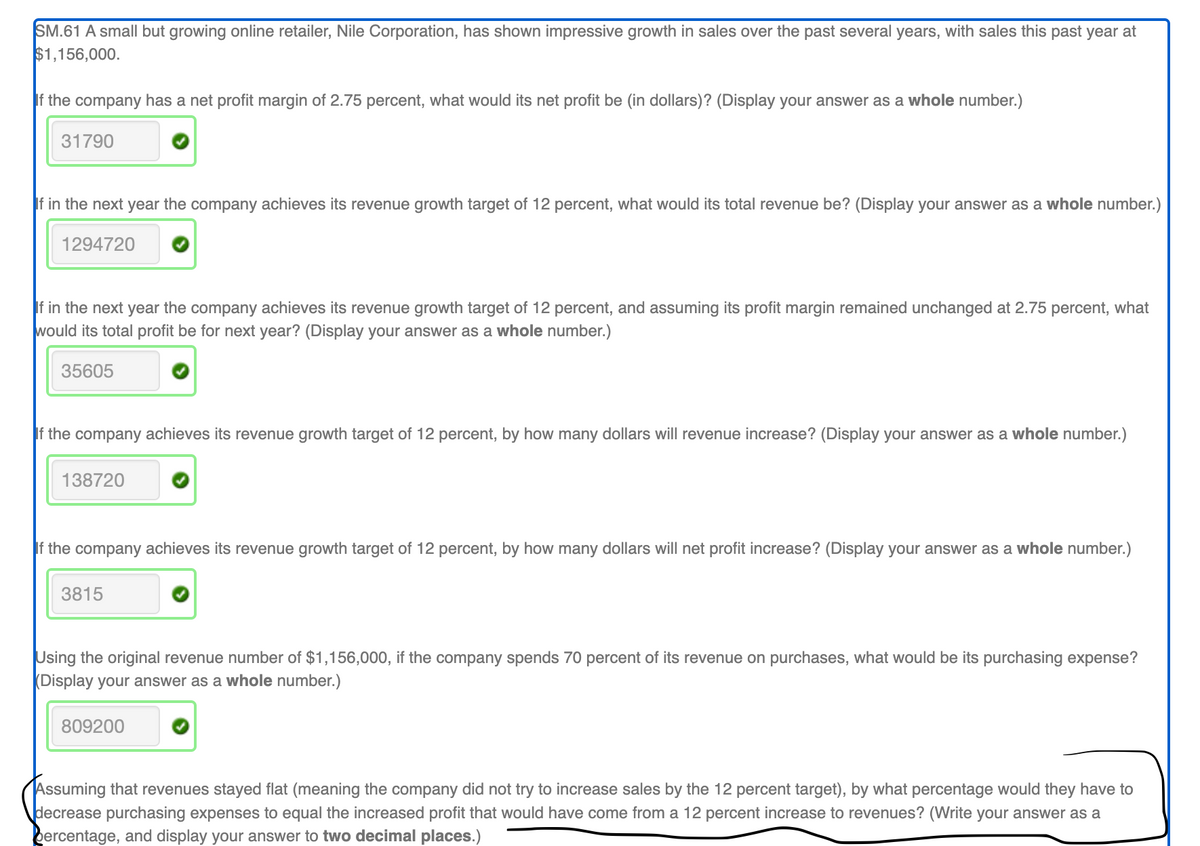

Transcribed Image Text:SM.61 A small but growing online retailer, Nile Corporation, has shown impressive growth in sales over the past several years, with sales this past year at

$1,156,000.

If the company has a net profit margin of 2.75 percent, what would its net profit be (in dollars)? (Display your answer as a whole number.)

31790

f in the next year the company achieves its revenue growth target of 12 percent, what would its total revenue be? (Display your answer as a whole number.)

1294720

If in the next year the company achieves its revenue growth target of 12 percent, and assuming its profit margin remained unchanged at 2.75 percent, what

would its total profit be for next year? (Display your answer as a whole number.)

35605

If the company achieves its revenue growth target of 12 percent, by how many dollars will revenue increase? (Display your answer as a whole number.)

138720

f the company achieves its revenue growth target of 12 percent, by how many dollars will net profit increase? (Display your answer as a whole number.)

3815

Using the original revenue number of $1,156,000, if the company spends 70 percent of its revenue on purchases, what would be its purchasing expense?

(Display your answer as a whole number.)

809200

Assuming that revenues stayed flat (meaning the company did not try to increase sales by the 12 percent target), by what percentage would they have to

decrease purchasing expenses to equal the increased profit that would have come from a 12 percent increase to revenues? (Write your answer as a

bercentage, and display your answer to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education