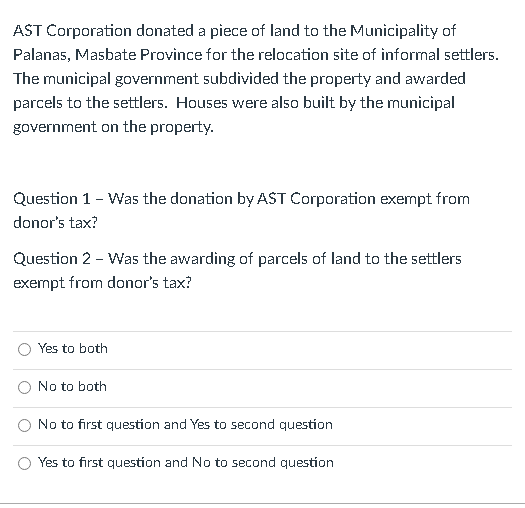

AST Corporation donated a piece of land to the Municipality of Palanas, Masbate Province for the relocation site of informal settlers. The municipal government subdivided the property and awarded parcels to the settlers. Houses were also built by the municipal government on the property. Question 1 - Was the donation by AST Corporation exempt from donor's tax? Question 2 - Was the awarding of parcels of land to the settlers exempt from donor's tax? Yes to both No to both No to first question and Yes to second question O Yes to first question and No to second question

AST Corporation donated a piece of land to the Municipality of Palanas, Masbate Province for the relocation site of informal settlers. The municipal government subdivided the property and awarded parcels to the settlers. Houses were also built by the municipal government on the property. Question 1 - Was the donation by AST Corporation exempt from donor's tax? Question 2 - Was the awarding of parcels of land to the settlers exempt from donor's tax? Yes to both No to both No to first question and Yes to second question O Yes to first question and No to second question

Chapter23: Exempt Entities

Section: Chapter Questions

Problem 3DQ

Related questions

Question

timed task, need help please. thanks!

about transfer taxes

Transcribed Image Text:AST Corporation donated a piece of land to the Municipality of

Palanas, Masbate Province for the relocation site of informal settlers.

The municipal government subdivided the property and awarded

parcels to the settlers. Houses were also built by the nunicipal

government on the property.

Question 1 - Was the donation by AST Corporation exempt from

donor's tax?

Question 2 - Was the awarding of parcels of land to the settlers

exempt from donor's tax?

Yes to both

No to both

No to first question and Yes to second question

Yes to first question and No to second question

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you